Are you diving into the world of cryptocurrency trading and wondering what exactly what does 100x leverage mean in crypto? If so, you’re not alone! Many crypto enthusiasts are eager to leverage their investments to maximize potential returns. But understanding leverage, especially at such a high ratio, can be a game-changer. So, grab your favorite crypto gadget, and let’s explore!

what does 100x leverage mean in crypto

A Beginner’s Guide to Leverage in Crypto Trading

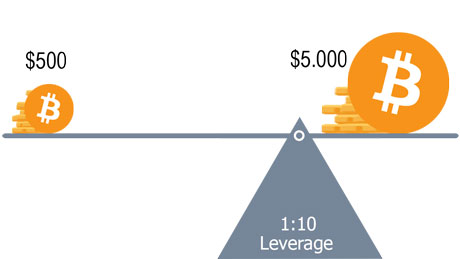

Before we plunge deeper, let’s clarify what leverage means in the context of trading. Leverage involves borrowing funds to amplify your trading position. In simpler terms, 100x leverage means you can control a $100,000 position while only investing $1,000 of your own money. Sounds exciting, right? But before you get too carried away, it’s essential to understand both its appeal and the risks involved.

what does 100x leverage mean in crypto

The appeal of 100x leverage lies in its potential for monumental gains. If your $100,000 position appreciates by just 1%, you could pocket $1,000 – a 100% return on your initial investment. However, this is where the danger lurks. A mere 1% drop in the asset’s value could wipe out your entire investment. This high level of risk is crucial for traders to understand before engaging in leveraged trades.

what does 100x leverage mean in crypto

The Basics of Leverage

Let’s delve deeper into the advantages and disadvantages of using leverage. Leverage can be incredibly powerful if applied wisely, and it’s often used by more experienced traders. According to statistics from Binance, over 70% of their users trade with some form of leverage, indicating its popularity. However, many new traders underestimate their risk exposure.

what does 100x leverage mean in crypto

Case Study: A Closer Look at 100x Leverage

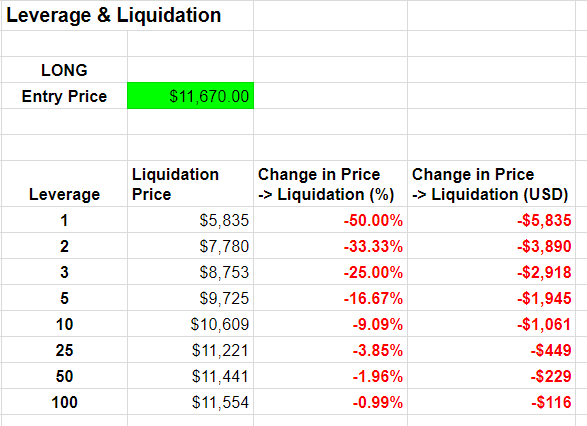

To provide a clearer picture, let’s explore a practical scenario. Suppose you open a long position on Bitcoin when it’s priced at $10,000 using 100x leverage. With your $1,000 investment, you control a $100,000 position. If Bitcoin’s price rises to $10,100, you make a profit of $1,000. Congratulations – you just doubled your investment! But, if the price drops to $9,900, you’re out of the game with a total loss. This exemplifies both the rewards and dangers of high leverage.

what does 100x leverage mean in crypto

Why 100x Leverage is Risky

Given the volatile nature of cryptocurrencies, the risks associated with 100x leverage can’t be understated. Let’s dissect a few risk factors. First, substantial price fluctuations are common in the crypto market, which can trigger your liquidation point very quickly.

Moreover, market manipulation can play a significant role. This means that significant players can purposely cause price changes to liquidate positions of smaller traders. In fact, according to a market analysis report by Chainalysis, approximately $1.5 billion of user funds were lost to liquidations last year – a substantial portion due to high-leverage trading.

Risk Management Strategies

Now that we’ve covered the risks, how can you manage them? Here are some effective strategies:

- Use Stop-Loss Orders: This is one of the most effective strategies for minimizing losses. Setting a stop-loss order will automatically close your position at a predefined price point.

- Trade with Caution: Start with lower leverage ratios and gradually increase as your trading confidence grows. This approach lets you acclimatize to market fluctuations.

- Diversify Your Investments: Diversifying your portfolio spreads risk and helps cushion losses in one area with gains in another.

The Psychology of Trading with High Leverage

Trading isn’t just technical; it’s psychological. The pressure from high leverage can lead to emotional decision-making. Traders may feel an overwhelming urge to react to market movements rather than following their strategy. To combat this, it’s critical to develop a solid trading plan and adhere to it, regardless of market emotions.

Moreover, leveraging heavily can lead to a phenomenon known as “FOMO” (fear of missing out). Studies indicate that traders using leverage often experience increased anxiety related to potential losses, which can lead to impulsive trading. Thus, creating a solid strategy becomes essential not only for financial success but also for mental well-being.

Interactive Poll: Your Trading Experience

Let’s take a quick survey! How do you generally feel about trading with leverage? Consider these options:

- A) It’s exciting, and I love the thrill!

- B) I prefer to keep my investments safe and conservative.

- C) I’m still learning how it works.

Tools and Resources for Successful Leveraged Trading

If you’re serious about trading with high leverage, you’ll need tools and resources. Platforms like Binance and BitMEX provide advanced charting tools, market analysis, and risk management solutions. Additionally, numerous online communities offer forums to discuss strategies and share experiences, which can be invaluable for new traders.

Educational platforms such as Investopedia and online courses offered through Coursera can help sharpen your understanding of leverage. The more knowledge you gain, the better decisions you can make.

Case Study: The Rise and Fall of a Leveraged Trader

Let’s share a story about Jane, a trader captivated by the appeal of 100x leverage. Initially, she made successful trades, capitalizing on Bitcoin’s rallies. However, one day, sharp market volatility led to an unexpected drop in prices. Despite her initial profits, Jane lost her entire investment in a matter of minutes because she didn’t use stop-loss orders. Her experience illustrates the importance of risk management strategies.

Conclusion: Is 100x Leverage Worth It?

Ultimately, whether you choose to use 100x leverage depends on your risk appetite and understanding of the crypto market. For many, the potential for substantial gains is appealing, but the risks are tangible. Anyone considering leveraging in crypto must thoroughly research, develop a solid plan, actively manage risks, and continuously educate themselves.

Crypto trading can be a roller coaster; be sure you’re strapped in and prepared for the ride! Always remember to assess your risk tolerance and invest wisely.