As the cryptocurrency landscape evolves, understanding the crypto emissions schedule is crucial for both investors and developers. The Ultimate Guide to Crypto Emissions Schedule Template for 2024 provides a comprehensive overview of the best practices and tips to navigate this intricate aspect of digital currencies. Emissions schedules dictate how new coins are generated and released into circulation, which has significant implications for the market value and supply dynamics of cryptocurrencies. In 2024, it is essential to be aware of various factors such as inflation rates, halving events, and governance models that can drastically affect the overall ecosystem. This guide highlights effective strategies to develop a transparent and robust emissions schedule, ensuring both sustainability and fairness within the community. It details the importance of aligning your crypto project with long-term goals while fostering trust among stakeholders. By following the best practices outlined here, readers can better position themselves to capitalize on the ever-changing dynamics of the cryptocurrency market in 2024. Whether you’re a seasoned investor or a newcomer, this guide is an invaluable resource to help you understand and implement an effective emissions schedule.

![]()

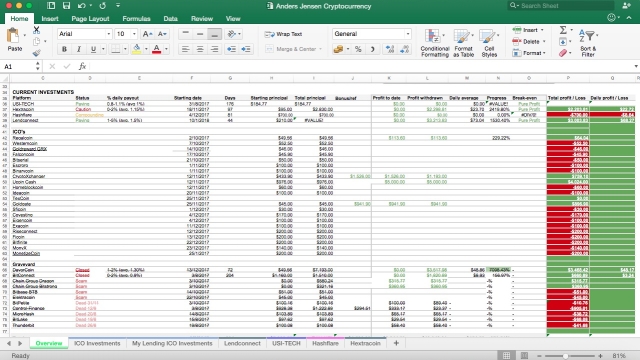

crypto emissions schedule template excel

How to Create an Effective Crypto Emissions Schedule Template for Your Project

Creating an effective crypto emissions schedule template is crucial for the success of your cryptocurrency project. The emissions schedule outlines how and when tokens will be released into circulation, thereby impacting the overall tokenomics. This guide provides a comprehensive approach to designing a robust emissions schedule.

First, it’s vital to define the total supply of your tokens. Establishing a cap on the maximum number of tokens available helps maintain value and reduces inflation risks. Next, determine the emission rate—this is the speed at which new tokens will be created and entered into the market. You might consider a decreasing rate over time to create scarcity.

Incorporate clear milestones into your emissions schedule. For instance, you could allocate a certain percentage of the total supply for staking rewards, development funds, or community incentives during specified phases of your project. Detailed timelines for these releases improve transparency and help build trust within your community.

Implement vesting periods for team members and early investors to prevent immediate sell-offs. This not only ensures that your team remains committed over the long term but also stabilizes the market. Additionally, consider using smart contracts for automated management of token distribution, enhancing trust through algorithmic governance.

Finally, regularly review and update your emissions schedule based on market conditions or community feedback. Transparency is key; make your emissions schedule publicly available and easy to understand. This encourages a better understanding of your cryptocurrency ecosystem and fosters a loyal user base.

![]()

crypto emissions schedule template excel

Best Practices for Tracking and Reporting Crypto Emissions: Tools and Techniques

As the demand for transparency in cryptocurrency emissions continues to grow, it is essential for projects to implement effective strategies for tracking and reporting their environmental impact. Utilizing the right software solutions can greatly enhance tracking accuracy and ensure compliance with regulations.

One of the most efficient methods for monitoring crypto emissions is the use of blockchain analytics tools. These tools allow for real-time visibility into transaction data, enabling projects to calculate energy consumption and carbon footprints with precision. Key players in this space include Coin Metrics and CarbonX, which provide detailed reporting capabilities and insightful analytics.

Another aspect to consider is adopting carbon accounting frameworks that align with industry standards. Frameworks like the Greenhouse Gas Protocol can help projects categorize their emissions accurately, ensuring that all sources of greenhouse gases are accounted for. This step is crucial for creating a comprehensive report that stakeholders can trust.

Additionally, leveraging data visualization tools can make emissions data more comprehensible. Platforms like Tableau and Power BI can transform raw data into visual reports that highlight trends and areas for improvement. This not only aids internal stakeholders but also provides external parties with accessible information regarding an organization’s sustainability efforts.

Implementing a robust reporting methodology is crucial for maintaining credibility. Regularly updating stakeholders on progress while being transparent about challenges faced can foster trust. Moreover, engaging third-party auditors for independent reviews further enhances the authenticity of the reported data.

![]()

crypto emissions schedule template excel

Regulatory Compliance and Crypto Emissions: Navigating the Legal Landscape in 2024

In 2024, the landscape of crypto emissions regulation has become increasingly complex, necessitating a comprehensive understanding of the evolving compliance requirements. Regulatory bodies across the globe are instituting measures aimed at reducing the environmental impact of cryptocurrency mining and transactions, compelling project creators to adapt swiftly to maintain operational integrity.

Compliance with these regulations is not merely a legal obligation; it is crucial for establishing trust with stakeholders and the broader community. Project creators must understand their responsibilities, which include accurately reporting emissions, adopting sustainable practices, and ensuring transparency in operations. Failure to comply can result in significant legal repercussions, including fines and reputational damage.

The regulatory framework often involves not just national laws but also international guidelines that set standards for emissions reporting and sustainability. As such, understanding the specific obligations in one’s jurisdiction has become essential for crypto businesses. Engaging with legal experts who specialize in this area is advisable to navigate the intricacies of compliance effectively.

Moreover, the concept of sustainable cryptocurrency practices is gaining traction, pushing project creators to invest in renewable energy sources and energy-efficient technologies. This shift not only helps in mitigating environmental impact but also resonates with a growing segment of environmentally conscious investors, strengthening the project’s overall market appeal.

Ultimately, the importance of regulatory compliance in the context of crypto emissions cannot be overstated. It serves as a cornerstone for fostering trust and credibility within the cryptocurrency ecosystem, which is crucial for its long-term success and acceptance.

![]()

crypto emissions schedule template excel

Impact of Crypto Emissions on Market Value and Investor Confidence

The dynamics of the crypto market are significantly influenced by crypto emissions schedules. An effective emissions strategy can play a crucial role in shaping market dynamics and establishing investor confidence. As cryptocurrencies are introduced into circulation through various mechanisms such as mining or staking, their emissions must be carefully managed to maintain market stability.

High inflation rates resulting from excessive cryptocurrency emissions can lead to a decrease in market value, making investors skeptical. If asset supply outpaces demand, it creates selling pressure, undermining investor trust. On the other hand, a well-structured emissions schedule that gradually reduces issuance can help maintain scarcity, thereby enhancing the perceived value of a cryptocurrency over time. This controlled approach can foster a positive feedback loop, boosting investor sentiment and encouraging long-term holding.

The design of emission strategies also affects project stability. Projects that clearly communicate their emissions policies tend to instill greater confidence among investors. Transparency regarding tokenomics allows investors to understand the potential long-term impacts on price and market health. Moreover, mechanisms such as halving events or capped issuance can positively influence how investors perceive the asset’s future value, thereby enhancing overall market performance.

As the cryptocurrency space continues to evolve, the relationship between emissions and investor behavior remains a critical focus. Emerging projects must prioritize thoughtful emissions strategies to build a robust market foundation that can withstand fluctuations and cultivate lasting investor loyalty.

![]()

crypto emissions schedule template excel

Case Studies: Successful Crypto Projects with Effective Emission Schedules

Emissions schedules play a crucial role in the sustainability and success of cryptocurrency projects. Various successful projects have demonstrated the significance of well-planned emissions in maintaining investor confidence and network stability.

Bitcoin is a prime example of a cryptocurrency with an effective emissions schedule. Its halving event, happening approximately every four years, reduces block rewards by half, effectively controlling inflation and incentivizing miners. This predictable path keeps supply in check, thus driving demand, which has resulted in significant price increases over the years.

Ethereum has also navigated its emission schedule with great care. Transitioning from a proof-of-work to a proof-of-stake mechanism through Ethereum 2.0, it reduced the inflation rate while enhancing security and energy efficiency. The new model introduces staking rewards that align with overall network growth, making it one of the most anticipated upgrades in the crypto ecosystem.

| Project | Emission Strategy | Key Benefit |

|---|---|---|

| Bitcoin | Halving every 4 years | Controlled supply & increased demand |

| Ethereum | Transition to proof-of-stake | Reduced inflation & enhanced security |

| Cardano | Fixed supply with staking incentives | Long-term sustainability & community engagement |

Cardano illustrates how a fixed supply, combined with staking incentives, leads to long-term sustainability. This strategy fosters community engagement and promotes a stable economic environment where users are rewarded for participation in the network.

By studying these models, new crypto projects can learn to establish fair and effective emissions schedules, ensuring their growth and stability in a competitive landscape.

Common Mistakes to Avoid When Creating a Crypto Emissions Schedule

Developing a crypto emissions schedule is crucial for any blockchain project aiming to maintain trust and stability in its ecosystem. However, many projects fall into frequent pitfalls that can hinder their success. Understanding these common mistakes will enhance the project’s credibility and long-term sustainability.

One major error is failing to incorporate realistic projections of token demand. Creating an emissions schedule without a clear understanding of market dynamics can lead to oversupply or scarcity, adversely affecting token value. It’s essential to conduct market research and analysis to align the emissions strategy with expected growth.

Another mistake is not considering community engagement in the emissions planning process. Neglecting the input of stakeholders can result in a plan that lacks support, jeopardizing its acceptance. Engaging with the community ensures that the emissions schedule meets their needs and expectations, fostering loyalty and trust.

Additionally, creating an inflexible emissions schedule can be detrimental. The cryptocurrency landscape is ever-changing, and a rigid plan fails to adapt to evolving market conditions. Flexibility allows projects to respond promptly to regulatory changes, market trends, and technological advancements.

Moreover, unclear communication regarding the emissions schedule can lead to confusion and distrust among investors. It’s critical to provide transparent information about token release timelines, total supply, and purposes of emissions. Clarity builds confidence in the project.

Lastly, overlooking the importance of environmental impact is a mistake that can have serious repercussions. Projects must consider sustainability practices as part of their emissions strategy to avoid backlash from eco-conscious stakeholders. Incorporating green practices can enhance reputation and align with global standards.

Resources and Tools for Developing Your 2024 Crypto Emissions Schedule

In the rapidly evolving world of cryptocurrency, understanding the impact of emissions is crucial for sustainability. Developing a comprehensive crypto emissions schedule for 2024 can be daunting, but various resources and tools can streamline the process. This guide offers a curated list of essential tools that cover all aspects of emissions tracking and management.

First, consider leveraging sustainability software designed specifically for the crypto sector. These platforms often include features for calculating carbon footprints, tracking energy consumption, and generating reports essential for regulatory compliance. Popular options such as Ecochain and Carbon Footprint Ltd provide comprehensive analytics that can help determine your project’s emissions profile.

In addition to software, templates can simplify the creation of your emissions schedule. Excel and Google Sheets offer customizable templates tailored to cryptocurrency projects. Using these, you can maintain a clear record of emissions sources, track progress over time, and visualize data effectively.

Online communities are invaluable for gathering insights and sharing best practices. Platforms like Discord and Reddit host numerous groups focused on crypto sustainability. Engaging with these communities can provide practical advice and necessary feedback on your emissions strategies.

Finally, consider collaborating with environmental experts or engaging in workshops led by organizations dedicated to crypto and sustainability. These interactions can provide access to cutting-edge research, influencing your emissions management approaches.

By utilizing these resources, you can craft an effective emissions schedule that enhances your project’s sustainability while adhering to regulatory expectations.

FAQ

What is a crypto emissions schedule template?

A crypto emissions schedule template is an Excel document designed to help users track and manage the distribution of newly minted or issued cryptocurrency over time. It organizes data such as the emission rate, total supply, and timeline for releases, facilitating easier analysis and planning.

How can I use the crypto emissions schedule template in Excel?

To use the crypto emissions schedule template, download the Excel file and input your specific parameters, such as the total supply of coins, initial issuance date, and the schedule for future emissions. The template will calculate the emissions based on the set criteria.

Is the crypto emissions schedule template customizable?

Yes, the crypto emissions schedule template is fully customizable. Users can adjust the emission rates, schedule dates, and any other parameters to fit the specific requirements of their cryptocurrency project.

Can I automate calculations within the Excel template?

Yes, the crypto emissions schedule template can include formulas that automatically calculate emissions based on the input parameters. This allows for real-time updates and makes it easier to manage changes to the schedule efficiently.

What benefits does using a crypto emissions schedule template provide?

Using a crypto emissions schedule template helps ensure transparency and organization in the issuance of new tokens. It allows project teams and investors to understand the supply dynamics, prepare for potential market impacts, and adhere to regulatory standards.

Is the template suitable for all types of cryptocurrencies?

While the template can be adapted for many types of cryptocurrencies, it is particularly designed for projects that follow a predefined issuance schedule. Users should ensure that the template aligns with the specific economic model of their cryptocurrency.

Where can I find a reliable crypto emissions schedule template?

You can find reliable crypto emissions schedule templates on various financial and cryptocurrency-focused websites, as well as forums and communities dedicated to crypto development. Ensure you download from reputable sources to avoid inaccuracies.