Hey there! If you’ve ever wondered how to navigate the buzz around crypto unit, you’re not alone—especially with 2024 just around the corner! From blockchain technology to trading platforms, the world of cryptocurrency is evolving faster than you can say “Bitcoin”. In this article, we’ll dive deep into what crypto units are, their benefits, and how you can harness them to ramp up your crypto investing game.

crypto unit

What Is a Crypto Unit?

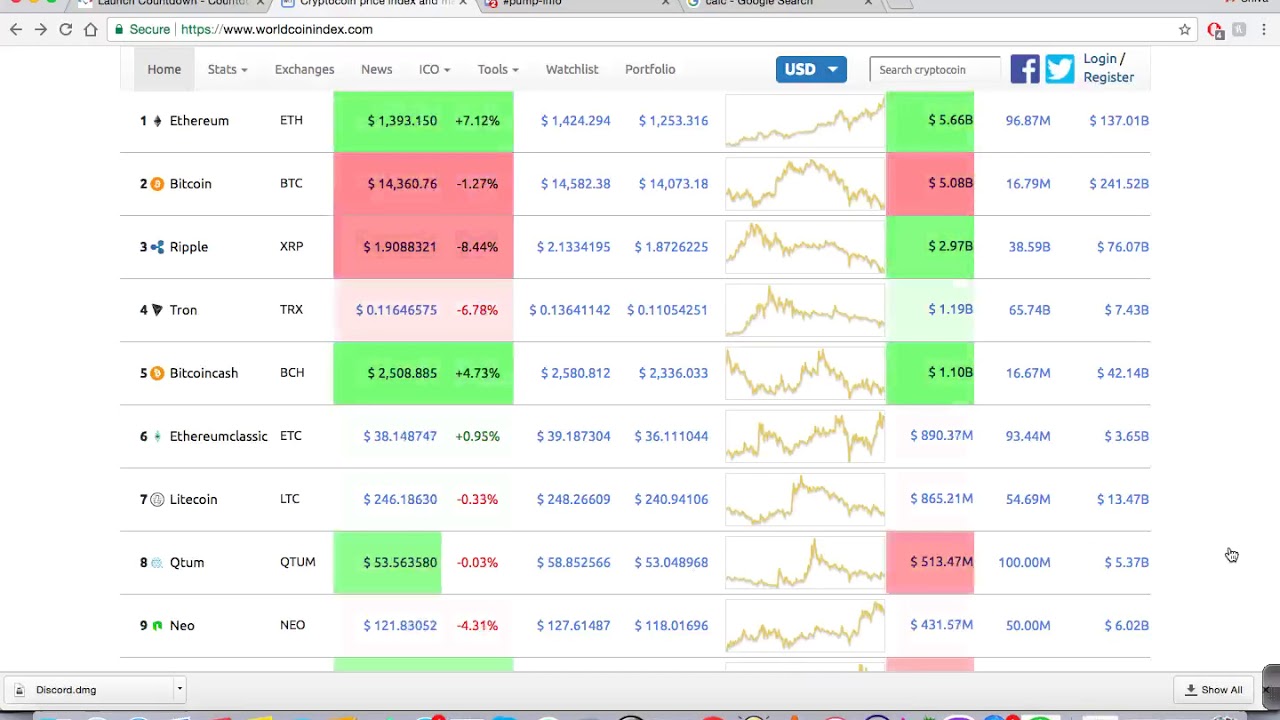

Simply put, a crypto unit is a measurement of cryptocurrency that serves as a unit of account in its specific blockchain environment. Whether it’s Bitcoin, Ethereum, or some lesser-known altcoin, each crypto unit defines the smallest divisible part of that currency, commonly referred to as a satoshi for Bitcoin (1 millionth of a Bitcoin). This concept is crucial for understanding cryptocurrencies and how they function in financial transactions.

crypto unit

Imagine this: You’re at a coffee shop, and instead of digging into your pockets for cash or swiping your card, you can simply scan a QR code and send crypto units directly from your digital wallet! This seamless process highlights the core advantage of using crypto units: speed, efficiency, and security.

crypto unit

The Benefits of Using Crypto Units

Let’s break down the primary advantages of working with crypto units in your investment portfolio:

crypto unit

- Decentralization: Unlike traditional currencies, many cryptocurrencies operate without a central bank, giving you greater control over your finances.

- Global Transactions: Send and receive your funds anywhere in the world with just a few clicks, bypassing hefty banking fees.

- Transparency: Most crypto transactions are recorded on a public ledger (the blockchain), meaning anyone can confirm transaction histories.

- Potential for High Returns: Though risky, investing in crypto units has substantially outperformed traditional assets this past decade.

Case Studies: Crypto Success Stories

To further illustrate these points, let’s take a closer look at a couple of real-world examples. In 2020, an investor named Mark purchased $100 worth of Bitcoin. Fast forward to early 2021, and that same investment surged to nearly $3,000! Mark didn’t just ‘buy and hold’; he learned the nuances of crypto units, understanding the timing for his trades. His story showcases the immense potential of mastering crypto units through strategic investing.

crypto unit

Another example is Ethereum’s rise, which has propelled innovative decentralized applications (dApps). By utilizing crypto units, developers can interact seamlessly on the Ethereum network. Zhang, a software engineer, created an award-winning dApp that generated over $1 million in revenue within months! The success stories in the crypto market are as inspiring as they are instructive.

Market Trends and Predictions for 2024

Now let’s discuss what the future holds for crypto units. According to a report from Forbes, we can anticipate several key trends in 2024:

- Increased Regulation: Governments worldwide are refining regulations for cryptocurrencies, aiming to strike a balance between innovation and consumer protection.

- Institutional Investment: More established institutions are investing in cryptos, indicating a maturing market and increasing mainstream acceptance of crypto units.

- Environmental Concerns: With heightened scrutiny of energy usage in cryptocurrency mining, we can expect more eco-friendly options emerging as alternatives.

How to Get Started with Crypto Units

If you’re feeling inspired, let’s outline some steps to effectively start using crypto units:

1. Choose a Reliable Exchange

Platforms like Coinbase, Binance, and Kraken allow you to buy, sell, and trade various cryptocurrencies easily. Make sure to do your homework and select an exchange that aligns with your trading needs and local regulations.

2. Secure Your Digital Wallet

Your digital wallet is as crucial as a bank vault—if not more so! Explore options between hardware wallets (like Ledger or Trezor) and software wallets (like Metamask). Whichever you choose, enable two-factor authentication to enhance security.

3. Learn Market Analysis

Understanding how to read market trends is vital. Familiarize yourself with technical analysis tools and resources such as TradingView. Keeping abreast of news affecting cryptocurrencies through resources like CoinTelegraph can provide invaluable insights.

4. Start Small

When you first dip your toes into crypto investing, it’s best to start with a minimal investment. Use fractions of crypto units to test your strategy, refining your approach as you gain confidence.

5. Diversify Your Portfolio

Just like any other investment portfolio, diversification is crucial. Instead of focusing solely on Bitcoin or Ethereum, consider incorporating a mix of established cryptocurrencies and promising altcoins. This strategy can balance out risks and open doors for different growth opportunities.

Visual Data Representation of Crypto Trends

Seeing is believing! Below are some SVG charts that visualize the trends in cryptocurrency growth and user adoption over the past year. These insights can help you spot patterns:

Engage with the Crypto Community

To maximize your chances in the crypto game, consider engaging actively within the community. Platforms like Reddit and Telegram host active discussions around crypto units. Learning from fellow crypto enthusiasts can provide real-world insights that are often overlooked.

FAQs About Crypto Units

What’s the Difference Between a Coin and a Token?

A coin is a digital currency that operates on its blockchain (e.g., Bitcoin, Ether), while a token operates on an existing blockchain (e.g., ERC-20 tokens on Ethereum).

How Do I Store Crypto Units Safely?

Utilize wallets, either hardware or software, ensuring to activate two-factor authentication for enhanced security.

Can I Use Crypto Units for Everyday Purchases?

Yes! Many merchants now accept crypto payments, allowing you to shop using crypto units.

Are Crypto Units Taxable?

Absolutely! Crypto transactions may be subject to capital gains tax, depending on your jurisdiction.

Final Thoughts

In conclusion, navigating the realm of crypto units in 2024 presents exciting opportunities and challenges. By understanding these units, leveraging market strategies, and involving yourself in the community, you can strategically position yourself for success. So, what are you waiting for? Dive into the world of crypto and get your piece of the digital finance pie!