If you’ve clicked on this article, chances are you’re curious about crypto arbitrage. Welcome to the club! This fascinating practice is not just a buzzword in the tech sphere; it’s a proven method of potentially making profits in the crypto market. So grab a comfy chair and let’s dive in!

crypto arbitrage

Understanding Crypto Arbitrage

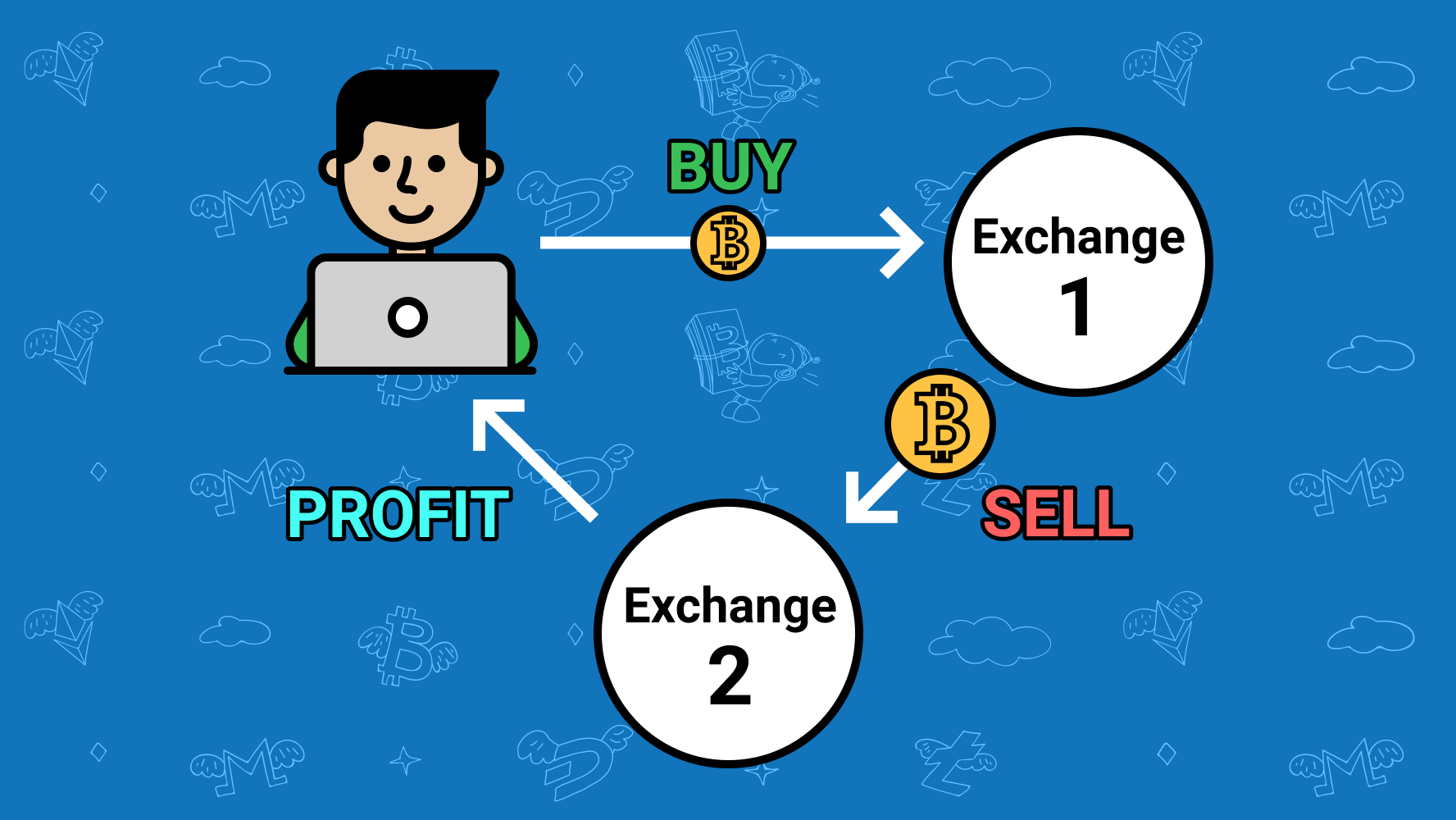

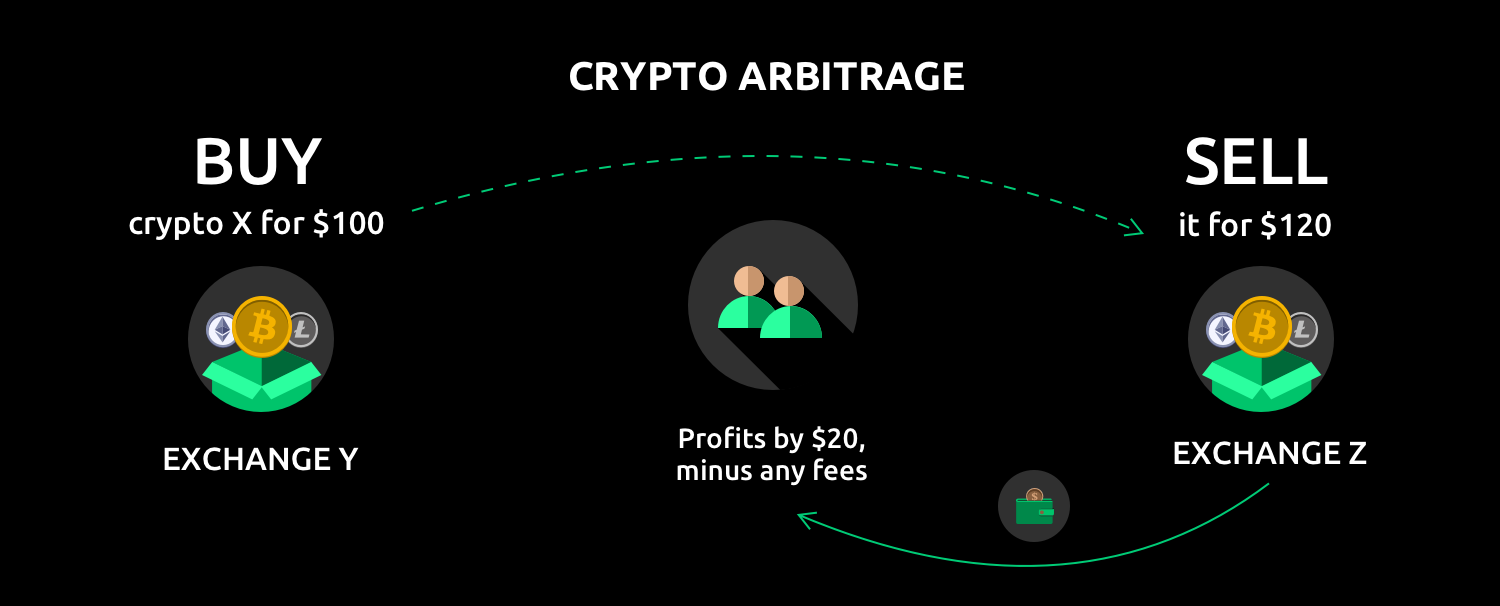

Crypto arbitrage is essentially the practice of taking advantage of the price differences of the same asset across various exchanges. Picture this: Bitcoin is trading for $60,000 on Exchange A and $60,500 on Exchange B. A savvy trader could buy Bitcoin on Exchange A at a lower price and sell it on Exchange B for a profit. Sounds simple, right? But as with anything in finance, there’s much more to it!

crypto arbitrage

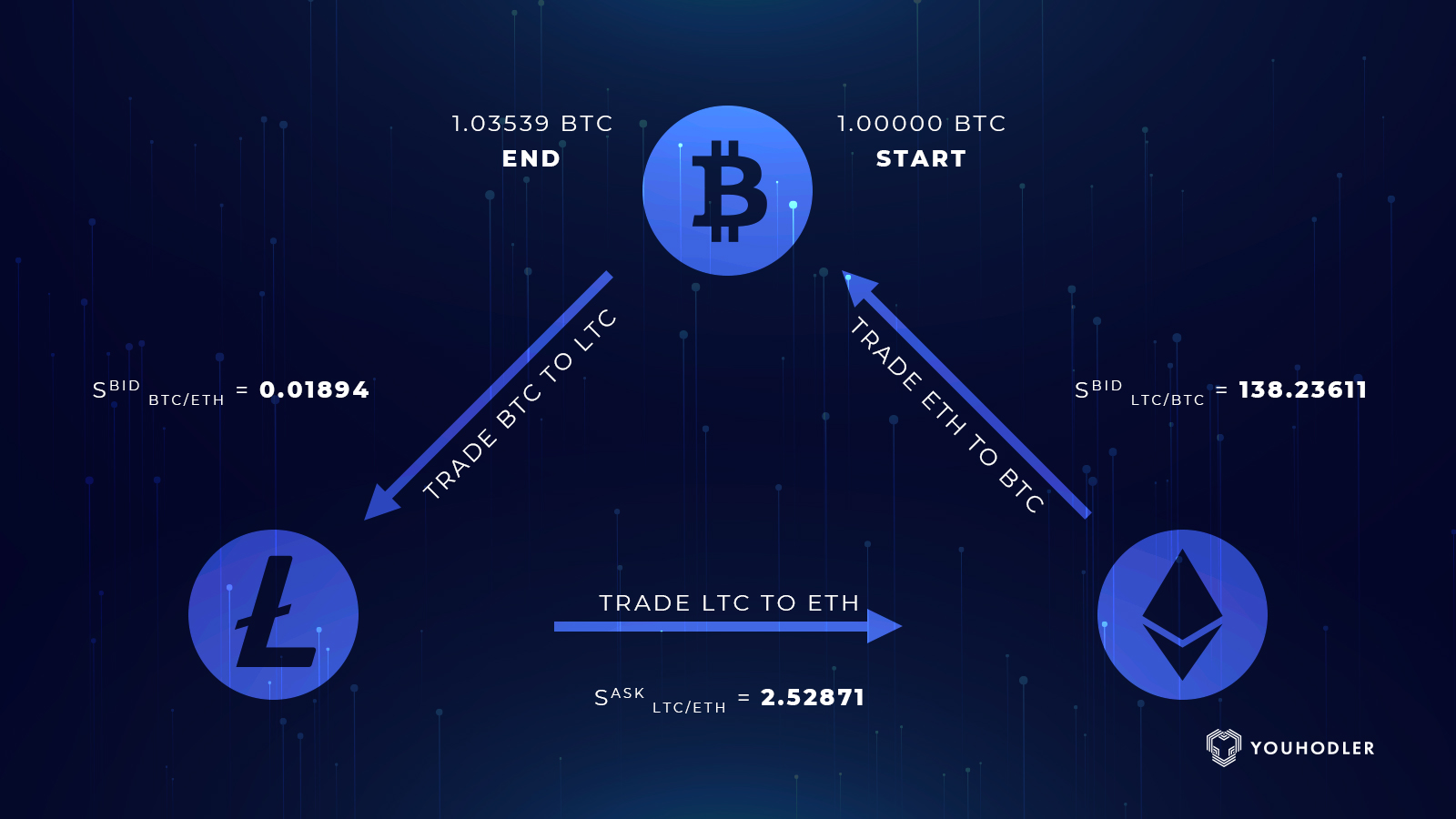

Types of Crypto Arbitrage

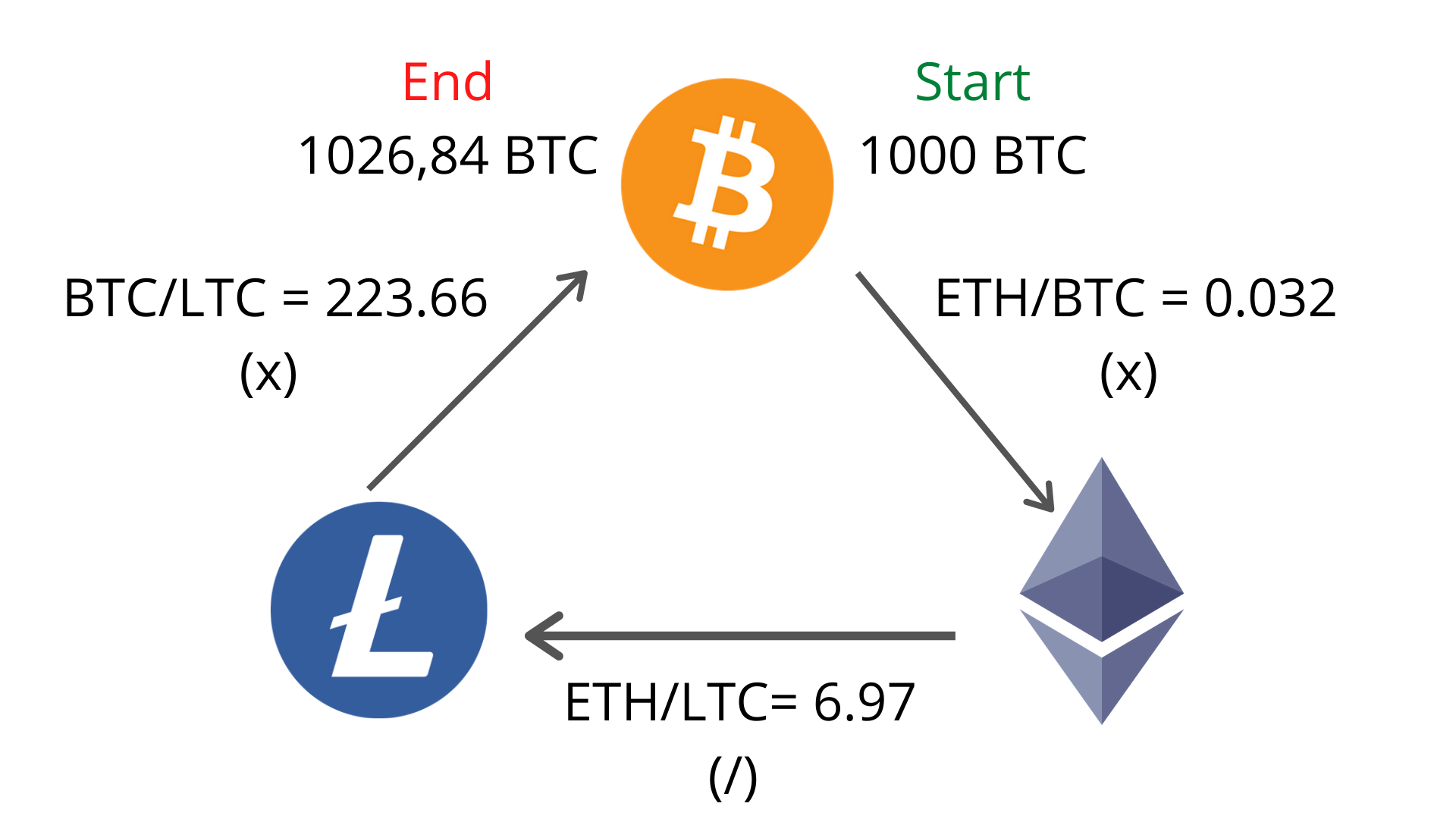

There are different types of crypto arbitrage, each with its own intricacies:

crypto arbitrage

- Spatial Arbitrage: This involves taking advantage of the price differences between exchanges.

- Statistical Arbitrage: This is a more complex approach that uses statistical models to predict price movements.

- Temporal Arbitrage: Here, traders seek to benefit from delayed market reactions to news events.

Why Engage in Crypto Arbitrage?

Investors often ask, “Why should I bother with crypto arbitrage?” Well, here are some compelling reasons:

crypto arbitrage

- Opportunity for Profit: The crypto market is notoriously volatile, creating ample opportunities for savvy traders.

- Market Inefficiencies: Due to the globalization of trading, discrepancies in prices across various platforms are common.

- Diverse Strategies: With various types of arbitrage, traders can choose methods that best fit their risk tolerance and expertise.

Case Study: A Successful Arbitrage Trade

Let’s look at a hypothetical case study. Meet Sarah, a beginner trader intrigued by crypto arbitrage. One day, she notices that Ethereum is priced at $3,000 on Exchange A and $3,050 on Exchange B. Sarah buys 10 ETH from Exchange A and sells them on Exchange B. After considering transaction fees, she clears approximately $500 in profit. This success motivates her to learn more about the intricacies of trading.

crypto arbitrage

Tips for Getting Started with Crypto Arbitrage

Starting your journey in crypto arbitrage doesn’t have to be an uphill battle. Below are some straightforward steps that can set you on the right path:

- Research Exchanges: Choose established and reliable exchanges to minimize risks.

- Stay Informed: Follow market trends and news to catch price discrepancies early.

- Utilize Tools: Trading bots can optimize your trades by executing them at lightning speed.

Understanding the Risks

As enticing as crypto arbitrage sounds, it’s not without its risks. Here are a few to keep in mind:

- Market Volatility: Rapid price changes can eliminate profit margins.

- High Fees: Transaction and withdrawal fees can eat into profits if not accounted for.

- Regulatory Risks: Crypto regulations vary across different countries and can suddenly affect your trading strategies.

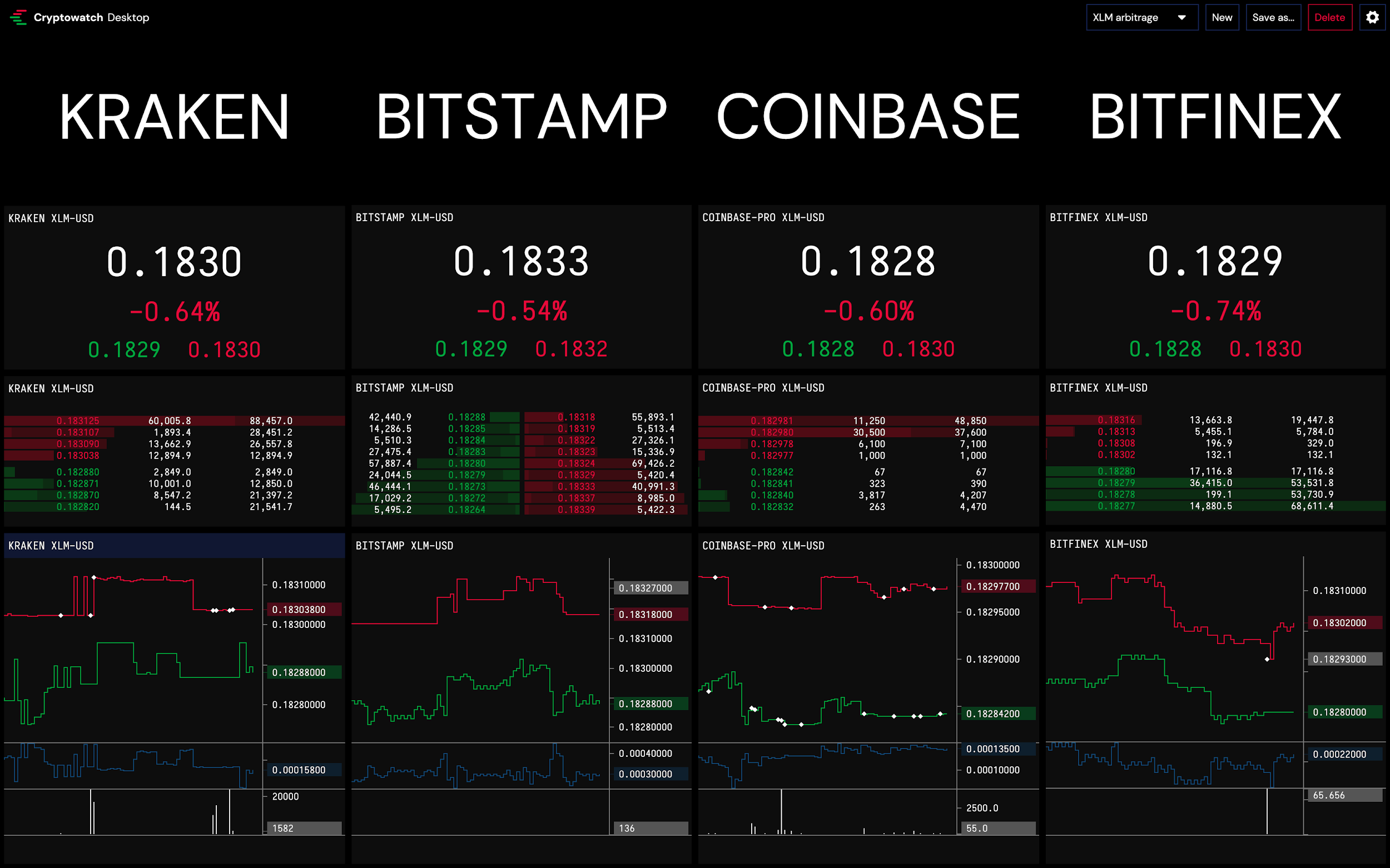

Exploring Market Trends and Data

To illustrate the importance of market awareness, let’s examine some recent data trends associated with crypto arbitrage. According to a report published by Chainalysis, the biggest price discrepancies were observed in smaller, less liquid exchanges. This information underscores the need for traders to analyze exchange liquidity levels before diving into arbitrage trading.

Visual Data Representation

Below is an example of how exchange price discrepancies can look over a week, presented in a bar chart:

This chart shows that on Day 3, the price difference reached its peak, which could have been a lucrative opportunity for traders like Sarah.

Navigating User Experiences: Real-World Impact

Scenario: A Bad Trade

Consider John, an experienced trader but one who underestimated the technicalities involved in crypto arbitrage. He rushed into a trade without proper research and ended up losing money due to high fees and slippage. His experience serves as a lesson that even the simplest of strategies require thorough understanding and preparation.

Scenario: Automated Trading

On the other hand, automated trading has proven beneficial for many. Amanda, another trader, set up a bot to monitor price differences in real-time. This allowed her to take advantage of fluctuations across multiple exchanges without being glued to her computer screen. Automation is not only about setting trades; it’s about optimizing strategy on a whole new level!

Learning Resources and Continued Improvement

No journey is complete without proper resources. Here are some top resources to help deepen your understanding of crypto arbitrage:

- Investopedia – Articles, guides, and tutorials on cryptocurrency investment.

- CoinDesk – For current news and in-depth analysis.

- Binance Academy – Learn everything from basic concepts to advanced trading strategies.

User Feedback and Community Discussions

Communities like Reddit and specialized forums provide platforms for users to share experiences, strategies, and lessons learned from crypto arbitrage. Participating in these discussions can be invaluable in aiding your own growth. You take heed of the successes and missteps of others, thus enriching your understanding of the crypto landscape.

Conclusion: Your Next Steps in Crypto Arbitrage

Ultimately, crypto arbitrage represents more than just a trading strategy; it embodies a mindset of observation, analysis, and opportunity. By employing the tips and insights shared throughout this article, you’ll be well-equipped to venture into this exciting realm. As with any investment, always proceed with caution and ensure that you’re well-informed!

Curious to learn more? Consider checking out our other articles for additional insights and strategies!