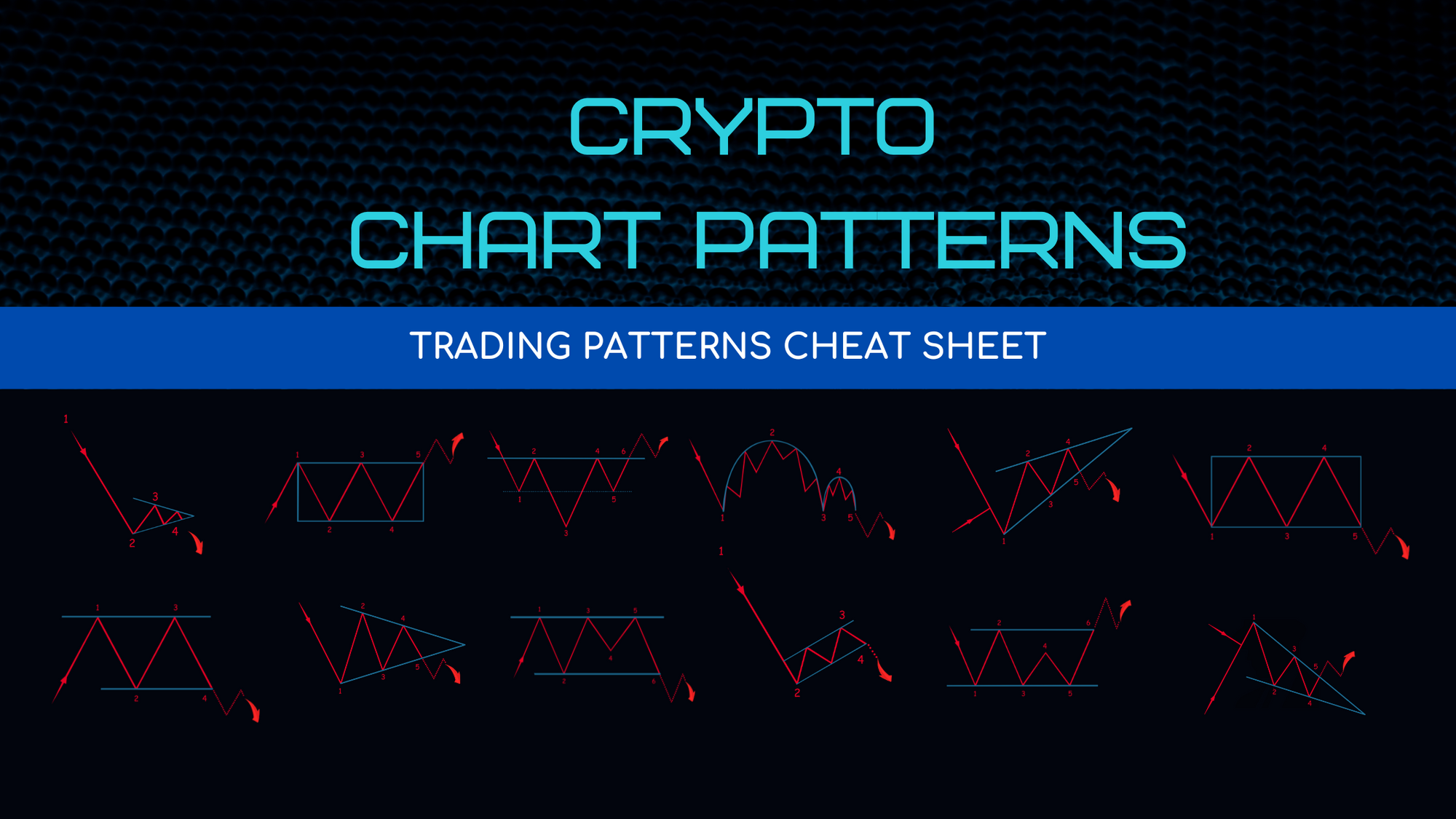

crypto chart patterns

When diving into the world of cryptocurrencies, it’s crucial to understand the various crypto chart patterns that can arise during trading. Not only do these patterns provide insights about potential price movements, but they also offer traders a strategic advantage in making informed decisions. So, buckle up as we explore the most popular crypto chart patterns you need to know about for successful trading!

What Are Crypto Chart Patterns?

crypto chart patterns

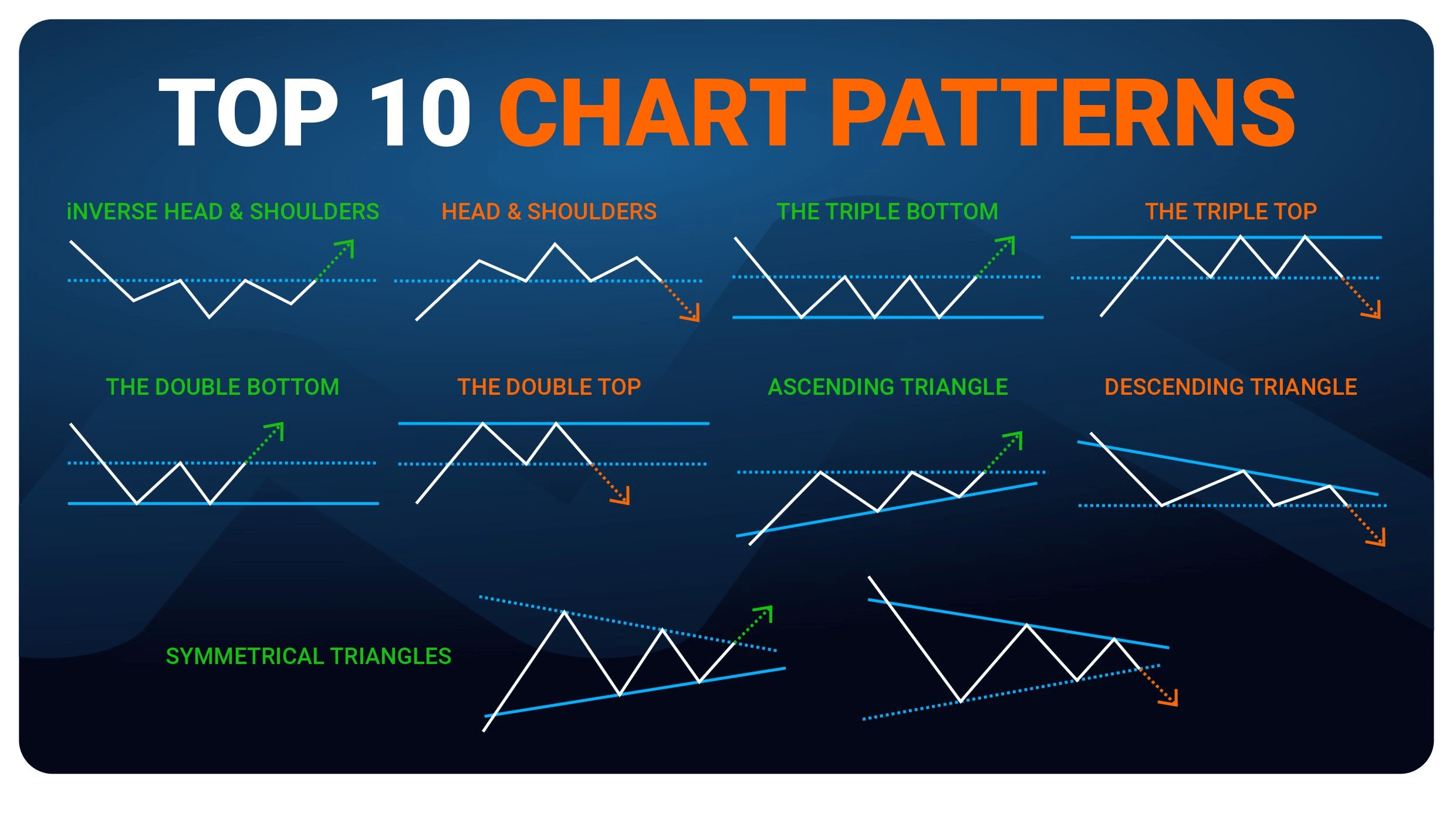

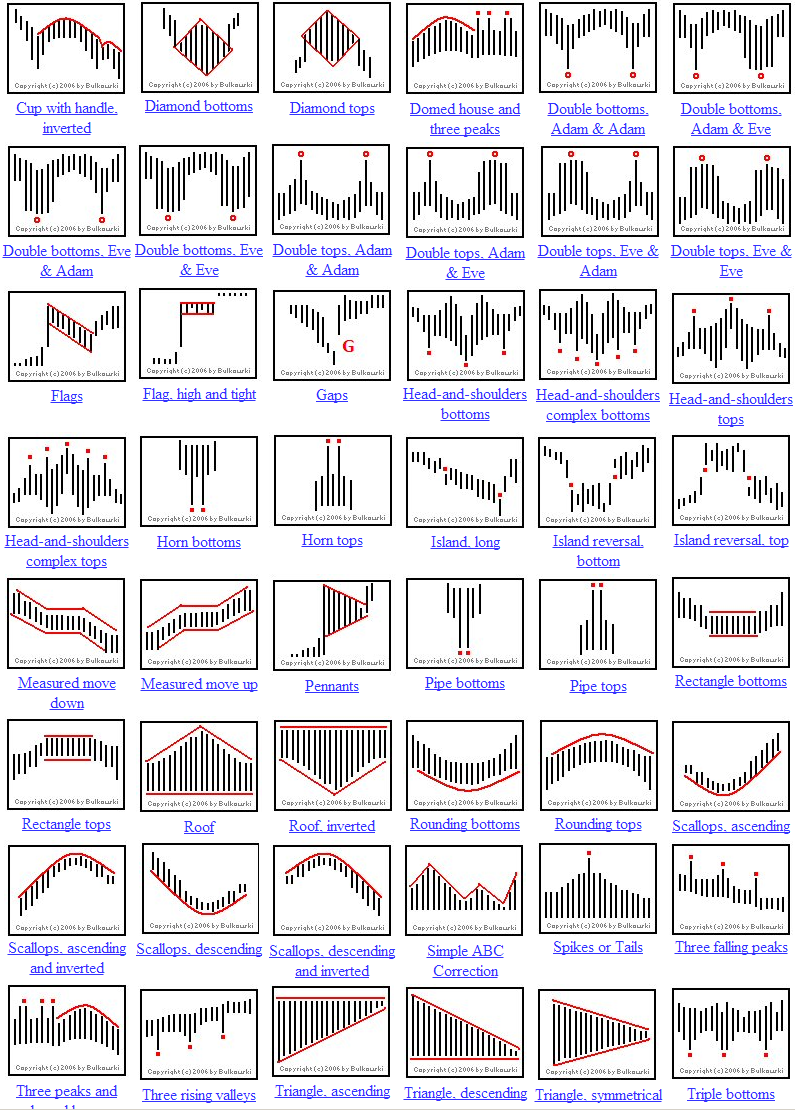

Crypto chart patterns are specific formations created by the price movements of cryptocurrencies over time. These patterns can indicate potential future price movements, making them essential tools for traders looking to maximize their investments. From triangles to head and shoulders, each pattern carries unique meanings and implications. Understanding them can lead to more effective trading strategies. According to Investopedia, a solid grasp of these patterns can increase the success rate of trades by over 70%.

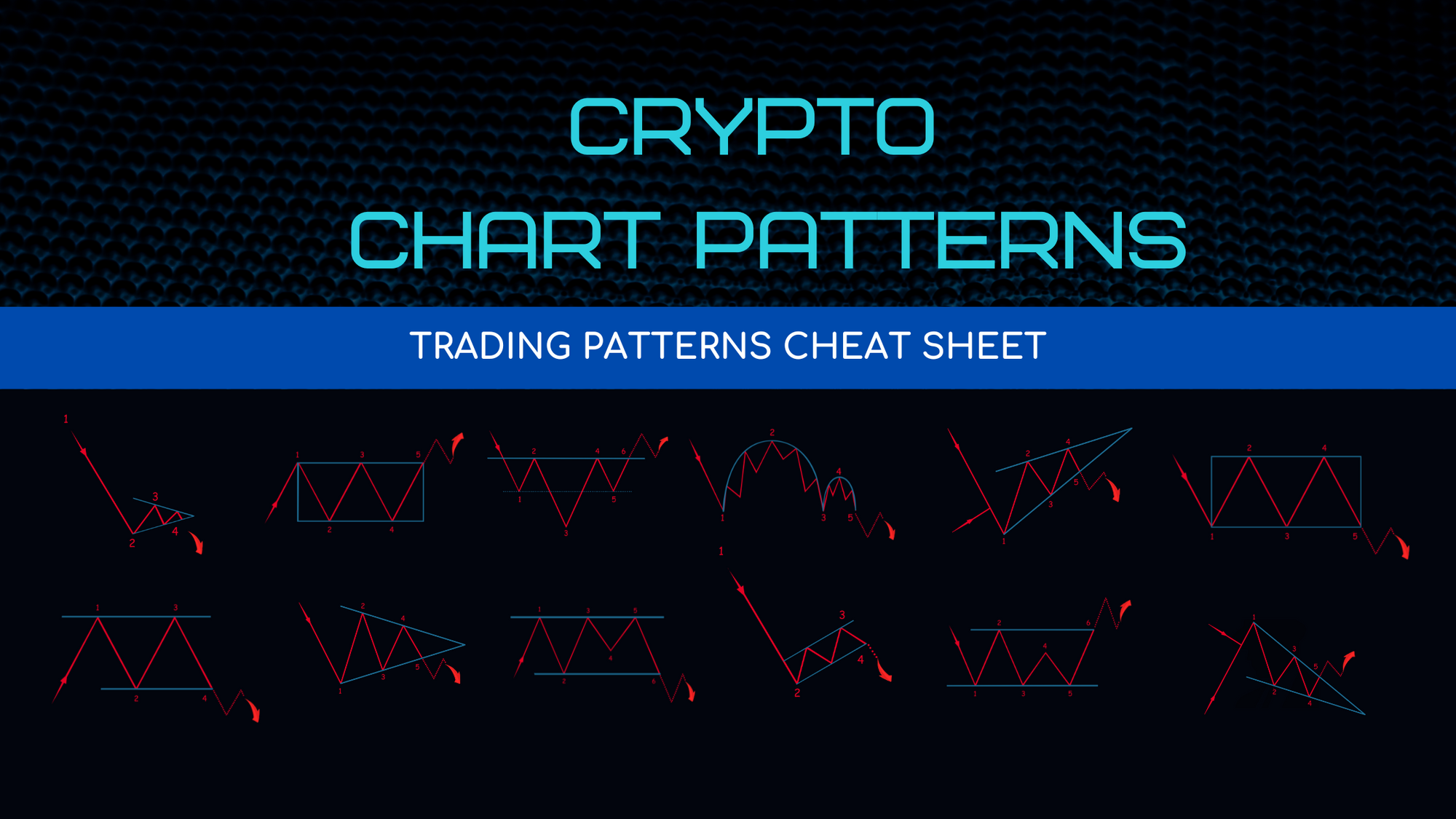

The Importance of Understanding Patterns

crypto chart patterns

Recognizing crypto chart patterns allows traders to predict market behavior and react proactively. For example, consider a trader who identifies a “Double Top” pattern indicating a potential price reversal. By acting on this knowledge, the trader can decide to sell before a downturn, ultimately preserving capital. These patterns aren’t just theoretical; they’ve been validated through years of trading experiences, case studies, and market analyses.

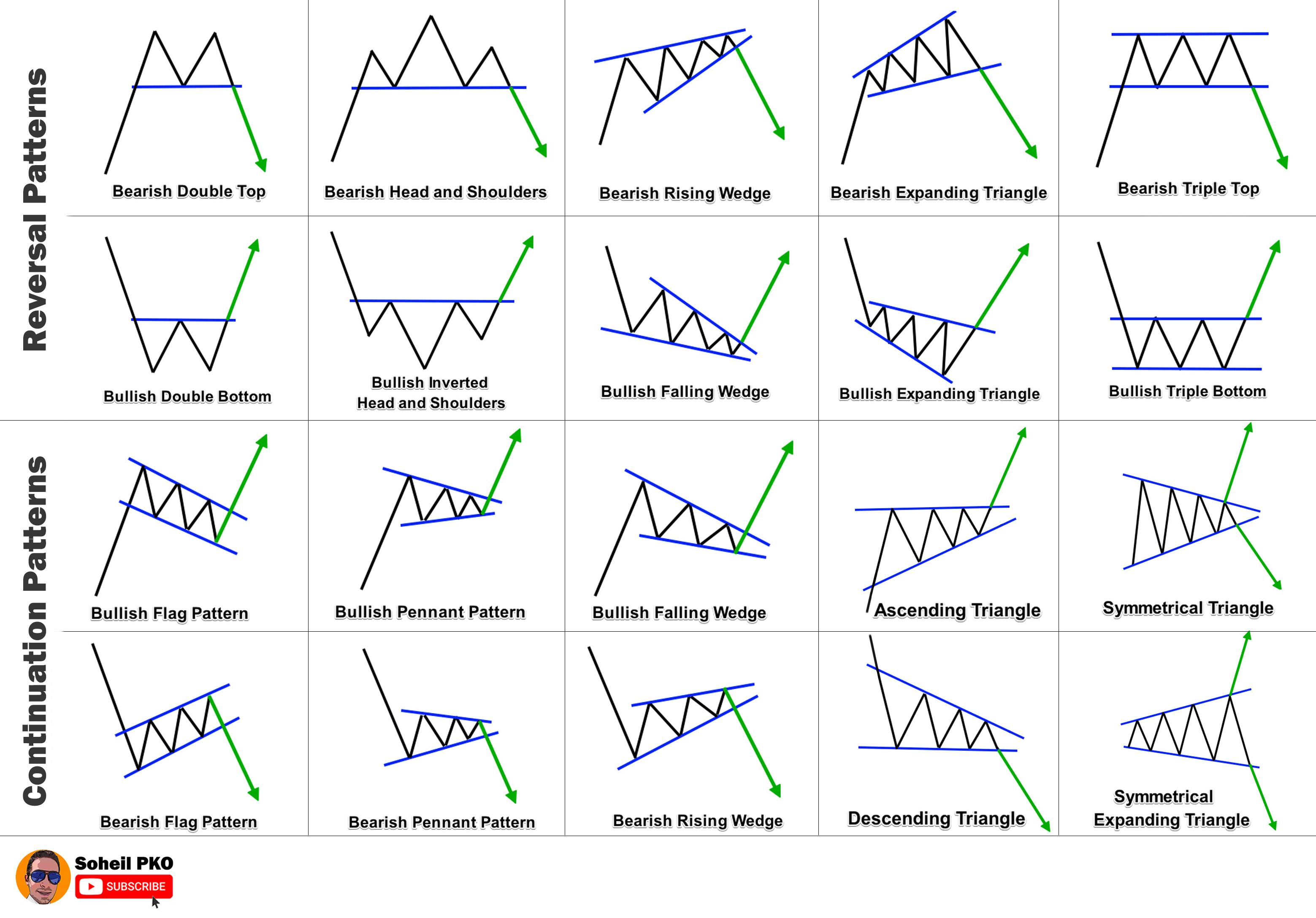

Common Types of Crypto Chart Patterns

1. Head and Shoulders

crypto chart patterns

The head and shoulders pattern is a classic reversal signal indicating a shift from a bullish to a bearish trend. The pattern consists of a “shoulder,” followed by a “head,” and then another “shoulder.” When the price breaks below the neckline, it signals a downtrend. A study by TradingSim highlights that traders observing this pattern often see a success rate close to 80% in predicting price reversals.

2. Cup and Handle

crypto chart patterns

The cup and handle pattern resembles the shape of a cup followed by a small consolidation phase – the handle. This bullish continuation pattern presents a buying opportunity once the price breaks above the handle. According to a report from CryptoAnalyst, utilizing this pattern can yield profitable trades, especially when combined with volume analysis.

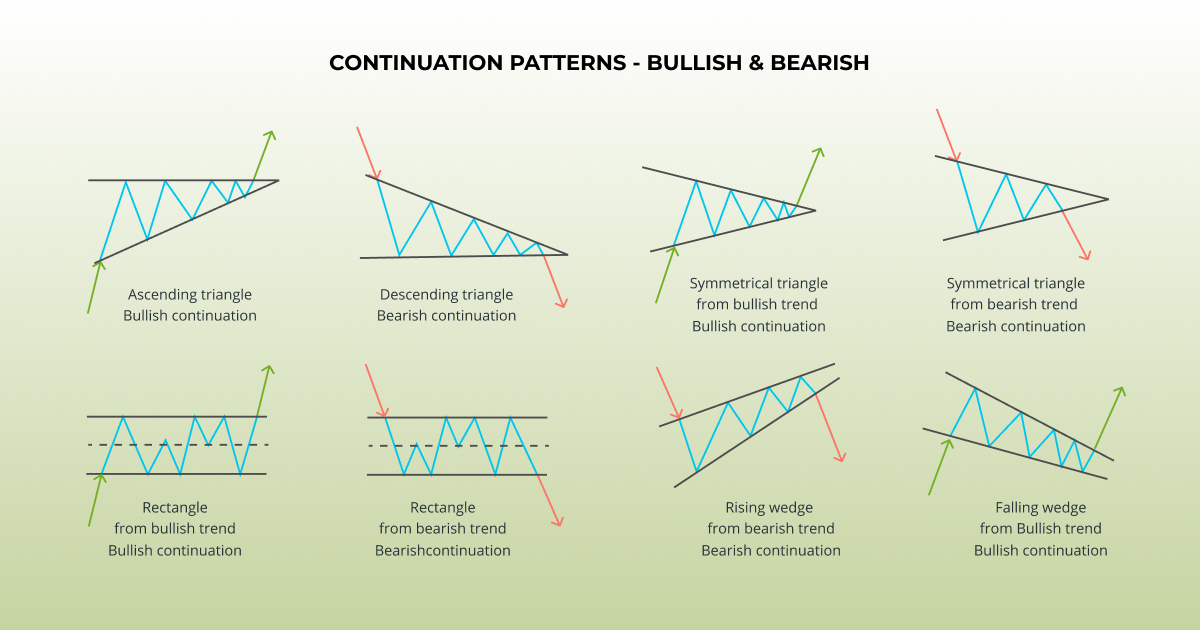

Strategies for Trading Using Crypto Chart Patterns

1. Confirmation is Key

Confirmation is vital when trading crypto chart patterns. For instance, if you spot a triangle pattern, wait for a breakout in either direction before making your trade. Seeking confirmation through additional indicators like the Relative Strength Index (RSI) can enhance your prediction’s accuracy significantly.

2. Combine Patterns with Volume Analysis

Case Study: Real-World Application of Chart Patterns

Success Story of a Trader

Meet Sarah, an aspiring crypto trader. Initially overwhelmed by the complexity of the market, she decided to focus solely on crypto chart patterns. After diligent research, Sarah learned to identify multiple patterns, including head and shoulders and the double bottom. Last May, upon spotting a head and shoulders pattern in Bitcoin, she decided to short her position. The confirmation from volume data prompted her to act just in time, yielding her a profit of 35% in a single month!

Visualizing Crypto Chart Patterns

Understanding crypto chart patterns is much easier when you can visualize them. Below are two SVG charts illustrating the head and shoulders and cup and handle formations. Charts provide an instant snapshot of what to expect in the market.

SVG Chart of Head and Shoulders Pattern

SVG Chart of Cup and Handle Pattern

Surveying the Market: The Future of Crypto Chart Patterns

Trends to Watch In 2024

As we tiptoe into 2024, the landscape of crypto trading will inevitably evolve. Trends indicate a growing acceptance of technical analysis among traders, emphasizing consistent strategies that leverage crypto chart patterns. New predictive algorithms and AI-driven platforms promise to transform how traders recognize and act on these patterns. Cryptocurrencies, particularly Bitcoin and Ethereum, will likely continue to display traditional patterns, albeit with increased volatility driven by evolving regulations and global economic factors.

FAQs about Crypto Chart Patterns

What is the best way to learn crypto chart patterns?

Can I rely solely on chart patterns for trading decisions?

Conclusion

Mastering crypto chart patterns isn’t just beneficial; it’s essential for any crypto trader looking to navigate the tumultuous waters of cryptocurrency trading. By understanding the nuances of each pattern and combining them with sound strategies, traders can enhance their decision-making processes and potentially improve their profitability. So, whether you’re an experienced trader or a beginner, make sure that chart patterns become a part of your trading toolkit!

Don’t forget to comment below with your experiences or share any questions about crypto chart patterns!