Are you baffled by traditional banking methods when it comes to transferring money abroad? You’re not alone! Many are turning to cryptocurrency as a modern solution for cross-border payments. In this article, we’ll explore how to transfer money to another country with crypto, making the intricate world of digital currency easy to understand. So, grab your digital wallet, and let’s get started!

how to transfer money to another country with crypto

What is Cryptocurrency?

Cryptocurrency is a digital or virtual currency that uses cryptography for security. Unlike traditional currencies issued by governments (fiat), cryptocurrencies are decentralized and typically rely on blockchain technology. This technology provides a secure and transparent way to conduct transactions. Bitcoin, Ethereum, and Ripple are among the most popular cryptocurrencies used for cross-border transfers today.

how to transfer money to another country with crypto

How Does Crypto Work for Transfers?

Transferring money internationally with cryptocurrency is a multi-step process:

how to transfer money to another country with crypto

- Choose a Cryptocurrency: Select a crypto like Bitcoin or Ethereum to send.

- Create a Wallet: Ensure both sender and receiver have crypto wallets.

- Obtain the Recipient’s Address: This is crucial for sending your crypto safely.

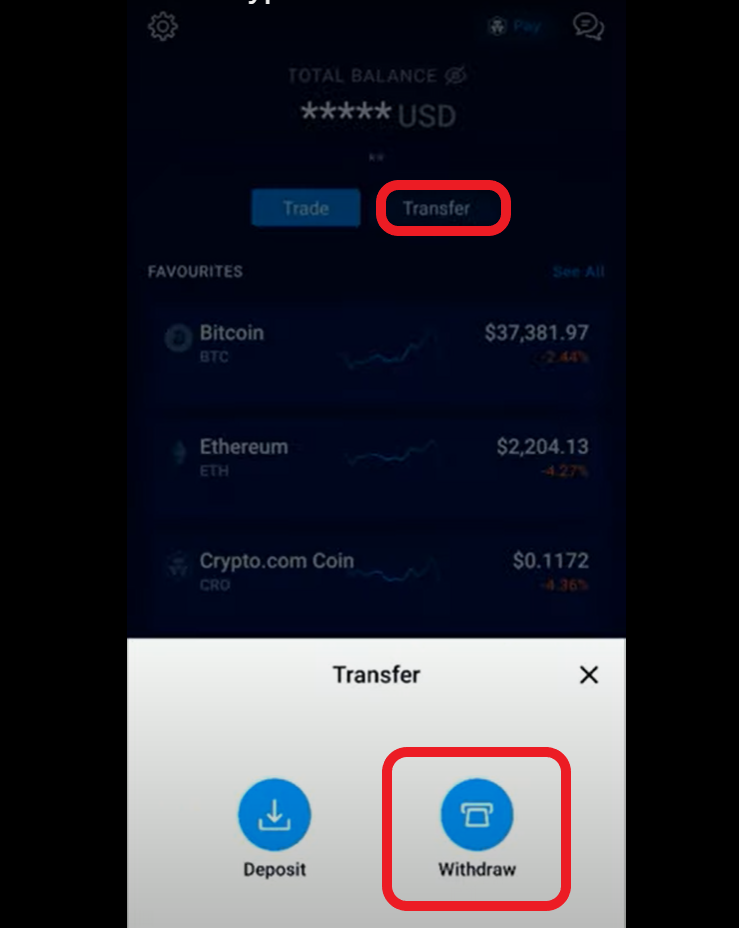

- Initiate the Transaction: Send the cryptocurrency through your wallet interface.

- Confirm the Transaction: Wait for confirmations based on the blockchain network.

Real-World Example:

Let’s consider a scenario where John, who lives in the USA, wants to send money to his brother Tom in the Philippines. Instead of using a traditional transfer service, John decides to use Bitcoin. He purchases Bitcoin worth $1,000, sends it to Tom’s wallet address, and within minutes, Tom receives the funds without costly fees or delays. This scenario highlights the simplicity and efficiency of transferring funds using crypto.

how to transfer money to another country with crypto

The Benefits of Using Crypto for International Payments

Using cryptocurrencies offers several advantages over traditional bank transfers. Here are some of the most notable benefits:

how to transfer money to another country with crypto

- Low Fees: Transaction fees for cryptocurrencies are generally lower than those imposed by banks.

- Speed: Transactions can often be completed in a matter of minutes, as opposed to several days.

- Accessibility: Anyone with internet access can send and receive cryptocurrency.

- Decentralization: No central authority governs crypto transactions, lowering the risk of censorship.

Why Are People Embracing Crypto Money Transfers?

The global financial landscape is changing, and many individuals are opting for cryptocurrency transfers due to their convenience and efficiency. According to a recent report from Statista, nearly 230 million people were using cryptocurrencies worldwide in 2024, a number expected to grow as more realize the potential of digital currencies for cross-border transactions.

How to Choose the Right Cryptocurrency for Transfers

Choosing the right cryptocurrency depends on several factors:

- Volatility: Select stablecoins like USDC or DAI for reduced price fluctuations.

- Transaction Speed: Consider cryptos with faster block times, such as Stellar or Ripple.

- Network Fees: Evaluate the transaction costs associated with each currency.

- Popularity: Choose widely accepted currencies to ensure smooth transfers.

Case Study: The Rise of Stablecoins

Stablecoins have emerged as a popular choice for international transfers because they are pegged to the value of fiat currencies. For instance, Tether (USDT) and USD Coin (USDC) provide users with the benefits of cryptocurrency without the volatility. In 2024, USDT became the leading stablecoin, with over 70% of total dollar volume traded, demonstrating a growing preference among users who prioritize stability.

Security Considerations when Transferring Crypto

When you send cryptocurrency, security is paramount. To ensure safe transactions:

- Use Reputable Wallets: Choose wallets with strong encryption and good reviews from the community.

- Enable Two-Factor Authentication: Extra security goes a long way in protecting your funds.

- Beware of Scams: Always verify recipient details and avoid unsolicited offers.

- Track Transactions: Use blockchain explorers to monitor the status of your transfers.

Common Security Risks

Security risks associated with cryptocurrency transactions can arise from several factors, including phishing attacks, wallet hacks, and even malware. Statistically, in 2023, over $3 billion worth of cryptocurrency was lost to hacks and scams, emphasizing the need for security best practices.

Statistics on Crypto Transfers

Conclusion

In conclusion, how to transfer money to another country with crypto opens up a world of possibilities for individuals looking for fast, affordable, and secure money transfers. As cryptocurrency continues to evolve, it is essential to remain informed about the latest trends and best practices in this space. With its ability to provide financial freedom, the adoption of digital currencies will likely continue to grow in 2024 and beyond.

FAQs

1. Is it legal to transfer money using cryptocurrency?

Yes, in most countries, it is legal to transfer money using cryptocurrency, although regulations vary by jurisdiction.

2. Can I use crypto for remittances?

Absolutely! Many people use cryptocurrencies for remittances, especially in countries where traditional banking is less accessible.

3. What are the risks of using cryptocurrency for international transfers?

The main risks include price volatility, security vulnerabilities, and regulatory challenges.

4. How do I convert cryptocurrency back into fiat currency?

You can convert cryptocurrency back to fiat using exchanges or ATMs that support cash withdrawals.

Want to Learn More?

For additional insights and guides on cryptocurrency and financial technology, read more.