The intersection of traditional trading and the cryptocurrency world offers a plethora of opportunities for savvy investors. With the rising interest in crypto assets, many are exploring where to trade stocks and futures using cryptocurrencies. This article dives deep into effective platforms, strategies, and tips on leveraging crypto for trading stocks and futures seamlessly. Prepare to discover not just the ‘where’ but also the ‘how’ behind this exciting blend of finance!

were can i trade stocks futures with crypto

Understanding the Landscape: The Rise of Crypto Trading Platforms

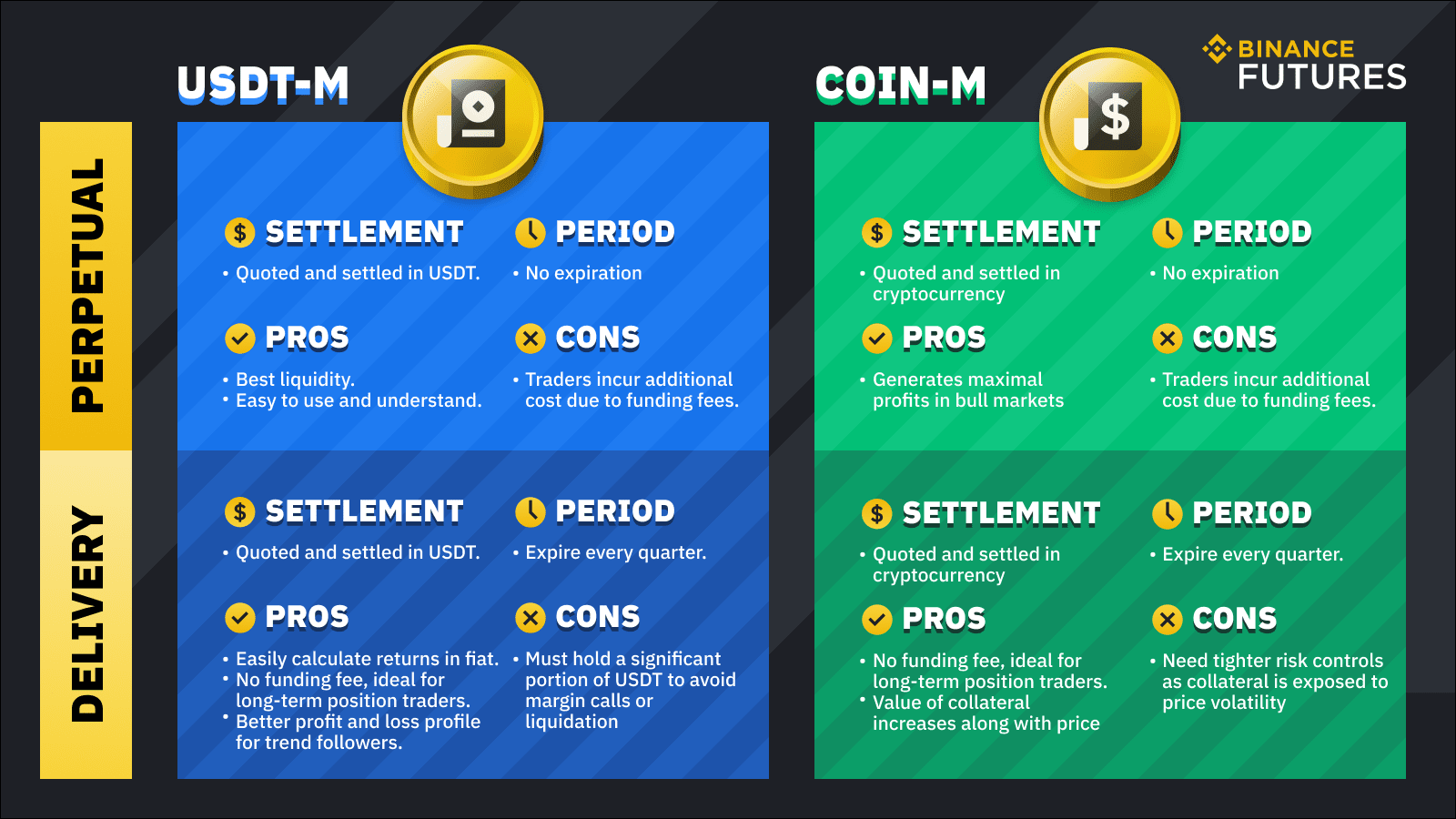

As the adoption of cryptocurrencies grows exponentially, numerous platforms are sprouting up, each claiming to facilitate seamless trading of stocks and futures. It’s crucial to identify which of these platforms actually delivery on their promises. Many traders have found delight in using integrated exchanges, which allow them to trade both crypto and traditional financial instruments from one interface.

were can i trade stocks futures with crypto

Consider Amy, a seasoned trader. “I never thought I could merge my stock trading with Bitcoin so easily. It’s like having the best of both worlds!” she enthuses. Platforms that support trading in this hybrid manner often offer enhanced features like real-time market analysis and insightful trading tools that can significantly ease decision-making processes.

were can i trade stocks futures with crypto

Furthermore, the regulatory landscape is shifting, making crypto trading more accessible. Jake, an emerging entrepreneur, notes, “With new regulations coming into play, I feel more secure trading crypto alongside stocks. The volatility is daunting, but it also opens doors to immense profit potential.” Understanding these dynamics can greatly enhance your ability to choose the right trading vehicles.

were can i trade stocks futures with crypto

Many traders now look for platforms that simplify the process of transferring assets. The convergence of traditional and cryptocurrency markets has brought forth innovative tools, like decentralized exchanges that allow for quick trades without extensive paperwork. This evolution is a game-changer for both novice and experienced traders alike.

were can i trade stocks futures with crypto

Top Platforms: Where Do You Start?

Finding the right platform can be overwhelming, with the sheer number of options available. However, several platforms stand out for their user-friendliness and robust features. Gemini, for instance, is rapidly becoming a go-to choice for traders who want to venture into stocks and crypto.

Mark, an investor, shares, “Gemini allows me to trade my stocks directly with my crypto holdings. It’s refreshing to have everything in one place without the need to switch frequently between different apps.” This integration is especially beneficial in fast-moving market conditions.

Moreover, many traders are now checking out Robinhood. It has attracted significant attention for its commission-free trades that span various assets, including cryptocurrency. “I love that I can grab a few shares while also investing in my favorite coins. The ability to diversify risk and manage my portfolio efficiently is pivotal,” claims Rachel, a tech-savvy trader.

Beyond the slick interfaces and low fees, security is paramount. Each trader’s funds should remain protected against hacks and breaches. Therefore, looking into exchanges equipped with cutting-edge security measures is non-negotiable for trading safely.

Strategize Your Trades: Setting Up for Success

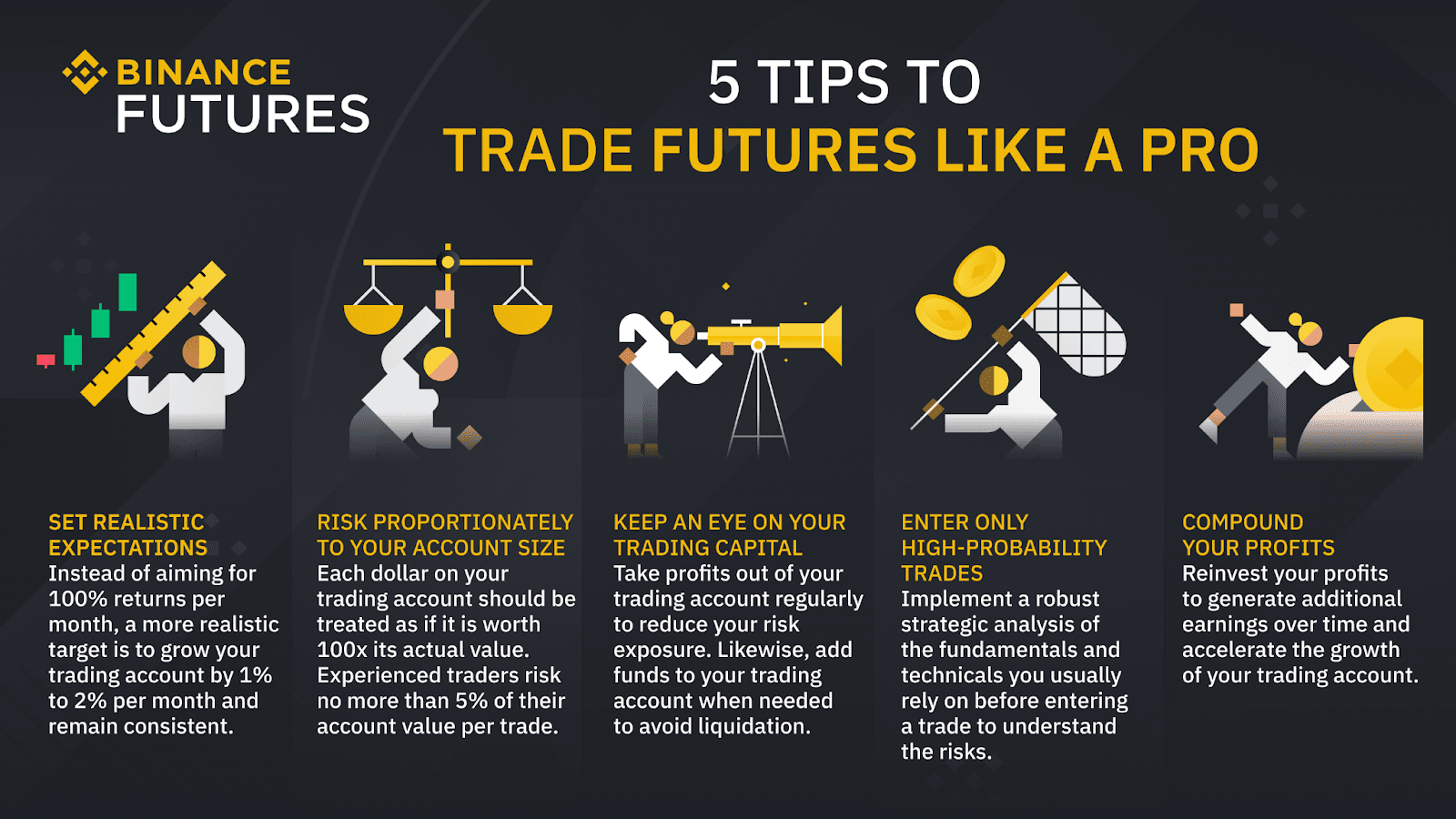

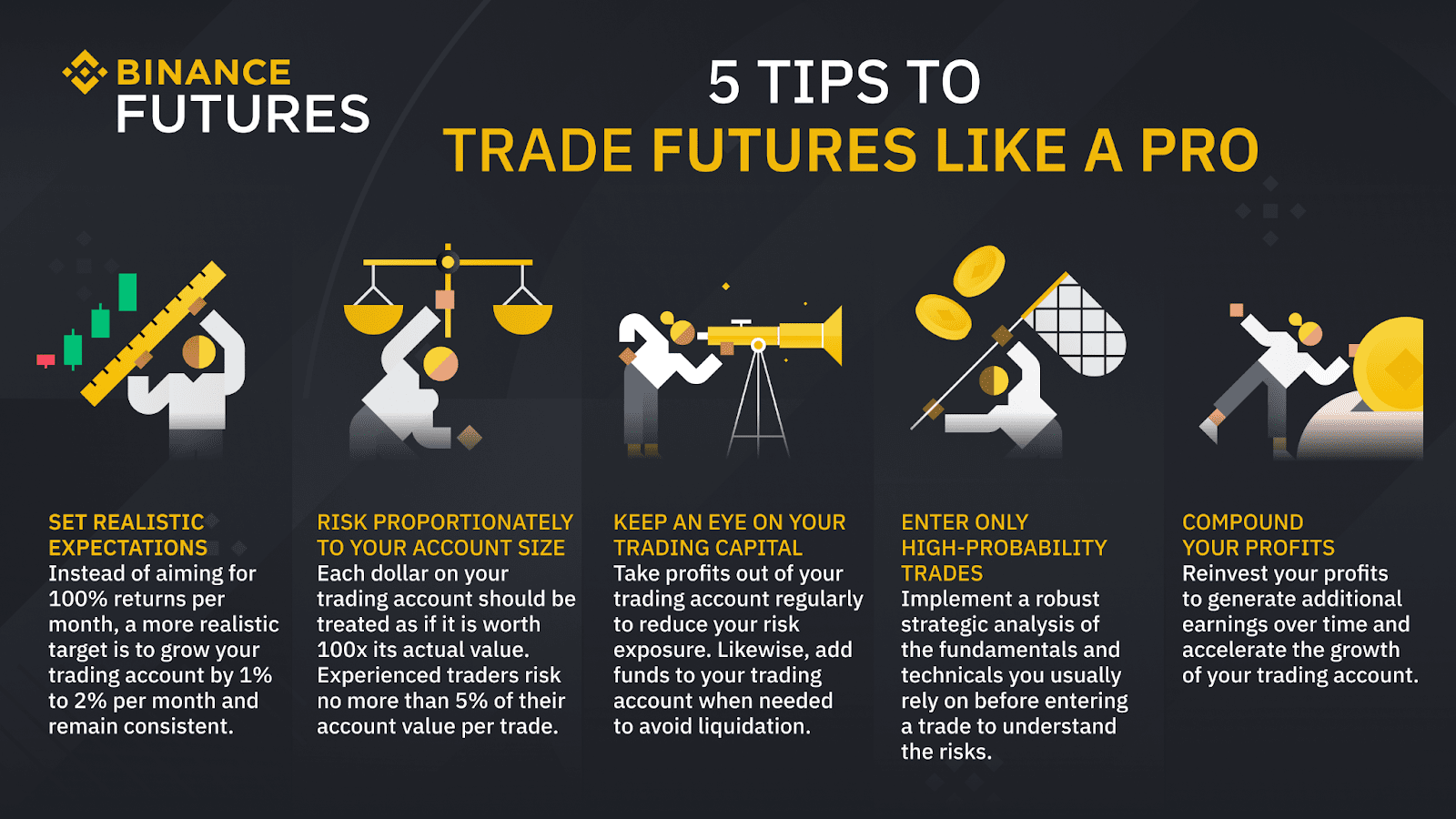

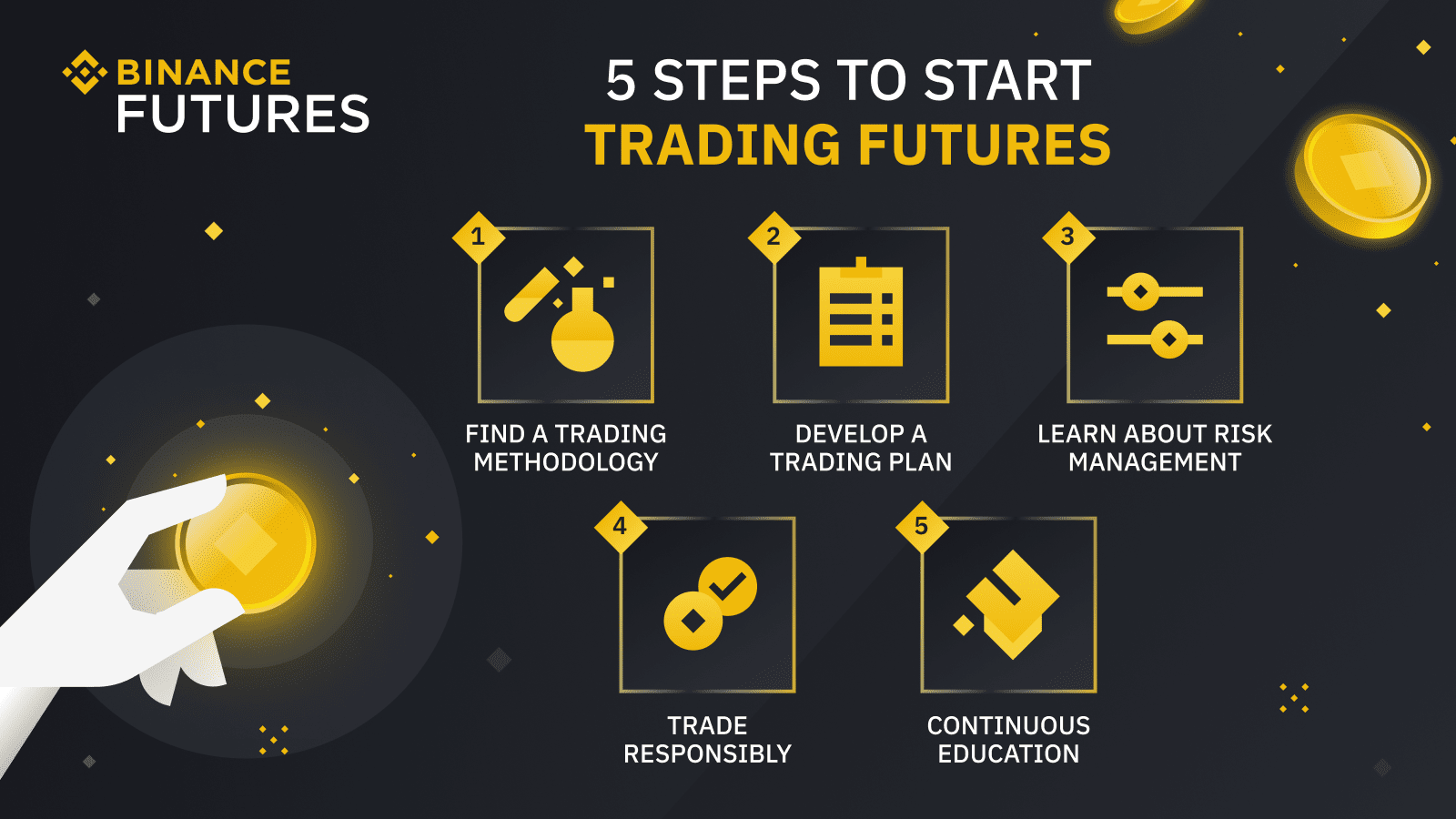

Once you’ve chosen a platform, executing trades efficiently hinges on strategies tailored to your trading style. Building a solid foundation involves researching market trends and understanding how crypto influences traditional stocks. Knowing when to enter and exit trades can be the difference between profit and loss.

“I constantly analyze both stock performance and crypto market sentiment. They often correlate more closely than you might think,” advises Lucas, a dedicated trader. “Understanding how fluctuations in the crypto market can ripple through stock prices has allowed me to make smarter, more informed trades,” he elaborates.

Moreover, employing tools and resources such as price alerts, analytics, and trading signals can help traders stay ahead. Resources that aggregate real-time market data are invaluable. They allow you to react quickly to news that impacts both stocks and cryptocurrencies.

Lastly, it’s crucial to stay disciplined and emotionally detached while trading. The combination of stocks and cryptocurrencies can have an adrenaline-pumping effect, but making impulsive decisions often leads to regret. “I remind myself to stick to my plan, regardless of market fluctuations,” shares Daniel, a level-headed trader who’s navigated both markets successfully.

The Future of Trading: Embracing Change

As the financial landscape evolves, the potential for new trading methods that incorporate cryptocurrencies will undoubtedly expand. With technology progressing and innovations like blockchain paving the way, the future of how we trade looks promising and more inclusive than ever.

Feedback from traders reflects a growing enthusiasm. “I can’t wait to see what’s coming next! The blend of crypto and traditional assets just feels revolutionary,” exclaims Justin, a blockchain enthusiast. This eagerness highlights a community eager to explore uncharted territory.

Educational resources continue to grow, empowering traders with knowledge on blending these markets effectively. Webinars, online courses, and communities offer infinite opportunities for learning and sharing experiences. “Joining a community has been instrumental for my growth as a trader,” remarks Sarah, an avid learner.

Ultimately, taking that leap to trade stocks and futures with cryptocurrencies may require some initial adjustments, but the potential rewards can be monumental for those willing to innovate and adapt. The ongoing collaboration between traditional finance and crypto highlights an exciting new era in trading.