In the world of cryptocurrency, understanding how to leverage crypto signals can be a game changer for investors of all experience levels. The beauty of crypto signals lies in their ability to provide timely insights and information that can significantly influence trading decisions. Embracing these signals can pave the way for profitable trades, and the right strategies can yield impressive returns. This article dives deep into the mechanics behind crypto signals, exploring their benefits, sources, and how to successfully implement them in your trading routine. Whether you are a seasoned trader or a curious newcomer, there’s something valuable for everyone!

crypto signals

What Are Crypto Signals and Why Should You Use Them?

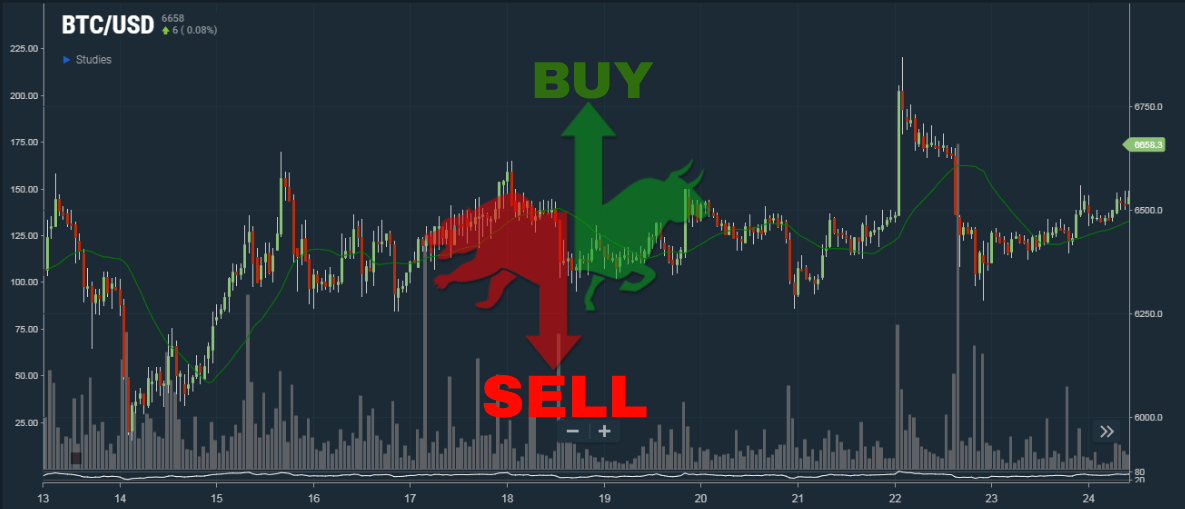

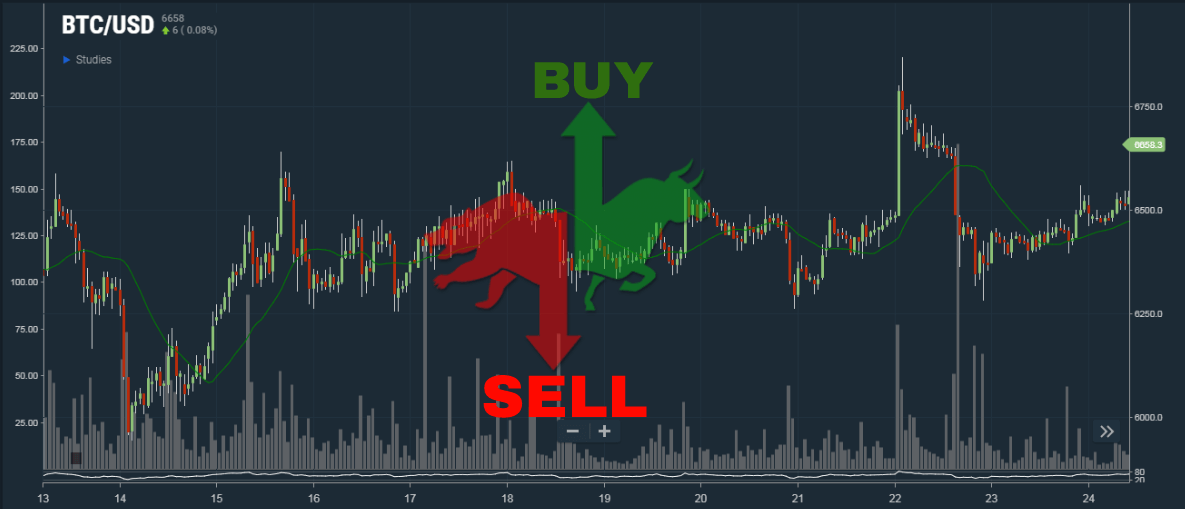

Crypto signals are essentially alerts that indicate the right time to buy or sell a cryptocurrency. These alerts are generated based on in-depth market analysis, which can include technical indicators, market trends, and sometimes even news events that could impact a coin’s value. Imagine receiving a notification that tells you when to jump into a trade just as the price begins to rise; this is the power of crypto signals.

crypto signals

Many traders utilize various tools and platforms to analyze market data, but the sheer volume of information can be overwhelming. According to Jake, a passionate crypto trader, “The first time I tried trading without any signals, I lost a significant amount before realizing how complicated and time-consuming it can be.” Here, the need for reliable signals becomes apparent—being guided by experts can help reduce the learning curve exponentially.

crypto signals

The accessibility of crypto signals is another draw. They come from a multitude of sources, including professional signal providers, trading bots, and dedicated apps. “I used to spend hours analyzing charts, but using signals simplified everything,” shares Emma, a busy professional who has found success in crypto trading. This newfound efficiency permits traders to focus on developing strategies rather than drowning in analytics.

crypto signals

Finding Reliable Sources for Crypto Signals

When it comes to crypto signals, the effectiveness hinges on the source you choose. Not all signals are created equal; some are based on thorough analysis, while others might be mere speculation. Thus, it’s critical to identify reputable signal providers. Researching different platforms, examining user reviews, and staying updated with community feedback is vital for selection.

crypto signals

Furthermore, there are subscription services that offer premium signals for a fee. While this might seem daunting financially at first, consider it an investment that could lead to significant returns. “I was hesitant at first, but paying for a high-quality signal service was one of the best decisions I’ve made for my trading career,” says Sarah, who now frequently attends webinars provided by her signal service to enhance her knowledge.

How to Implement Crypto Signals Effectively

Implementing crypto signals effectively involves more than just following them without thought. As Jonathan, an experienced trader points out, “Understanding the reasoning behind each signal is key. It’s not just about following orders blindly.” He emphasizes the importance of combining signals with your own research to make informed decisions. This approach allows traders to maintain a level of control over their investments.

Additionally, effective risk management cannot be overlooked. Crypto trading comes with its share of volatility, and it’s essential to set stop-loss orders to protect your investment. “I learned the hard way the importance of stop-losses. I now incorporate them into every trade based on the signals I receive,” states Amanda. Adopting such strategies enhances the benefits derived from following crypto signals.

Finally, keeping a trading journal is incredibly beneficial. Documenting your trades—successful or unsuccessful—can illuminate patterns and trends in your trading behavior. “My trading journal has been a game changer. It helped me understand where I go wrong consistently and how I can fix it,” notes Kevin. With time, this process reveals valuable insights that can enhance your trading decision-making.

Conclusions: Elevate Your Trading Game with Crypto Signals

In conclusion, leveraging crypto signals is a potent strategy for navigating the intricate world of cryptocurrency trading. With reliable sources, effective implementation, and continuous learning, you can potentially enhance your trading experience and maximize your returns. As we’ve seen from the experiences of various traders, understanding and utilizing these signals effectively can transform your approach to trading. Embrace the world of crypto signals today and unlock new opportunities for wealth creation!