In the ever-evolving landscape of cryptocurrency, crypto bridges have emerged as pivotal infrastructures that facilitate seamless transactions between different blockchain networks. But what exactly are these bridges, and why are they garnering so much attention? This article dives deep into the world of crypto bridges, unraveling their mechanics, applications, and the potential they hold for the future of digital finance.

crypto bridges

What Are Crypto Bridges?

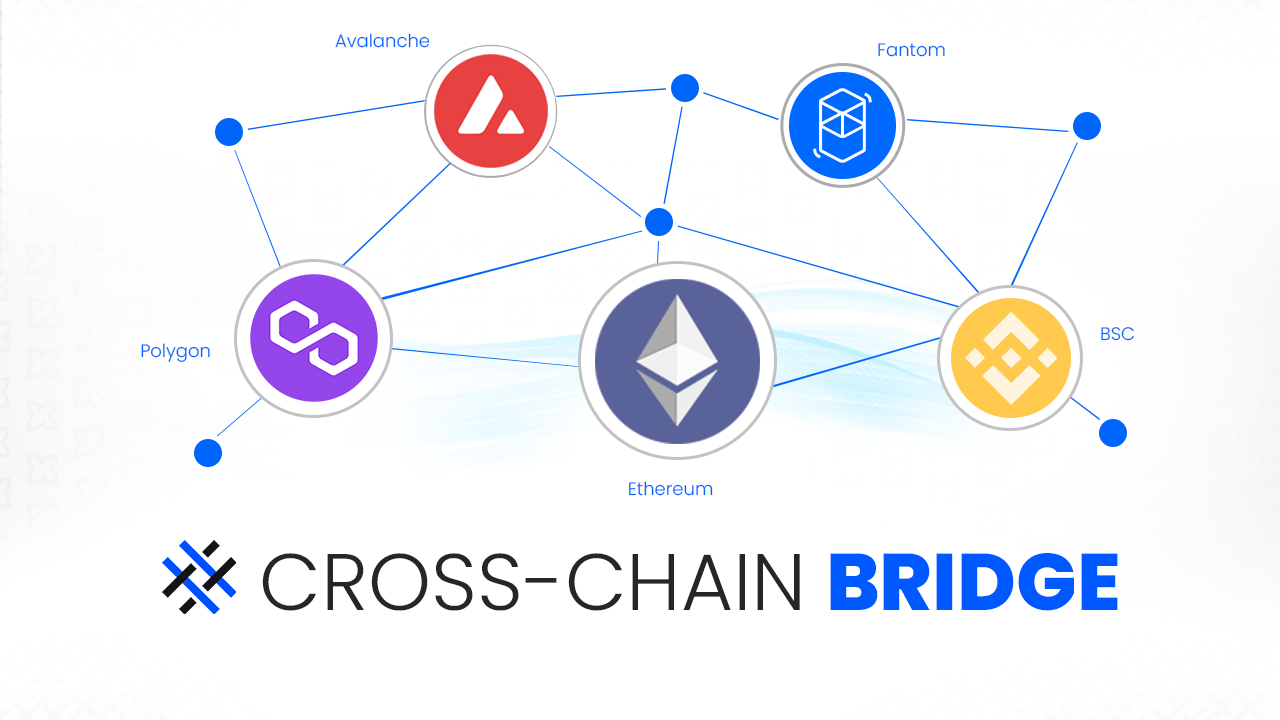

To understand crypto bridges, let’s begin with a simple analogy. Imagine two islands (blockchains) separated by a vast ocean (the technological divides). A crypto bridge acts as a boat, allowing assets and information to be transported from one island to the other. More specifically, a crypto bridge enables interoperability between different blockchain networks, allowing users to transfer tokens from one chain to another without the need for a centralized exchange.

crypto bridges

Many experts consider crypto bridges to be a critical solution to one of blockchain technology’s core challenges: fragmentation. Different blockchains serve varied purposes, but when users want to leverage the benefits of multiple networks, they often face hurdles. Crypto bridges dismantle these barriers, fostering an ecosystem where applications can operate more freely.

crypto bridges

Types of Crypto Bridges

While crypto bridges primarily serve the same purpose, they can be categorized into a few distinct types:

crypto bridges

- Centralized Bridges: These third-party services facilitate transactions between blockchains through a centralized mechanism. Users must trust the entity operating the bridge, which may raise security concerns.

- Decentralized Bridges: Operated on decentralized protocols, these bridges tend to offer better security through smart contracts. Users retain control over their assets, minimizing trust issues.

- Token Bridges: These allow users to wrap tokens from one blockchain into a format compatible with another. For example, Bitcoin can be wrapped into Ethereum-compatible tokens for use within that ecosystem.

The Benefits of Using Crypto Bridges

Now that we know what crypto bridges are, let’s explore the myriad benefits they offer:

crypto bridges

1. Improved Liquidity

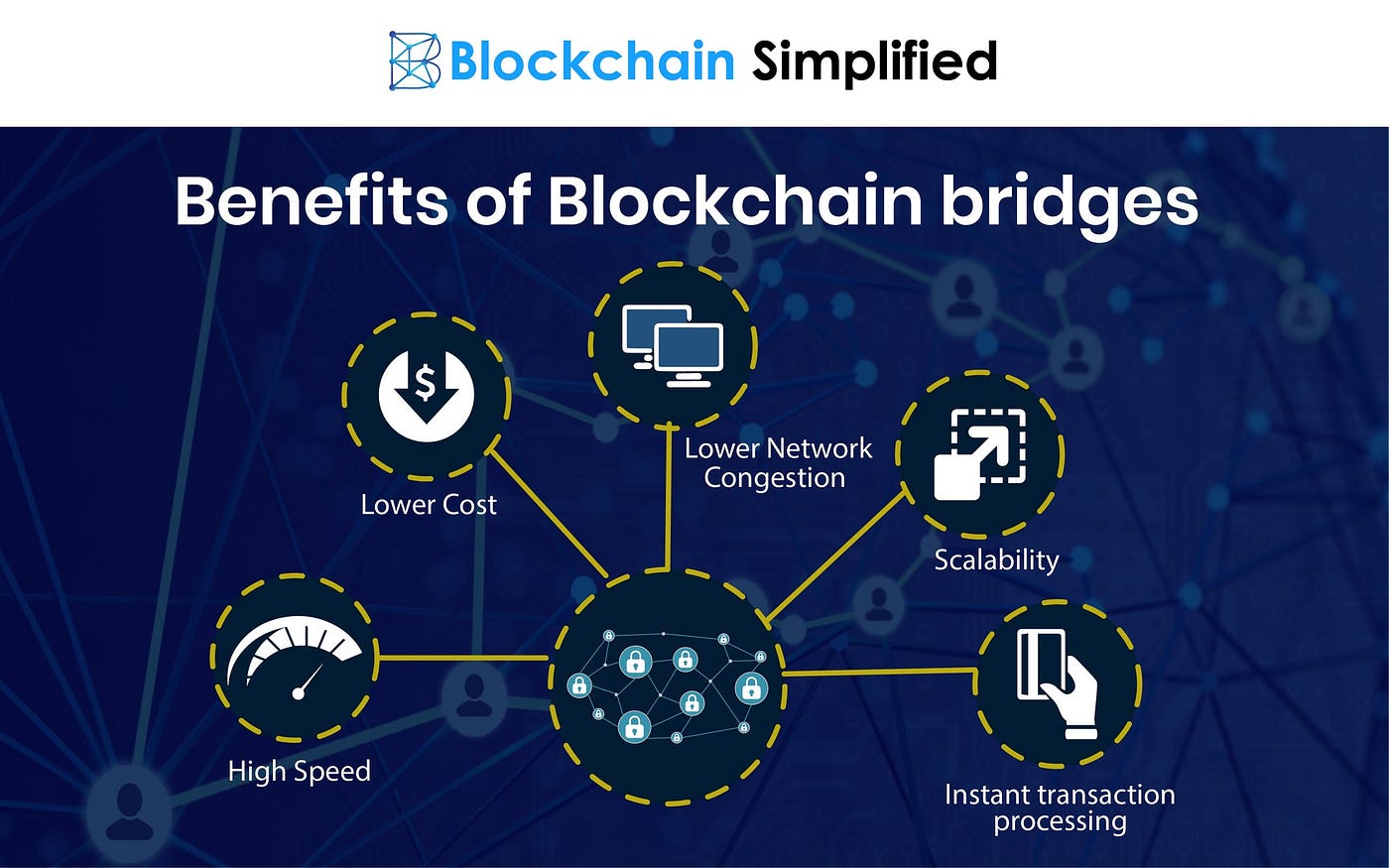

One of the significant advantages of crypto bridges is improved liquidity across different blockchains. By permitting the transfer of assets, these bridges facilitate a more extensive network of trading opportunities. Essentially, they allow users to tap into various markets that they may not have access to otherwise, significantly enhancing the trading ecosystem.

2. Enhanced User Flexibility

Imagine being locked into a single blockchain without the option to explore other networks. Sounds limiting, right? Crypto bridges expand the possibilities for users, enabling them to move their assets as they see fit. Whether it’s moving ETH to a DeFi platform on Binance Smart Chain or accessing advanced features on a layer 2 solution, the flexibility provided by these bridges is crucial.

3. Lower Transaction Costs

With the rising adoption of blockchain technologies, transaction fees can skyrocket, particularly during peak times. By using bridges, users can navigate towards the least congested networks, thus minimizing fees associated with transactions. This is particularly beneficial for smaller transactions where high fees could significantly cut into profits.

Real-World Applications: Case Study Insights

To illustrate the significance of crypto bridges, let’s delve into some real-world applications. Take the case of a hypothetical decentralized finance (DeFi) platform called YieldBoost. Without crypto bridges, YieldBoost could only operate on the Ethereum blockchain, limiting its reach. However, by integrating a decentralized bridge, it enables users to bring liquidity from Binance Smart Chain, Polygon, and more.

This integration led to a substantial increase in user engagement and liquidity. Users could now earn rewards on assets originally situated on different networks, showcasing the possibilities that bridging technology allows.

Market Trend Analysis

According to a report from Chainalysis, the use of crypto bridges surged by 200% in 2023, showing the growing importance of cross-chain transactions. The report highlights that platforms employing bridges outperformed their counterparts that didn’t, emphasizing the competitive edge afforded by such integrations.

Growth Rate of Crypto Bridges (2022-2024)

Addressing Concerns: Security Risks

While crypto bridges present numerous benefits, they are not without risks. Historically, centralized bridges have faced security breaches, resulting in significant losses for users. For example, in 2021, a major incident involving a centralized bridge led to the theft of over $600 million.

To mitigate these risks, users should be knowledgeable about bridge protocols. Engaging only with reputable services that have undergone comprehensive audits can drastically lower security threats. Additionally, users are encouraged to use hardware wallets for enhanced asset protection.

Future Trends in Crypto Bridges

As we look towards the future, the importance of crypto bridges is undeniable. Innovations are constantly emerging; we can expect more optimized and efficient bridges that will further reduce transaction times and costs. The introduction of cross-chain smart contracts could allow automated and instantaneous transfers, setting the stage for even more complex interactions between various networks.

Furthermore, as regulatory frameworks develop, compliant bridges will likely become more prominent, paving the way for institutional adoption of cryptocurrencies. This shift will facilitate a more robust financial ecosystem.

Conclusion: Embracing the Future

In 2024 and beyond, crypto bridges are poised to be at the forefront of digital finance evolution. By understanding their workings, benefits, and implications, individuals and businesses alike can capitalize on these innovative solutions. Bridging gaps not only between blockchains but also between traditional finance and the crypto world, these infrastructures will facilitate a new era of economic interconnectivity.

With the ongoing advancements in technology, the landscape of cryptocurrency will continue to transform, making it vital for users to remain informed. Are you ready to navigate the exciting waters of crypto bridges? The time to explore is now!

FAQ

- What is a crypto bridge? A crypto bridge is a technology that connects different blockchain networks, allowing for the transfer of assets and information.

- Are centralized bridges safe to use? Centralized bridges introduce trust concerns; it’s essential to only use reputable ones.

- What are the benefits of using crypto bridges? Benefits include improved liquidity, user flexibility, and lower transaction costs.