As we approach 2024, understanding the mid curve becomes increasingly crucial for crypto investors navigating this dynamic market. The mid curve refers to the point in the crypto market cycle where assets often experience moderate volatility, creating both challenges and opportunities. At this stage, investors must carefully evaluate their strategies to maximize potential returns while minimizing risks associated with sudden market fluctuations. A deep dive into the mid curve can reveal patterns that may influence how cryptocurrencies perform in the coming year.

For crypto enthusiasts, staying informed about the economic factors that could affect the cryptocurrency market is vital. Key developments in technology, regulation, and macroeconomic trends can all impact the mid curve, creating a complex landscape for those looking to invest in digital assets. As we move forward, understanding these factors can help investors make informed decisions and position themselves advantageously. Embracing a strategic approach during this pivotal period can aid in identifying potential gains while effectively managing risk. Ultimately, the mid curve presents a unique opportunity for insight and growth for astute crypto investors in 2024.

mid curve meaning crypto

Key Factors Influencing the Mid Curve in 2024

As we look into 2024, several key factors are poised to significantly impact the mid curve of various financial instruments. Understanding these market trends is critical for investors and policymakers alike. One of the primary influences will be the ongoing regulatory changes that govern the market landscape. Stricter regulations aimed at promoting transparency and stability could reshape the risk profiles associated with mid-term investments.

In addition to regulation, technological advancements are set to play a pivotal role. Innovations such as AI-driven analytics and blockchain technology are enhancing trading efficiencies and enabling more accurate pricing models. Consequently, these advancements will likely lead to fluctuations in the mid-term interest rates, affecting both borrower and lender behaviors.

Economic indicators will also be crucial in shaping the mid curve outlook. Key data points such as inflation rates, unemployment figures, and consumer confidence indices will inform investors about the broader economic climate. For instance, if inflation continues to rise, we might see a shift in investor sentiment, leading to a more steeply inclined mid curve.

Furthermore, geopolitical developments and global trade policies could introduce volatility into the mid curve. Events that disrupt supply chains or alter investment flows may create uncertainties within financial markets. Investors must remain vigilant regarding these shifts to adapt their strategies suitably.

Lastly, the anticipated shifts in monetary policy, particularly if central banks decide to modify their interest rate strategies, will play a substantial role. As these factors converge, the mid curve dynamics will undergo notable transformation, demanding close attention from all market participants.

mid curve meaning crypto

How the Mid Curve Affects Crypto Investment Strategies

The mid curve concept plays a pivotal role in shaping effective crypto investment strategies for 2024. By understanding the dynamics of the mid curve, investors can make informed decisions, increasing the potential for higher returns. The mid curve illustrates how assets perform over time, highlighting critical price levels that can influence market trends.

Investors focusing on short-term trading may utilize the mid curve to identify optimal entry and exit points. Recognizing price fluctuations along this curve allows for effective timing, which is crucial in the highly volatile crypto market. Moreover, analyzing historical data related to the mid curve can reveal patterns that guide traders in predicting future price movements.

For long-term investors, the mid curve can inform an overall investment strategy by identifying which cryptocurrencies are likely to appreciate. Monitoring the shift in curve trends can help in selecting robust projects with sustainable growth potential. Investors should consider incorporating indicators that track the mid curve’s movement alongside other metrics, such as market sentiment and technical analysis, to build a comprehensive investment profile.

Furthermore, as regulatory landscapes evolve and new technologies emerge, the mid curve can serve as a valuable tool for assessing the impact on various crypto assets. Being adaptable to changes in the mid curve enables investors to pivot their strategies, thereby mitigating risks associated with sudden market shifts. Overall, a solid grasp of the mid curve empowers crypto investors to blend predictive analytics with strategic foresight, crafting a tailored approach that aligns with their financial goals.

mid curve meaning crypto

Identifying Mid Curve Opportunities in Emerging Cryptocurrencies

Investing in emerging cryptocurrencies has gained traction in recent years, particularly as investors seek to identify mid curve opportunities. Mid curve opportunities refer to cryptocurrencies that are not at their peak but have shown substantial growth potential. To spot these, it’s essential to analyze various factors that contribute to a cryptocurrency’s success.

First, assess the market trends by examining the performance of similar cryptocurrencies over time. Look for those that have demonstrated a gradual rise rather than an instant spike, indicating steady growth. Utilize resources like cryptocurrency price charts and technical analysis tools to better understand potential upward trends.

Next, consider the project’s underlying technology and utility. Cryptocurrencies with robust blockchain technology and clear use cases often have greater potential for growth. Check the whitepaper and roadmap of the project for updates and future plans, as these documents reflect the team’s commitment to advancing the project.

Community engagement also plays a pivotal role in the success of a cryptocurrency. Active communities on platforms such as Telegram and Discord can indicate genuine interest and support. Monitoring social media trends and sentiment can provide valuable insights into the market’s perception of the cryptocurrency.

Furthermore, keeping an eye on partnerships and collaborations is crucial. Emerging cryptocurrencies that establish strategic alliances with established companies often enhance their credibility and market presence, making them prime candidates for mid curve investment opportunities.

Lastly, be sure to diversify your portfolio. Investing in multiple long-tail cryptocurrencies can mitigate risk while maximizing your chances of capitalizing on those that follow the mid curve trend.

mid curve meaning crypto

Risks and Challenges Associated with the Mid Curve

Navigating the mid curve presents a unique set of challenges for investors, particularly in the context of market volatility anticipated in 2024. As investors seek to balance risk and return, understanding the various factors influencing the mid curve becomes essential. One major concern is the liquidity risk, often exacerbated during periods of economic uncertainty. If market conditions shift rapidly, the ability to enter or exit positions may deteriorate, impacting overall investment performance.

The mid curve, characterized by its maturities that fall between the short-term and long-term bonds, often reacts sharply to changes in interest rates. An unexpected rate hike or geopolitical tension can lead to rapid fluctuations in prices, making it imperative for investors to stay informed about macroeconomic indicators. Furthermore, credit risk associated with mid curve instruments warrants attention, as the performance of these assets can be influenced by the issuing entity’s economic health. Investors must evaluate credit ratings and monitor the issuer’s financial stability continuously.

Moreover, inflation expectations also play a pivotal role in shaping mid curve dynamics. With the potential of rising inflation, real returns on mid-term investments may diminish, prompting investors to reassess their strategies. On a broader scale, the interconnectedness of global markets can increase susceptibility to systemic risk, where various economic factors converge to create unforeseen challenges for mid curve investors.

Overall, staying ahead of these potential pits and understanding the complex interplay of market forces will be crucial for investors as they navigate the mid curve within the unpredictable landscape of 2024.

mid curve meaning crypto

Expert Opinions on the Mid Curve: Predictions for 2024

As we approach 2024, numerous industry experts are offering their insights on the mid curve within the cryptocurrency market. This critical segment is defined by its ability to balance volatility and stability, making it particularly interesting for crypto traders. Analysts suggest that understanding the price trajectories and market dynamics will be crucial as we move forward.

One prominent analyst emphasizes the significance of technical indicators to gauge the health of the mid curve. By evaluating trends and patterns, traders can better navigate potential price fluctuations. This knowledge is essential as the mid curve is often where buying opportunities and sell signals manifest.

Furthermore, experts predict a growing interest in decentralized finance (DeFi) and the implications it will have on the mid curve. As more investors become adept at utilizing DeFi platforms, the liquidity within the mid curve may increase, providing greater opportunities for arbitrage and market entry.

Another key factor discussed by industry thought leaders is the impact of regulatory changes. With governments worldwide taking a closer look at cryptocurrency regulations, the evolving legal landscape will likely influence traders’ strategies within the mid curve. Keeping abreast of these developments will be vital for making informed decisions.

In summary, the expert consensus indicates a pivotal year ahead for the mid curve in 2024. With a focus on market trends, liquidity analysis, and regulatory impacts, traders are advised to stay informed and ready to adapt their strategies as the crypto landscape continues to evolve.

Long-Term vs Short-Term Investment: The Mid Curve Consideration

When evaluating investment strategies, it is essential to consider the mid curve perspective, especially when comparing long-term investments and short-term investments. Investors often face a dilemma: should they commit their capital for the long run or take advantage of shorter time frames for quicker returns? The mid curve approach facilitates a balanced view between the two, assessing the potential rewards and the inherent risks in each strategy.

In the realm of long-term investment strategies, investors typically seek assets that promise substantial appreciation over several years or even decades. These can include stocks, real estate, and index funds. The advantage here is the power of compound interest and the ability to ride out market volatility. However, long-term investors must possess patience and a risk tolerance for market downturns.

Conversely, short-term investment strategies, including trading stocks, options, or ETFs, aim for quick profits. Market conditions fluctuate rapidly, and short-term investors need to stay informed and adaptable. While these investments can yield immediate gains, they are often accompanied by higher risks, including market volatility and transaction fees that can erode profits.

The mid curve analysis involves understanding how both investment timelines can coalesce to provide a diversified portfolio that mitigates risk while maximizing returns. Investors can allocate a portion of their portfolio to long-term assets to capture growth and use short-term strategies to enhance cash flow. Balancing these approaches enables investors to hedge against market fluctuations while capitalizing on immediate opportunities.

Resources for Understanding the Mid Curve in Cryptocurrency

The mid curve in cryptocurrency refers to the critical area between short-term and long-term price trends, providing insights for investors looking to navigate market fluctuations. Understanding this dynamic is essential for maximizing trading strategies and portfolio management. This section compiles a variety of resources tailored for both novice and seasoned investors.

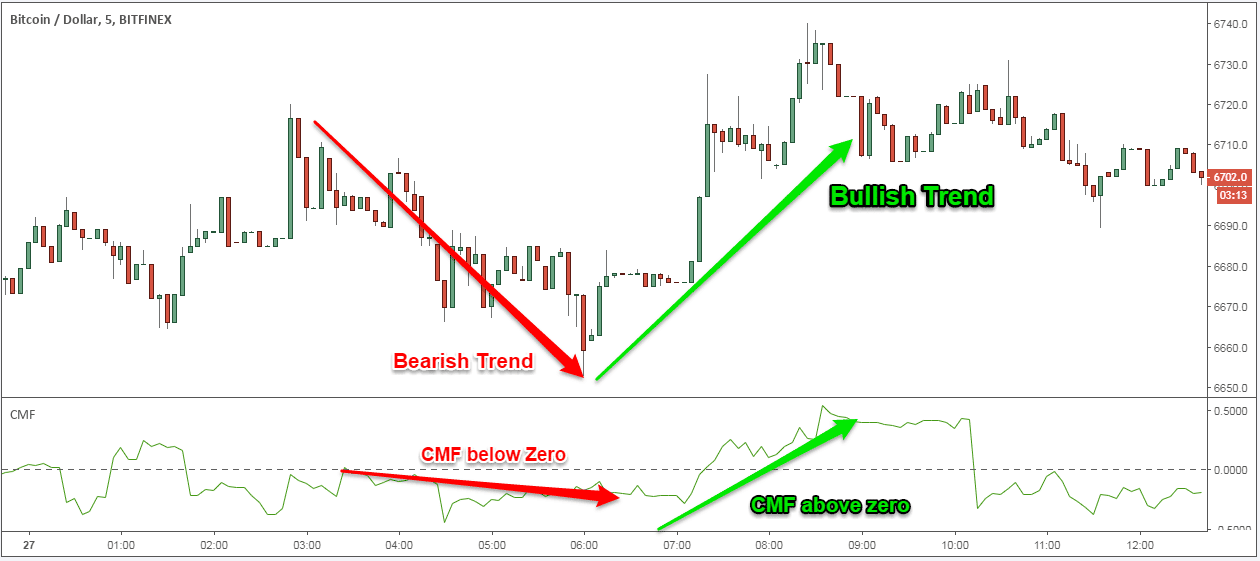

One of the primary tools for analyzing the mid curve is chart analysis software. Platforms like TradingView offer a plethora of tools, including technical indicators such as moving averages and Bollinger Bands, which help investors grasp the mid curve dynamics. Using these tools, traders can identify key price levels and potential reversal points within the mid curve.

Additionally, data analysis platforms such as CoinMarketCap provide extensive datasets that highlight price movements and trading volumes over time. By analyzing historical data, investors can better understand how the mid curve has behaved in various market conditions, which enhances their decision-making processes.

Another valuable resource is educational content available through cryptocurrency exchanges like Binance and Coinbase. These platforms often feature articles, webinars, and tutorials that cover market dynamics, including the significance of the mid curve in cryptocurrency trading.

Furthermore, engaging with online communities and forums, such as Reddit and Discord channels dedicated to cryptocurrency trading, allows investors to share insights and strategies concerning the mid curve. Peer discussions can unveil different perspectives and techniques that might be beneficial for navigating the complexities of the market.

Lastly, utilizing portfolio management tools can help investors visualize their holdings in the context of the mid curve, allowing them to optimize asset allocation and minimize risk.

FAQ Section

What does “mid curve” mean in crypto?

The term “mid curve” in the context of cryptocurrency typically refers to a point or range in the price or performance of an asset that lies between its lower and upper extremes. It can indicate a balanced market sentiment where volatility is reduced compared to the extremes of a market cycle.

How is the mid curve used in trading strategies?

Traders often use mid curve data to identify entry and exit points for buying or selling cryptocurrencies. It helps in assessing market stability and making informed decisions based on average performance metrics rather than extreme fluctuations.

Can the mid curve predict market movements?

While the mid curve provides insights into the average performance of a cryptocurrency, it is not a definitive predictor of future market movements. Traders must combine mid curve analysis with other technical and fundamental analyses to make predictions.

How can I calculate the mid curve for a cryptocurrency?

Calculating the mid curve typically involves taking the average price over a certain period and analyzing the price action within that timeframe. This could be done using tools such as moving averages or other statistical methods to determine the mid-range price.

Is mid curve analysis beneficial for long-term investors?

Yes, mid curve analysis can be beneficial for long-term investors as it helps in identifying trends and potential supports or resistances in the market. It can provide a clearer view of price stability and allow investors to make more strategic decisions.

What are the limitations of using mid curve analysis?

One limitation of mid curve analysis is that it may not account for sudden market changes or events that can cause significant price fluctuations. Additionally, it should not be the sole basis for investment decisions; a comprehensive analysis of various factors should be conducted.

Does the mid curve apply to all cryptocurrencies?

Yes, the concept of the mid curve can be applied to any cryptocurrency, though its relevance may vary based on market conditions, trading volume, and specific characteristics of each asset. Different cryptocurrencies may exhibit different behaviors around their mid curves.

Where can I find mid curve data for cryptocurrencies?

Mid curve data can often be found on various cryptocurrency market analysis platforms and trading websites. Many of these platforms provide tools that allow users to analyze price charts and calculate mid curves based on historical data.