Welcome to the fascinating world of cryptocurrency! If you’ve stumbled upon this article, you’re likely curious about what do the multipliers in crypto contracts mean. These multipliers can seem confusing at first glance, but fear not! We’re here to demystify this topic for you with engaging explanations and relevant examples.

what do the multipliers in crypto contracts mean

The Basics of Crypto Contracts

Before diving into the specifics, let’s start with the basics. Crypto contracts, often called smart contracts, are self-executing contracts with the terms of the agreement directly written into code. When certain conditions are met, the contract automatically enforces actions, eliminating the need for intermediaries. It’s like a vending machine for agreements!

what do the multipliers in crypto contracts mean

Understanding Multipliers in Crypto Contracts

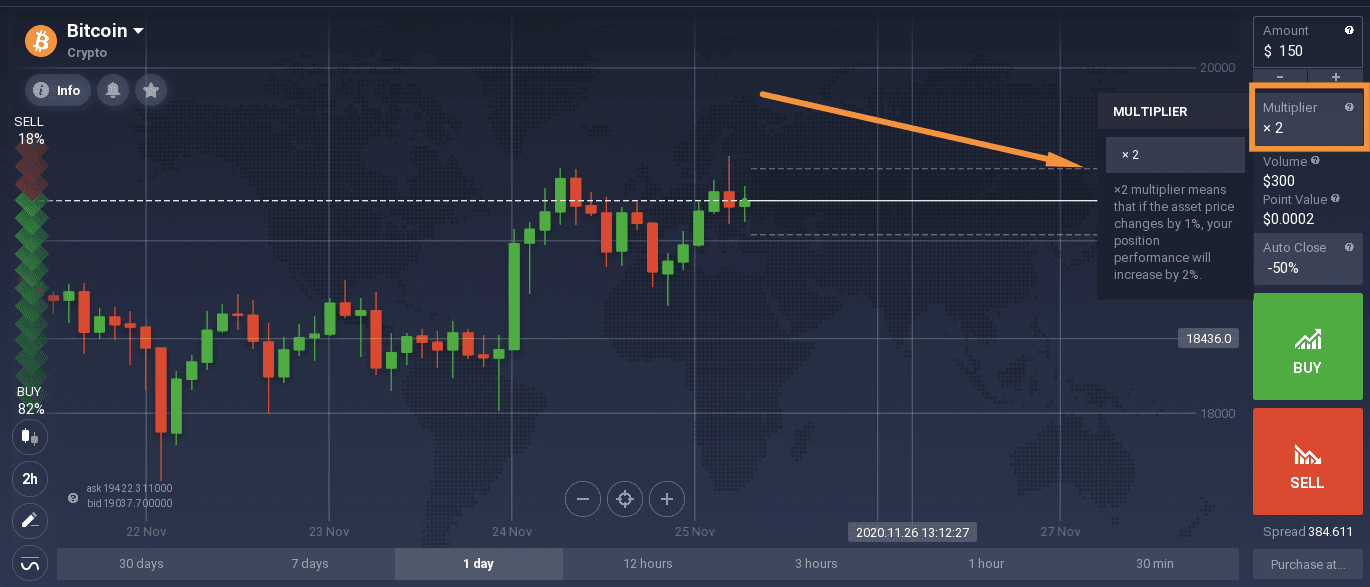

Now, let’s tackle the core question—what are these multipliers? In the context of crypto contracts, a multiplier functions to amplify certain outcomes based on your investment. For instance, a multiplier of 2x means that for every dollar you invest, the contract can potentially double your gains (or losses). Simple enough, right?

what do the multipliers in crypto contracts mean

Real-World Application of Multipliers

Imagine you’re a budding investor intrigued by a new crypto project. You decide to participate in a contract that offers a 3x multiplier. If you invest $100 and the market behaves positively, you might end up with a whopping $300! However, always remember—higher multipliers also come with increased risks.

what do the multipliers in crypto contracts mean

Market Examples & Case Studies

Let’s explore a couple of case studies to cement our understanding of how multipliers in crypto contracts work.

what do the multipliers in crypto contracts mean

Case Study 1: Ethereum’s EIP-1559 Upgrade

The Ethereum network underwent a significant upgrade in August 2021, introducing EIP-1559. This upgrade altered the fee market, providing more predictable transaction fees. Now, consider a protocol built on Ethereum offering a 2x multiplier on staking rewards. Originally, a user staking 1 ETH might receive 0.1 ETH as a reward. With a 2x multiplier, this could potentially double their rewards to 0.2 ETH!

Implications of the Upgrade

The introduction of a multiplier effectively motivates staking, thus adding liquidity to the system. However, higher transactional volume could also mean hitting gas limits more frequently—there are pros and cons to everything in the crypto world!

Case Study 2: Yield Farming

Yield farming is a popular trend within the cryptocurrency ecosystem, where users lend or stake their crypto assets to earn interest or rewards. Let’s say a DeFi platform introduces a yield farming opportunity featuring a 3x multiplier for liquidity provision. If you provide $200 worth of liquidity, your rewards could triple, leading to potential earnings of $600!

Analyzing Yield Farming Multipliers

However, rapid gains from these multipliers can come with risks including impermanent loss and changing APYs. Always conduct thorough research before investing in these lucrative but volatile opportunities.

Benefits of Using Multipliers

Multipliers are designed to attract investors by promising higher rewards. But what else do they provide?

Risk Management

Utilizing multipliers can also serve as a part of your risk management strategy. By understanding how these multipliers affect your potential returns, you can adjust your investment portfolio accordingly. For instance, if you’re aware that a particular project has a low multiplier but stable earnings history, it may align better with your investment strategy compared to a high-multiplier venture that’s highly volatile.

Enhancing User Engagement

Incorporating multipliers fosters a sense of community among users and encourages active participation in DeFi projects. When users feel their investments can yield significant returns, they are more likely to stay engaged and advocate for the platform.

Visual Understanding of Multipliers

Let’s take a moment to visualize this concept using data.

This simple graphic illustrates how different multipliers allow for varying levels of returns based on your investment. With a clearer picture, it’s easier to understand the stakes involved!

Keeping Up with Market Trends

The world of cryptocurrency contracts is ever-evolving. Staying updated with market trends is crucial. The introduction of new protocols, regulations, or technologies can influence the dynamics surrounding multipliers.

Potential Regulatory Impacts

As many governments are beginning to regulate the cryptocurrency market, understanding the impact of these regulations on multipliers is vital. For instance, tighter regulations may limit the use of high multipliers due to increased compliance requirements.

Community Response to Legislative Changes

The community’s reaction to such rules has ranged from optimism for protecting investors to skepticism regarding innovation suppression. Investors with a keen eye on legislation changes can better navigate their choices around multipliers.

The Risks Involved with Multipliers

While the thrill of potential high returns can be enticing, let’s not gloss over the risks involved.

Market Volatility

Multipliers amplify not just returns but also losses. Market swings can dramatically shift the value of your investments in a short period. Using the previous yield farming example, if the market dips drastically after your investment, you may find yourself at a loss instead of enjoying those projected gains.

Smart Contract Vulnerabilities

Smart contracts are only as good as the code they are built upon. Bugs, exploits, and hack attempts have plagued digital assets, leading to financial losses for investors relying on multipliers without thorough auditing of the smart contract involved.

Conclusion

In summary, understanding what do the multipliers in crypto contracts mean is essential for savvy cryptocurrency investing. By leveraging multipliers, investors can amplify their potential returns while also being mindful of the associated risks. As this landscape continues to develop, keeping informed about market trends and regulations will help you navigate the colorful yet intricate world of crypto contracts with confidence.

If you’re excited to learn more, check out our other articles focused on specific projects, or join an online community to stay updated. Happy investing!