If you’ve ever been curious about the ins and outs of crypto futures trading US, then you’re in the right place! This article will serve as your comprehensive guide to what is a complex yet rewarding area of the cryptocurrency world. Whether you’re an experienced trader or just dipping your toes into the crypto seas, understanding futures trading can be a game changer!

crypto futures trading us

What is Crypto Futures Trading?

So, what exactly is crypto futures trading? At its core, it involves contracts that allow you to buy or sell a specific amount of cryptocurrency at a predetermined price at a future date. This allows traders to speculate on the price movements of cryptocurrencies without directly owning the underlying asset. Imagine being able to bet on the future value of Bitcoin or Ethereum without actually having to buy them—that’s the essence of futures trading!

crypto futures trading us

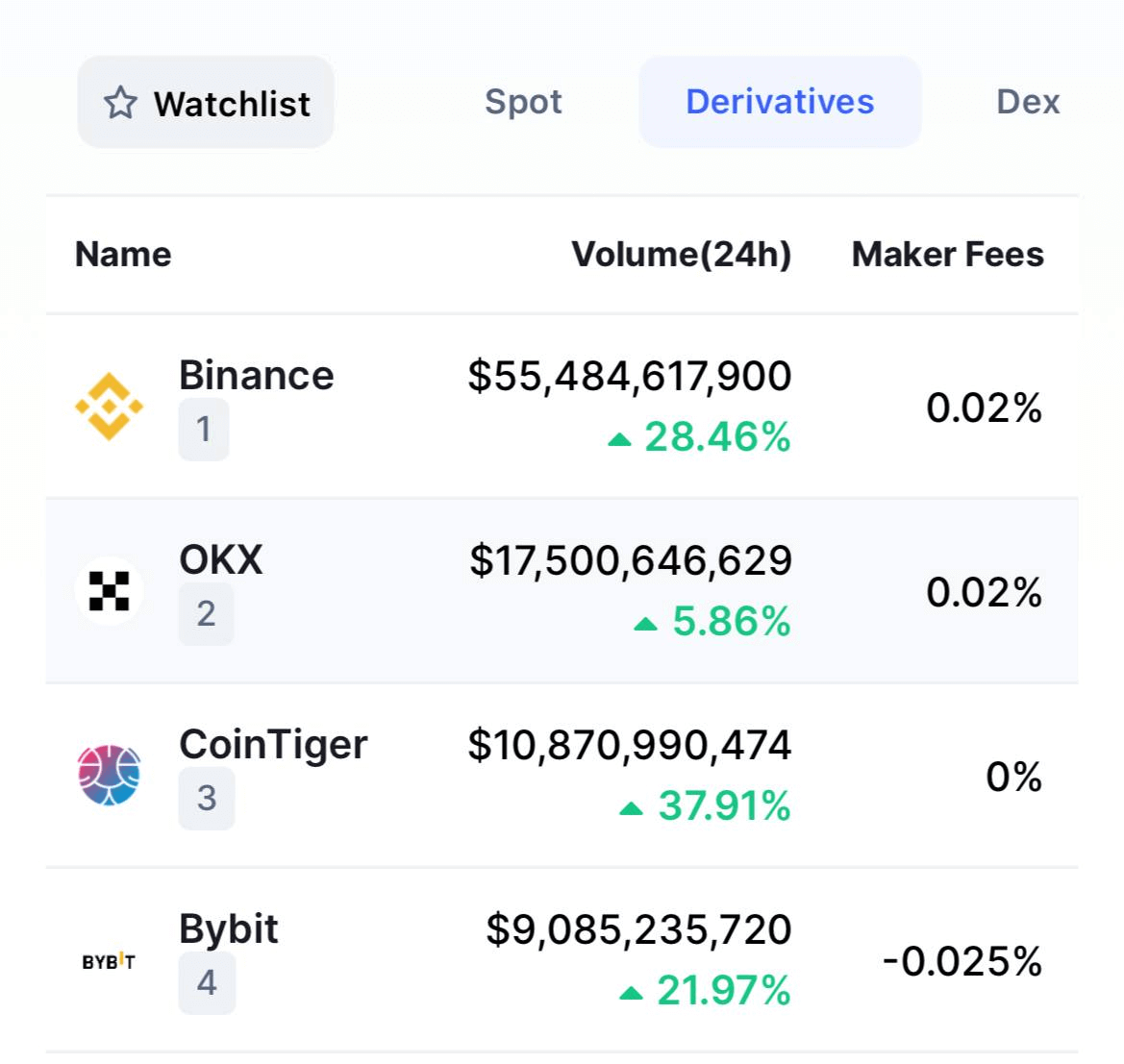

In the United States, futures trading has gained traction due to regulatory improvements and a growing interest in cryptocurrencies. According to a report by the Financial Times, the volume of crypto futures trading has grown significantly, with major exchanges like CME Group and Binance reporting record levels of activity.

crypto futures trading us

How Does Futures Trading Work?

When you enter a futures contract, you’re essentially making a pledge to buy or sell a cryptocurrency at a certain price in the future. This process is facilitated through exchanges specializing in futures, and these exchanges handle the complexities of matching buyers with sellers.

crypto futures trading us

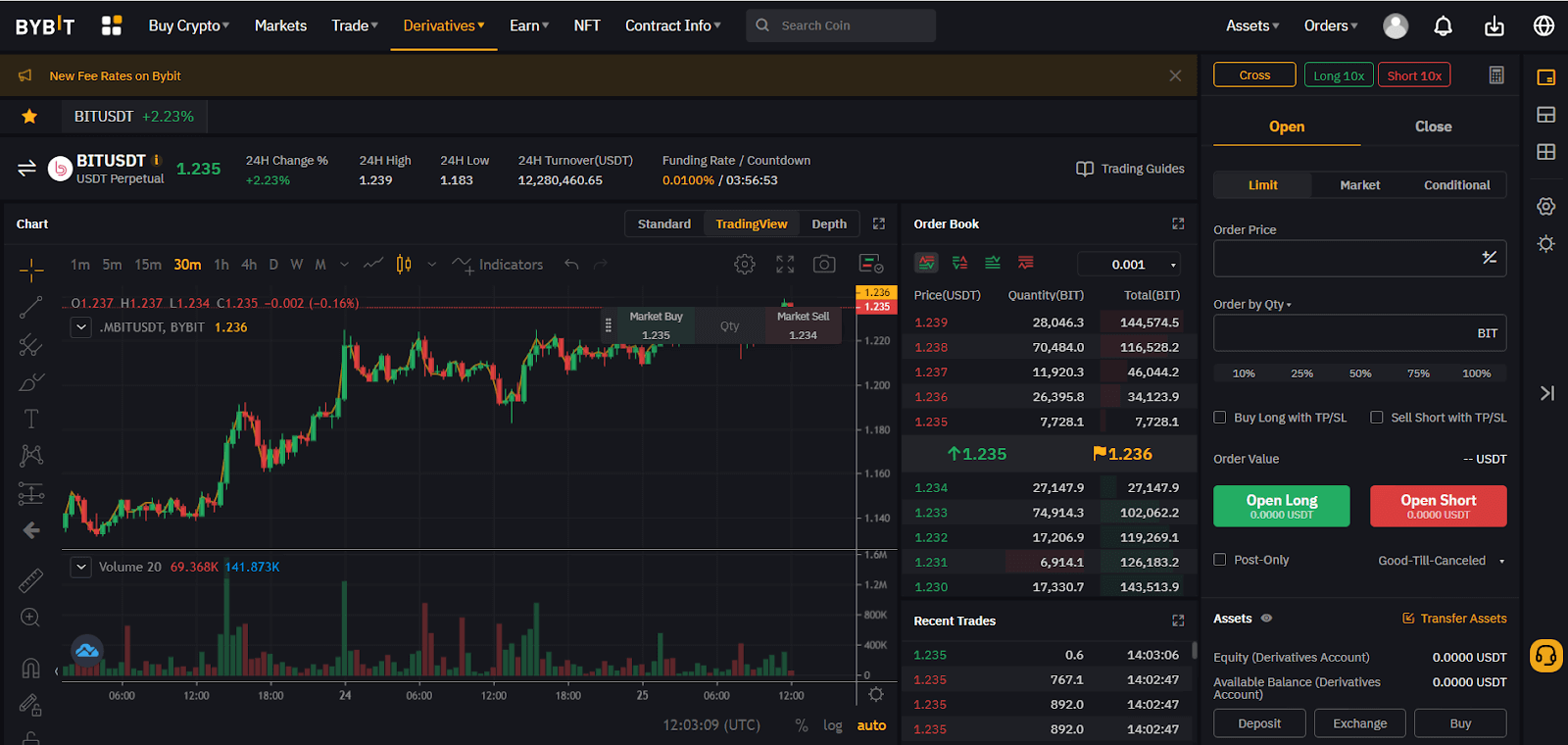

- Long Positions: This is when you believe the price of a cryptocurrency will rise. You buy a futures contract with the hope of selling it later at a higher price.

- Short Positions: Conversely, this is when you anticipate a price drop. You sell a futures contract, hoping to repurchase it later at a lower price.

Key Benefits of Crypto Futures Trading

Engaging in crypto futures trading brings several advantages to the table:

crypto futures trading us

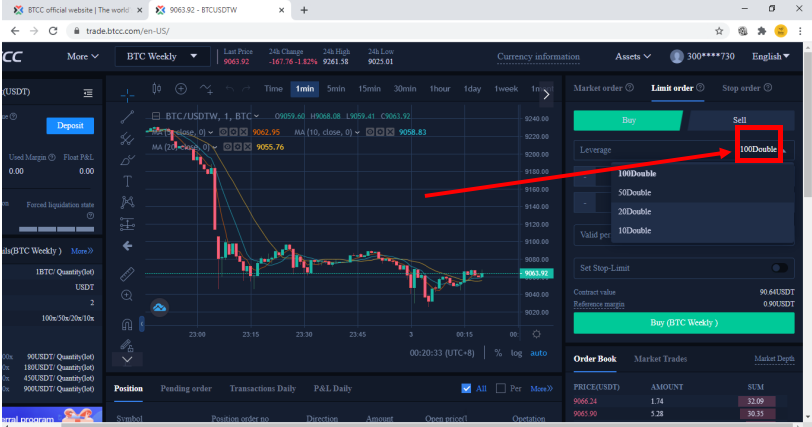

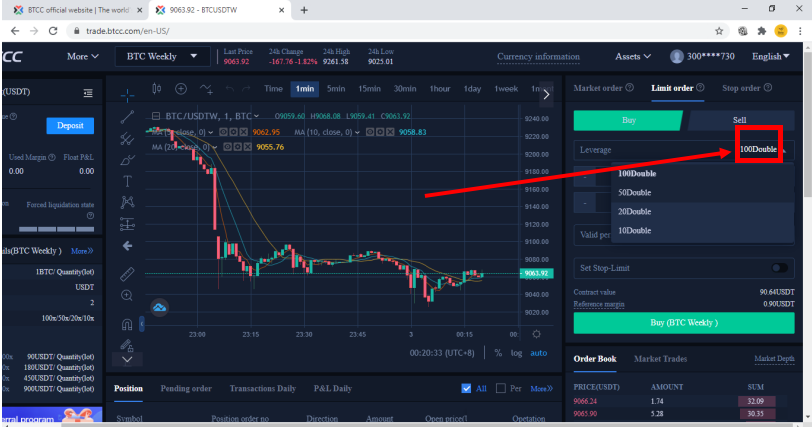

- Leverage: Futures trading often allows traders to use leverage, meaning you can control a larger position with a smaller amount of capital. This can amplify profits (and losses), making smart strategies crucial.

- Liquidity: Major exchanges have high volumes of trade, ensuring that you can enter or exit positions quickly with minimal slippage.

- Hedging Opportunities: Futures contracts can serve as a hedge against other investments, helping to mitigate potential losses in a volatile market.

Market Trends and Insights for 2024

As we look toward 2024, several trends are set to shape the landscape of crypto futures trading US:

The Rise of Decentralized Futures

DeFi, or decentralized finance, continues to revolutionize how we interact with traditional financial instruments. Platforms like Uniswap and Aave are beginning to offer futures capabilities that remove the need for intermediaries. This shift might attract a new wave of traders looking for more control over their investments.

Impact of Regulation

With increasing regulatory scrutiny, especially from the SEC and CFTC, the futures market is evolving. As clear regulations solidify, institutional investors are expected to pour more capital into the crypto space, driving liquidity and legitimacy.

Cultural Acceptance of Cryptocurrencies

As cryptocurrencies gain traction globally, there’s a cultural shift towards regarding them as viable assets. Educational initiatives and more accessible platforms are enhancing public understanding, making futures trading more popular among retail investors.

User Experience: A Case Study

Let’s explore a real-world example to illustrate how crypto futures trading US can be both beneficial and challenging.

Meet Sarah, a 28-year-old financial analyst from California. Initially, Sarah invested in Bitcoin directly, but after learning about futures trading, she decided to try it out. Using a reputable exchange, Sarah opened a futures trading account. She started with a small investment and learned the ropes while leveraging online resources.

After a few successful trades using technical analysis and market trends, Sarah scaled her trading strategy, quickly realizing gains that exceeded her traditional stock investments. However, she also faced challenges. A sudden market drop caught her off-guard due to unintended over-leverage, resulting in a significant loss.

Through her experience, Sarah emphasizes the importance of risk management and continuous learning. Tools like stop-loss orders and position sizing became essential lessons she shared with her peers.

Tips for Effective Crypto Futures Trading

To become proficient in crypto futures trading US, consider these practical tips:

1. Understand Market Trends

Keep an eye on both global economic indicators and crypto-specific news. Platforms like CoinMarketCap allow traders to gauge market sentiment. Utilizing RSS feeds and newsletters keeps you informed in real-time.

2. Leverage Tools and Resources

There are numerous trading platforms equipped with analytical tools. For instance, TradingView offers robust charting capabilities to help you understand price movements better.

3. Risk Management is Key

Always set stop-loss orders to minimize potential losses. The crypto market is volatile, and having a clear exit strategy reduces stress and emotional decision-making.

Visualizing Market Dynamics

Resilience in Trading

Understanding how to stay resilient in the face of market fluctuations is crucial. Emotional control can make or break your trading experience. Regular breaks and keeping a trading journal can help you reflect on your trading strategies and performance.

Final Thoughts and Future Recommendations

The landscape of crypto futures trading US is continually evolving, and as regulatory frameworks solidify, it is set to grow even more accessible. If you’re interested in diving deeper, consider joining platforms that offer webinars or trading simulations to enhance your skills before risking real capital.

Remember, while futures trading can be profitable, it comes with risks. By investing time in research and understanding market dynamics, you can establish a trading strategy that suits your preferences and risk tolerance.

Engage with Us!

Have questions? Interested in sharing your trading experiences? Feel free to leave a comment below or participate in our survey to let us know how your futures trading journey goes!

Join the Conversation: What are your experiences with crypto futures trading? Leave a comment!