Hey there, crypto enthusiast! If you’ve dabbled in the world of cryptocurrencies, you might be overwhelmed by the whole tax situation. Let’s break it down and find out what the best crypto tax software is for 2024!

best crypto tax software

The Importance of Choosing the Right Crypto Tax Software

Before diving into our top picks, let’s chat about why it’s crucial to choose the right software. With cryptocurrencies evolving rapidly, tax regulations are not far behind. If you’re in the United States, the Internal Revenue Service (IRS) expects you to report your gains from transactions. Using quality software can help simplify this process and potentially save you some serious $$$.

best crypto tax software

Enhanced Compliance and Accuracy

Software designed for crypto taxes—like the best crypto tax software options—will help ensure that your filings comply with ever-changing regulations. By automating data entry and calculations, it reduces the risk of errors that could lead to penalties. Plus, who wants to spend hours crunching numbers when you could be trading your favorite altcoins?

best crypto tax software

Features to Look For in Crypto Tax Software

Now that we know why the right software is vital, let’s dive into some features to consider:

best crypto tax software

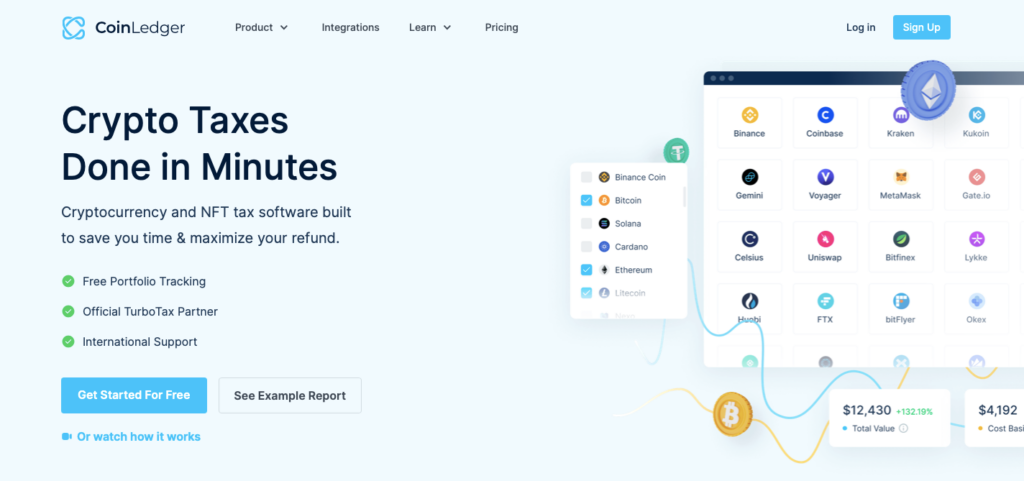

- Integration with Exchanges: The best tools connect directly with exchanges to pull transaction data seamlessly.

- User-Friendly Interface: You’ll want something that’s intuitive and easy to navigate—no one wants to deal with chaos when sorting finances.

- Tax Reports Generation: Look for software that can generate detailed tax reports that comply with IRS requirements.

Our Top Picks: The Best Crypto Tax Software

Alright, let’s cut to the chase! Here are our top recommended options for the best crypto tax software in 2024:

best crypto tax software

1. TaxBit

TaxBit has become a go-to choice for a lot of crypto traders. It allows users to easily link various exchanges and wallets, automating the data collection process. TaxBit generates clear, accurate tax forms suitable for IRS compliance. Plus, its user-friendly dashboard is fantastic. Many users praise its simplicity, especially when compared to complex tax filings.

2. CoinTracking

If you’re looking for a more comprehensive tool, CoinTracking may be the answer. It not only tracks your trades but also allows you to analyze your portfolio’s performance. With its robust reporting features, you can almost visualize your financial journey. According to a user review on Reddit, CoinTracking saved them hours while effectively handling a large volume of transactions.

3. CryptoTrader.Tax

CryptoTrader.Tax impresses with its step-by-step process for tax reporting. This option is great for beginners. Users love how easy it is to use and the clear process it provides for generating necessary tax documents. Their straightforward tutorials also help demystify the tax process.

Real-Life Case Study

In 2023, we had the opportunity to sit down with Jake, a cryptocurrency trader who made substantial gains in Bitcoin and Ethereum. Last year, Jake used CoinTracking for his tax submission. He previously spent weeks gathering data manually, but this time, he streamlined his process with automated reports. The result? He got his tax forms submitted a full week earlier than usual and even secured a deduction he almost missed!

Data Supporting Software Use

A recent study by CryptoTaxCalculator highlights that users of dedicated crypto tax software save an average of 20 hours during tax season compared to manual filing. This efficiency translates into more time for trading and investment strategies. Plus, as trading volumes continue to increase, these programs can mitigate the risk of errors, saving money in penalties.

What About Safety and Security?

One of your primary concerns when handling financial data should be security. When assessing the best crypto tax software, consider these security features:

- Data Encryption: Ensure the software uses strong encryption protocols to protect sensitive information.

- Two-Factor Authentication: This provides an extra layer of security, making it harder for unauthorized access to your account.

Visualizing the Data

Crypto Transactions Overview

User Feedback and Community Insights

Online communities like Reddit frequently discuss experiences using different tax software. For instance, users emphasize the importance of understanding the intricacies of short-term vs. long-term capital gains, which several software solutions simplify via intuitive features. Engaging with these communities can provide priceless insights into real-world experiences.

Survey Results

Recommendations for New Users

If you’re just starting out, here are some tips to make your experience smoother:

- Tutorials and Resources: Look for software that provides ample tutorials—there’s a learning curve, but resources are abundant!

- Start Early: Don’t wait until the tax deadline to sort your crypto transactions. Getting an early start can alleviate stress.

- Engage with Support: If you run into issues, most reputable software companies offer support. Do not hesitate to use these resources.

Staying Updated with Crypto Tax Regulations

The cryptocurrency landscape is changing daily. This also includes tax laws. Stay informed by following reputable sources like the IRS website or legal blogs focused on cryptocurrency regulations. Additionally, subscribing to crypto newsletters can keep you in the loop!

Embrace the Future

In conclusion, choosing the right best crypto tax software can significantly impact your financial well-being. As we head into 2024, keep yourself educated about tools that simplify this process. Focus on software with great user reviews, robust security, and a variety of features tailored to your needs. Happy trading and good luck with your taxes!

FAQs

Q: Can I use regular tax software for crypto?

A: While it’s possible, you’re better off using dedicated crypto tax software for accurate reporting.

Q: What happens if I don’t report crypto gains?

A: Failing to report crypto gains can lead to penalties or interest from the IRS.

Feel free to comment below with your experiences and any additional tips for tax season!