Introduction to FTA Asia Economy and Crypto Trends

The interaction between Free Trade Agreements (FTAs) and cryptocurrencies is evolving rapidly, reshaping the economic landscape in Asia. This year, 2024 promises a slew of changes that could redefine how businesses and consumers engage with these digital assets. As we delve into these ftasiaeconomy crypto trends, we’ll explore their implications, supported by data and case studies.

ftasiaeconomy crypto trends

Understanding the FTA Framework

Free Trade Agreements aim to reduce barriers to trade and increase economic cooperation among countries. In Asia, FTAs play a crucial role in establishing economic zones that can enhance the crypto ecosystem. For instance, countries like Singapore have embraced crypto-friendly regulations, attracting businesses from across the globe. The convergence of FTAs and cryptocurrencies presents a unique landscape that investors and companies need to navigate cautiously.

ftasiaeconomy crypto trends

The Crypto Landscape in Asia: Current Trends

Bitcoin Domination

As the leading cryptocurrency, Bitcoin continues to dominate the market. In Asia, it is gaining traction not only as a speculative asset but also as a means of payment. For example, in 2023, an exclusive study by Chainalysis noted an impressive growth rate in Bitcoin transactions in Asian countries, especially in Japan and South Korea. This paves the way for further integration of cryptocurrencies into everyday transactions, spurred by favorable regulations.

ftasiaeconomy crypto trends

Innovative Blockchain Solutions

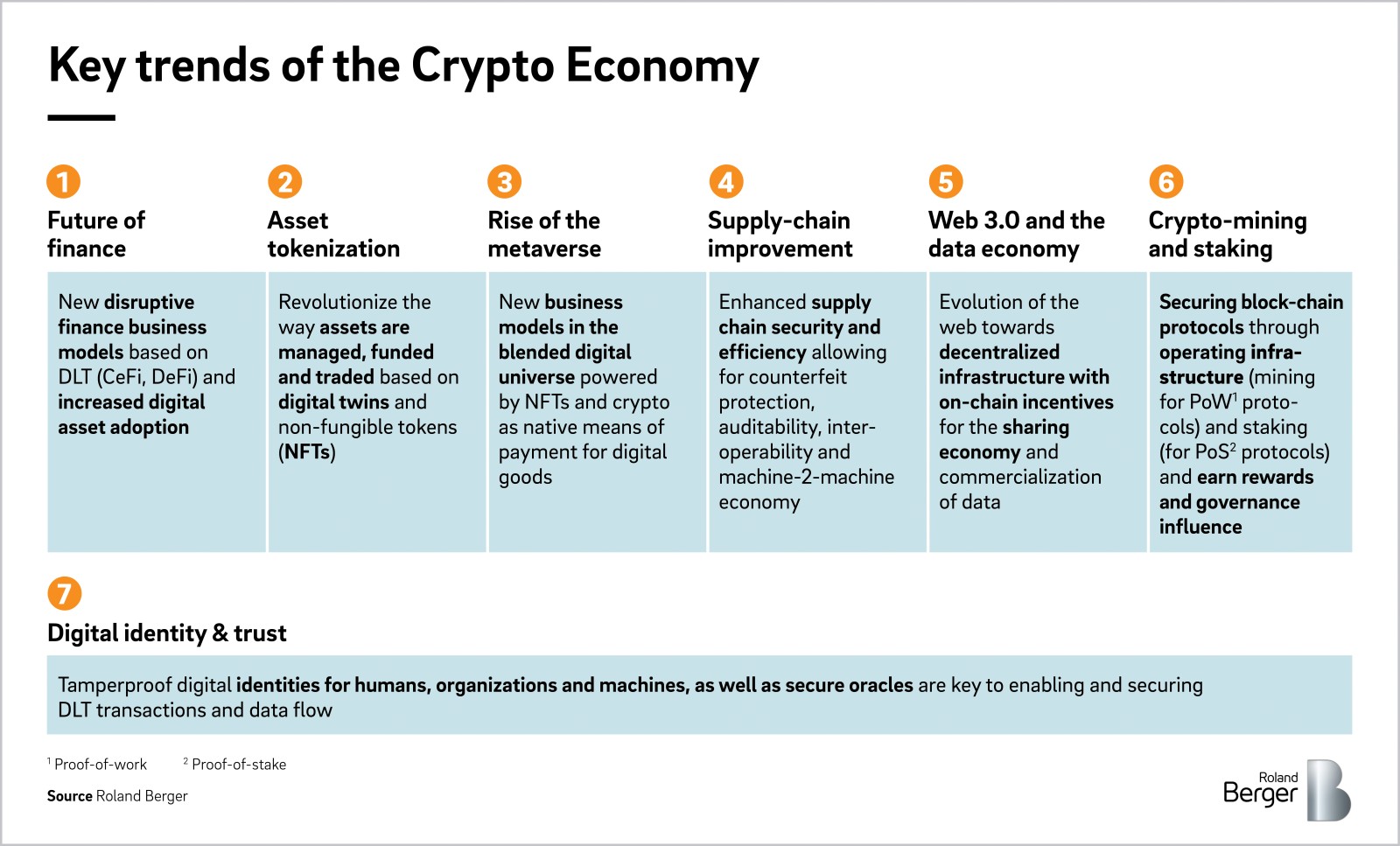

Asia is also at the forefront of adopting innovative blockchain technologies. Countries like China are investing heavily in Blockchain as a Service (BaaS) models, allowing businesses to adopt this technology without the overhead of building it from scratch. The advantages of transparency and security are crucial for sectors ranging from supply chain to finance, heightening the importance of ftasiaeconomy crypto trends as businesses look for reliable solutions.

ftasiaeconomy crypto trends

User Engagement and Feedback

Real User Experiences

Engaging directly with users can provide invaluable insights. A case study by the Asia Blockchain Review showcased a tech startup based in Hong Kong that launched a user-friendly crypto trading platform. Through user feedback, they were able to simplify complex processes, ultimately increasing their user base by 150% in just six months. Listening to the community is key in the fast-paced world of crypto.

ftasiaeconomy crypto trends

Survey Insights

A recent survey conducted by Crypto Asia revealed that 70% of respondents are eager to learn more about cryptocurrencies, indicating a significant interest in more educational resources that can demystify this space. As users become more informed, they are likely to contribute positively to the growth of the crypto economy, encouraging innovative solutions and more secure trading practices.

Market Analysis: Predictions for 2024

Increasing Institutional Adoption

One of the significant ftasiaeconomy crypto trends for 2024 will be the increasing adoption of cryptocurrencies by institutional investors. A report by Deloitte suggests that institutions are starting to view cryptocurrencies as a hedge against inflation, potentially leading to dramatic shifts in market dynamics. The growing participation of hedge funds and investment portfolios may stabilize prices and elevate the legitimacy of cryptos in financial markets.

The Rise of DeFi Platforms

Decentralized Finance (DeFi) platforms are expected to grow exponentially in the coming years. They offer users a way to lend, borrow, and invest without traditional intermediaries. An impressive surge in DeFi transactions has already validated this movement, with Asian markets leading the charge. For example, the total value locked in DeFi protocols in Asia increased by over 200% in 2023.

User-Friendly Solutions in Crypto Trading

Emerging Technologies Supporting Crypto Utilization

This year, solutions like digital wallets and peer-to-peer trading platforms are becoming increasingly sophisticated, making crypto trading more accessible to average users. Companies are leveraging Artificial Intelligence to analyze market trends, providing traders with actionable insights. This democratization of information is crucial, as it empowers even the less experienced traders to make informed decisions.

User Feedback Loops

Startups focusing on crypto education and user experience are thriving in this environment. For example, a Malaysia-based platform introduced gamification elements that educate users about trading concepts. According to user feedback, this approach has led to higher retention rates as users feel more involved and informed about their trading journeys.

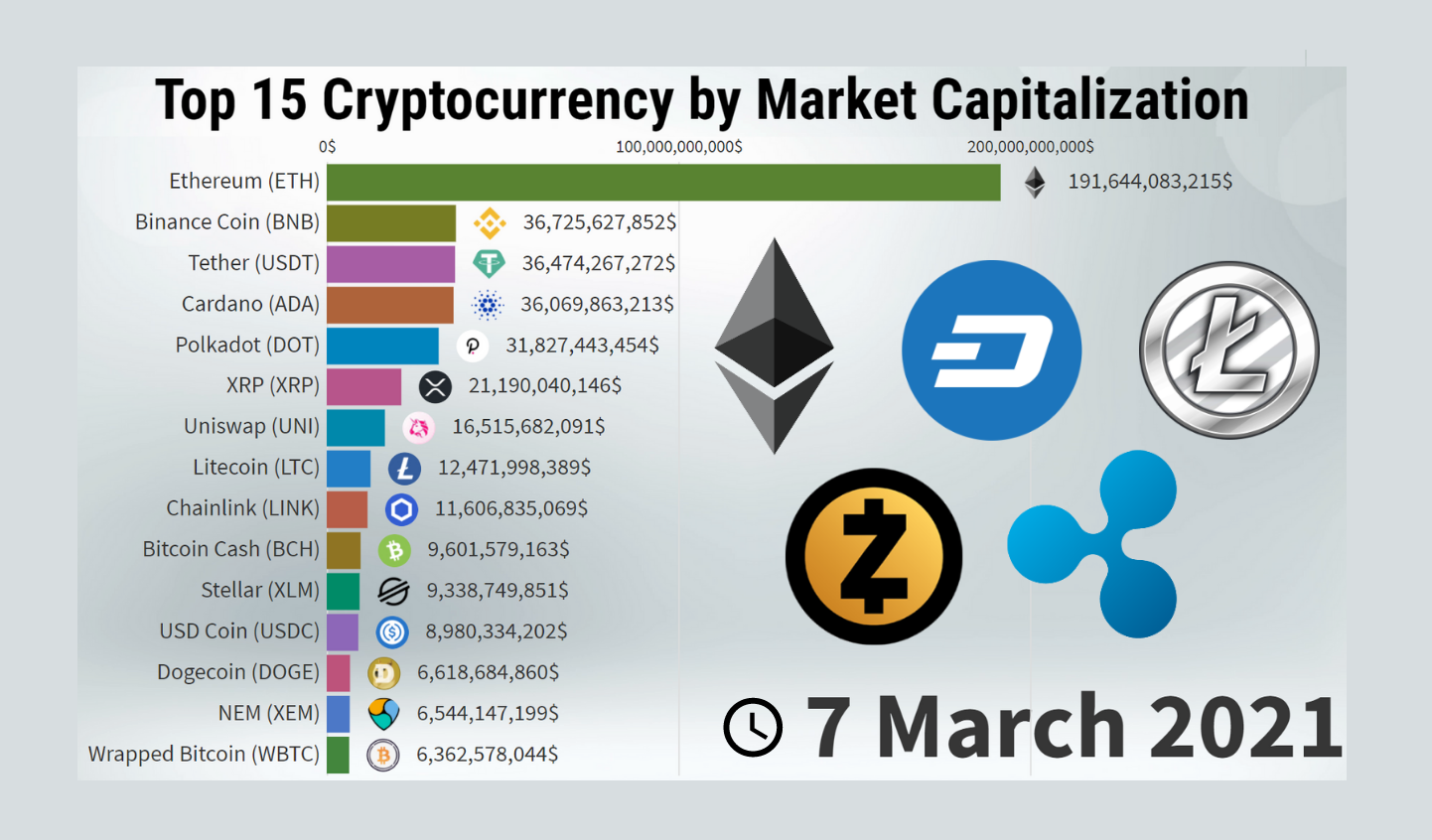

Visualizing the Trends: Data and Charts

Crypto Uptake Trends by Region

This simple bar chart represents the uptick in crypto transactions in three major Asian markets. Japan leads with a significant adoption rate, followed by South Korea and China.

Institutional Investments in Cryptocurrencies

This pie chart illustrates the distribution between institutional and retail investments in cryptocurrencies. Analysis indicates that the share of institutional investments is steadily growing, providing more stability to market fluctuations.

Final Thoughts: Preparing for the Crypto Future

Emerging Regulations and Compliance

The regulatory landscape in Asia is evolving, and businesses operating in this space must stay ahead. Governments are beginning to impose stricter regulations aimed at consumer protection without stifling innovation. As a result, companies must prioritize compliance strategies while continuing to innovate to cater to an increasingly sophisticated consumer base.

Advice for Investors

For investors, understanding these ftasiaeconomy crypto trends is essential. Engaging with community forums, attending webinars, and using sophisticated trading platforms can offer a better understanding of the market dynamics. Stay informed about global economic indicators, as they could directly impact crypto valuations.

FAQs

What are the main drivers for cryptocurrency adoption in Asia?

Several factors contribute to the growing acceptance of cryptocurrency in Asia, including technological advancements, favorable government regulations, and the increasing need for digital financial solutions, especially post-pandemic.

How can businesses leverage these trends?

Businesses can capitalize on these trends by adopting blockchain solutions, engaging with customers through education, and positioning themselves within the FTA frameworks that support cryptocurrency innovations.

Are there risks involved with investing in cryptocurrency?

Yes, investing in cryptocurrency carries risks due to market volatility, regulatory uncertainties, and technological challenges. It is crucial for investors to conduct thorough research and possibly consult financial advisors to navigate these waters.

Conclusion and Path Forward

2024 is poised to be a transformative year for the ftasiaeconomy crypto trends. As we embrace this digital revolution, understanding the interplay between regulations, technology, and user engagement will enable stakeholders to make informed decisions. Whether you’re an investor, entrepreneur, or consumer, staying proactive in your approach will be vital to thriving in this complex landscape.