The cryptocurrency landscape is filled with complexities, yet one of the most fundamental, yet often overlooked, concepts is understanding the smallest unit of ethereum. Just like how the dollar can be broken down into cents, Ethereum, the second-largest cryptocurrency by market capitalization, has its own basic unit of measurement known as Gwei. But what does this mean for everyday users? Let’s break it down!

smallest unit of ethereum

Understanding Ethereum’s Structure

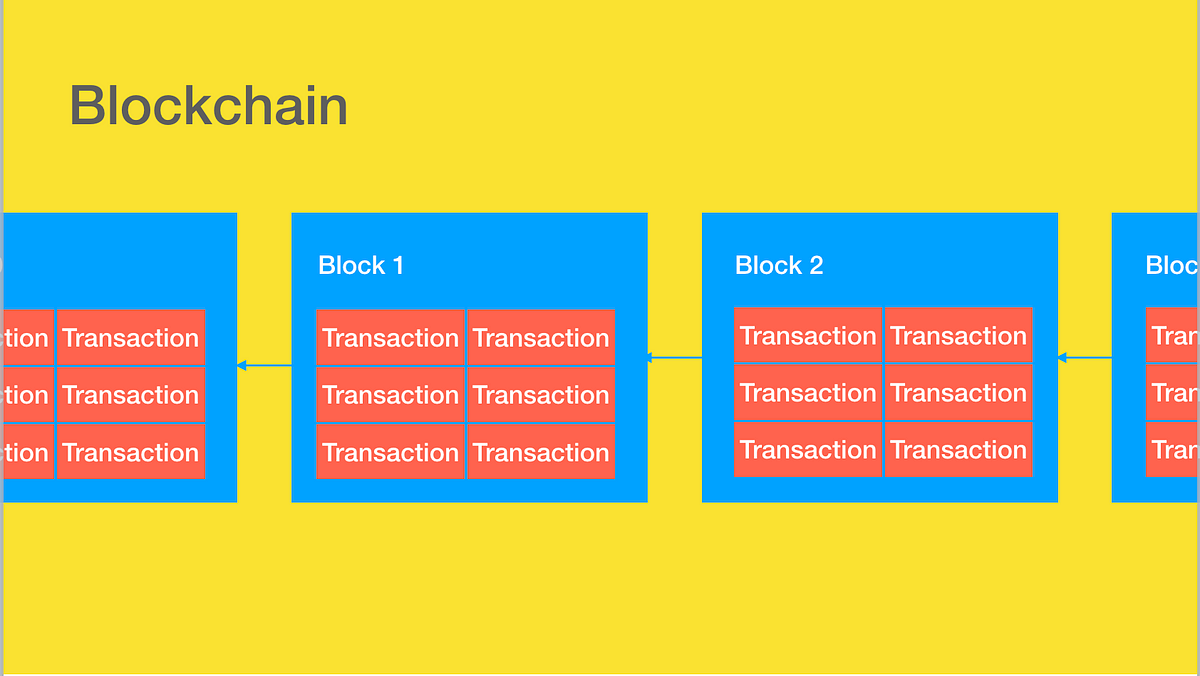

To comprehend the smallest unit of ethereum, it’s crucial to understand Ethereum’s architecture. Ethereum is a blockchain platform that enables developers to build and deploy decentralized applications (dApps). At its core, Ethereum operates on a network of nodes that validate transactions. Each transaction requires a certain amount of computational work, measured in Gas.

smallest unit of ethereum

The unit of measurement for cryptocurrency transactions, Gas is priced in Gwei. One Gwei is one billionth of an Ethereum (ETH). When you hear someone mention Gwei, they’re essentially discussing fractions of Ethereum needed to cover transaction fees or computational resources consumed. A transaction might cost, say, 21000 Gas, which at current prices could translate to a minuscule Gwei cost.

smallest unit of ethereum

The Conversion Rates: An Insightful Analysis

Wondering how Gwei translates into Ethereum? Here’s a quick representation:

smallest unit of ethereum

- 1 ETH = 1,000,000,000 Gwei

- 1 Gwei = 0.000000001 ETH

This relationship is key; it allows users to discuss costs in more manageable figures, especially when dealing with the minute fractions required for transaction fees in high-volume trades.

smallest unit of ethereum

Case Study: Transaction Fees Over Time

Let’s take a look at a real-world case to gain clarity. In 2020, Ethereum’s network faced skyrocketing demand. Suppose a transaction fee rose to 150 Gwei during peak hours. Users would need to pay 0.00000015 ETH just to get their transaction processed. In contrast, during off-peak times, the fees could reduce to around 20 Gwei. It reveals how dynamic Gwei can be and encourages strategic timing for transactions.

The Importance of Gwei in the Ethereum Ecosystem

Many new users often dismiss Gwei’s importance. After all, how meaningful can a few additional decimals be? Yet, understanding the smallest unit of ethereum opens doors to better financial strategies within the Ethereum ecosystem.

Market Trends and Their Impacts

Considering Ethereum’s price fluctuations, Gwei has become a critical aspect for traders. As the crypto market matures, fees can significantly impact profits. For example, during a bull market when the price of ETH rises, the Gas fees may too, compelling traders to time their entry and exit points wisely.

Research from Coin Metrics indicates that average transaction fees saw a record high in early 2021, revealing how intertwined Gwei and overall market behavior are. To capitalize on these volatile situations, it’s essential to understand the multitude of factors affecting Gas prices and, subsequently, Gwei.

Visual Representation of Transaction Fees

User Experience Stories

Consider the experience of Anna, a budding crypto investor. Last year, she decided to buy Ethereum when the price was at a modest $400. She didn’t worry too much about the transaction fees, which were around 20 Gwei at the time. However, fast forward a few months, and she found herself facing fees upwards of 200 Gwei for her next transaction.

Anna learned the hard way why understanding Gwei matters. That $10 fee now seemed negligible compared to the cost she faced later. If she had grasped Gwei’s role sooner, she’d have planned her transactions around low-fee times, maximizing her investment.

Strategies For Managing Gas Fees

So, what can you do to manage transaction costs effectively? Here are some practical tips:

- Monitor Gas Prices Regularly: Use platforms like ETH Gas Station to check real-time Gas prices before making transactions.

- Timing Is Key: Execute trades during off-peak times, typically on weekends or during late-night hours.

- Batch Transactions: If possible, bundle multiple transactions together to save on fees.

Conclusion: Embracing the Smallest Unit of Ethereum

Understanding the smallest unit of ethereum is not merely academic; it’s crucial for anyone involved in cryptocurrency trades and transactions. With Ethereum constantly evolving, keeping abreast of Gwei transaction dynamics ensures you make informed decisions. In a space defined by rapid shifts and market trends, knowledge truly is power. So, dive deeper, engage with the data, and navigate your Ethereum journey with competence and awareness.

Interactive Engagement: Join the Conversation

How do you manage transaction fees in your trading experience? Share your tips and stories in the comments below or take part in our survey to help us gather insights into user experiences using Ethereum.

References

- Coin Metrics – Detailed Insights on Ethereum

- ETH Gas Station – Real-Time Gas Price Monitoring