Are you curious about leverage trading crypto? If you’re looking to step into the world of cryptocurrency trading with a bit more oomph, you’ve landed in the right spot! This guide is designed to break down the ins and outs of leverage trading, how it works, and the critical factors you should consider along the way.

leverage trading crypto

What is Leverage Trading?

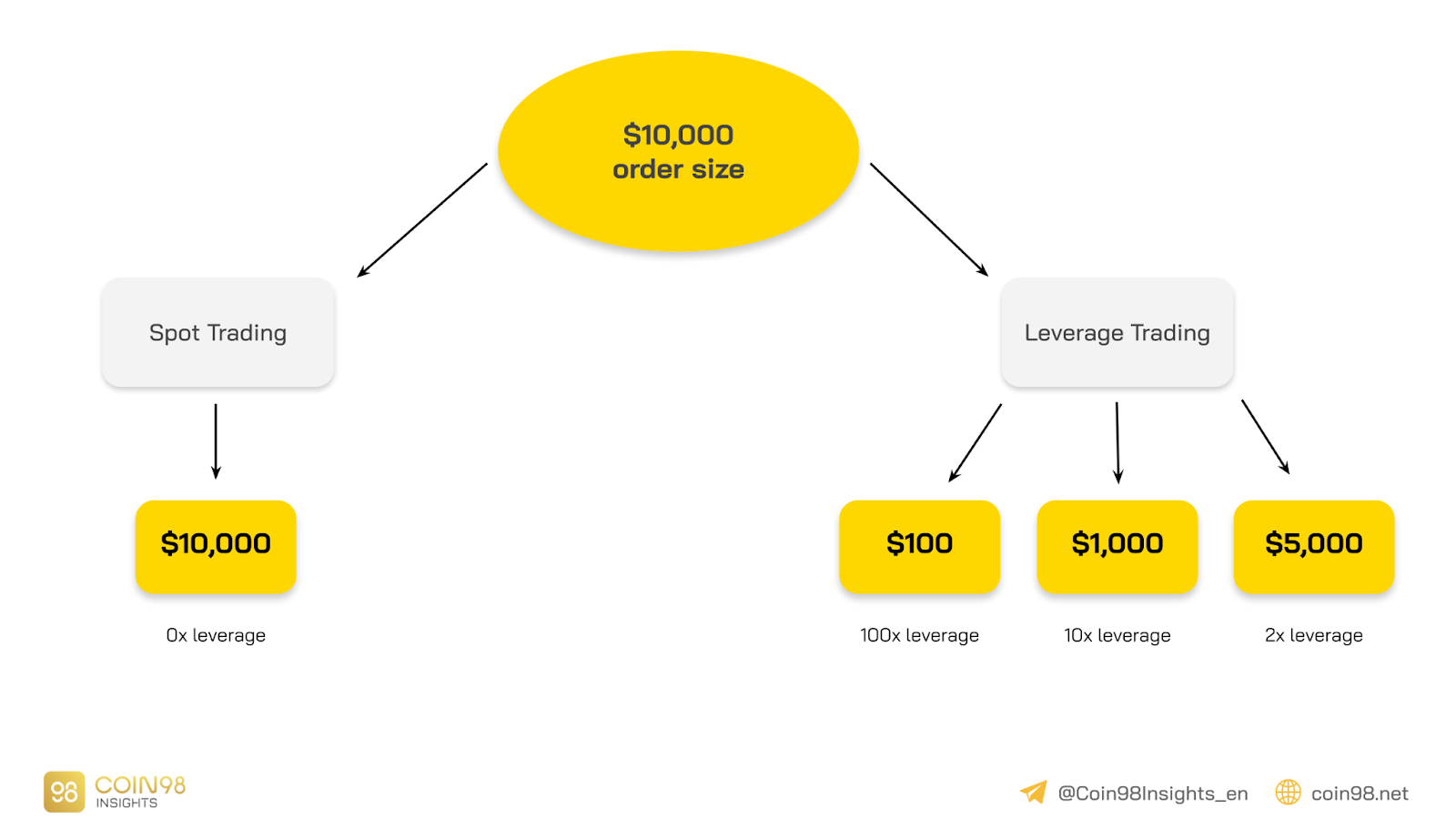

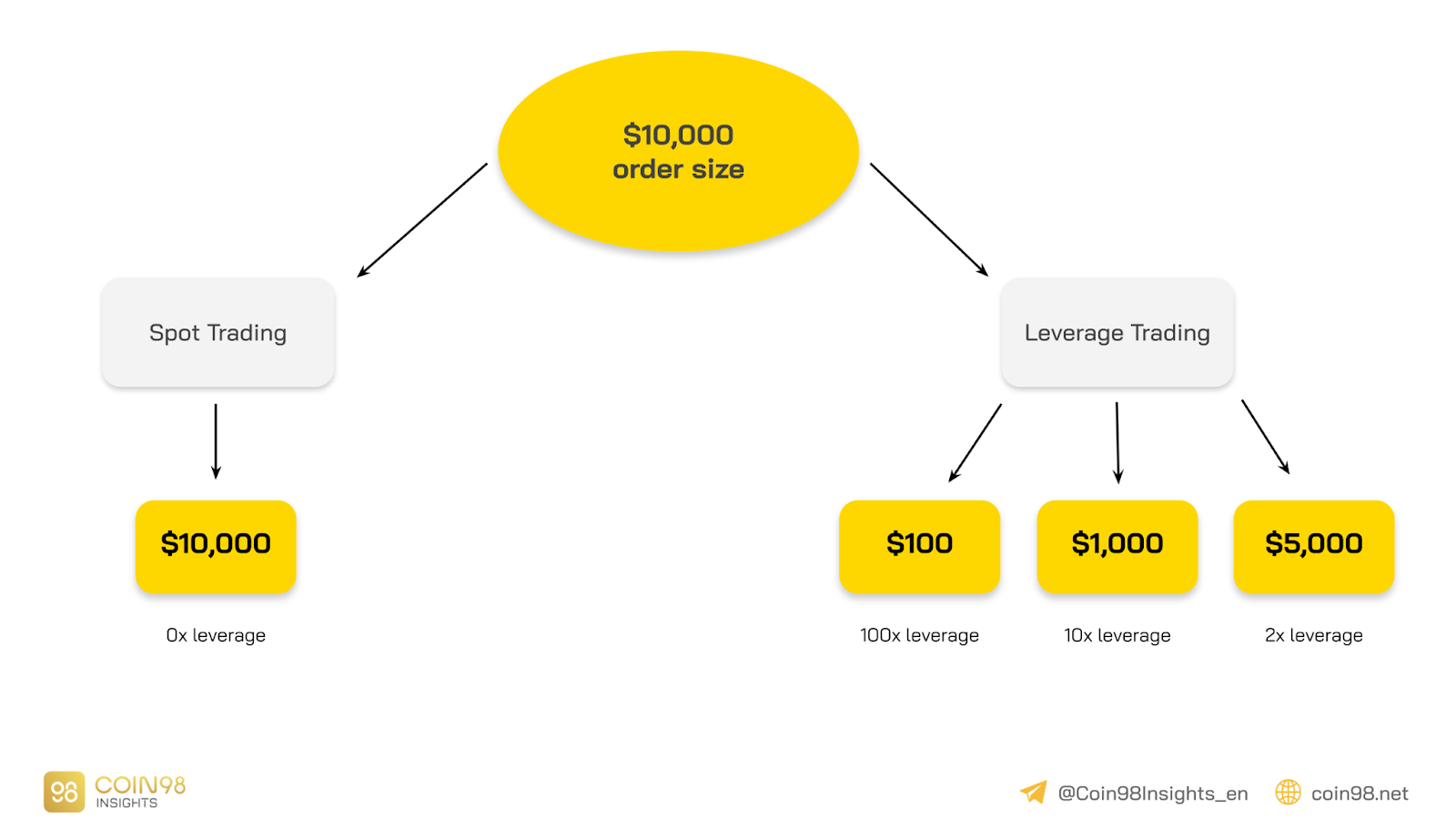

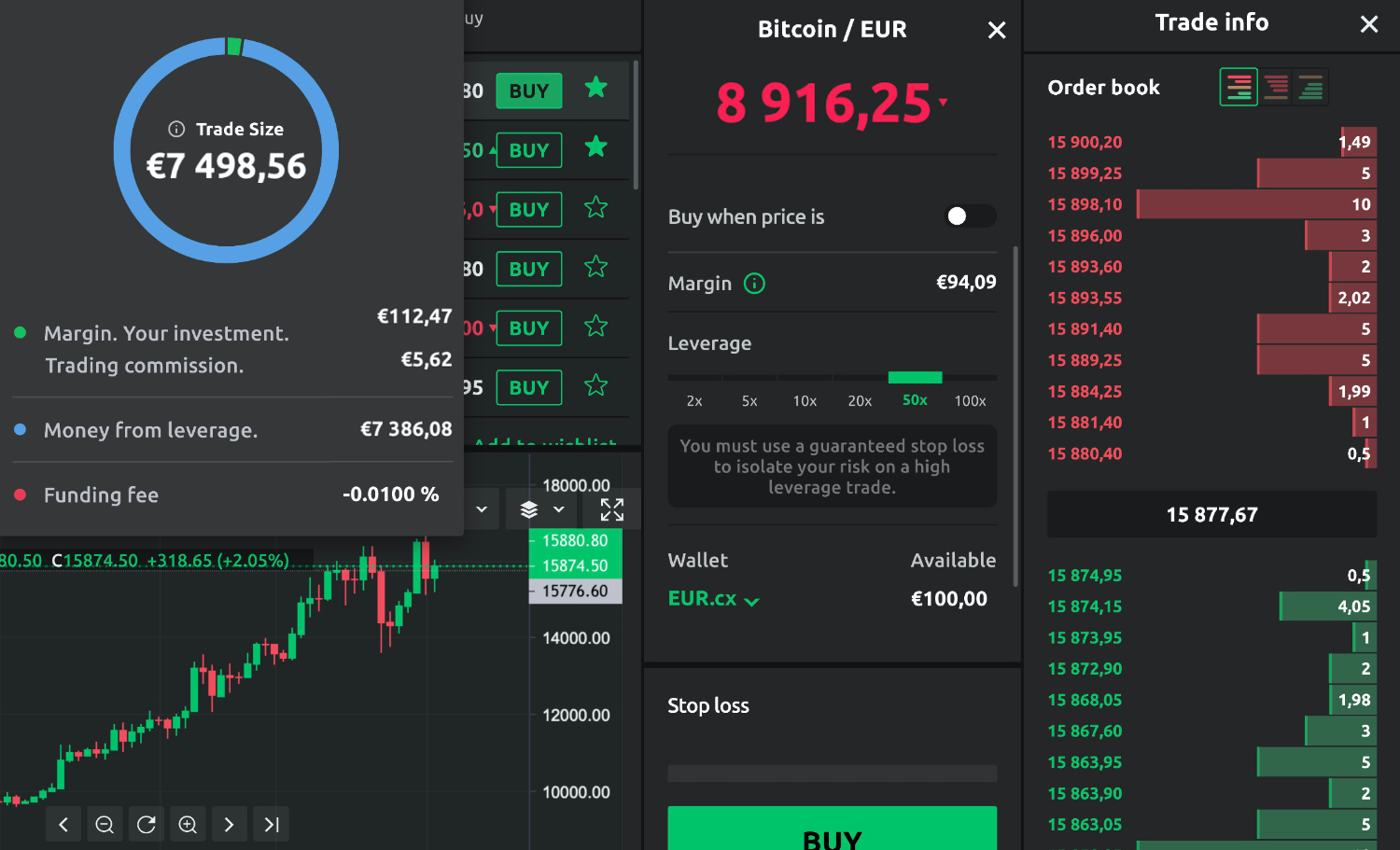

Leverage trading allows traders to borrow capital to increase their potential return on investment. Essentially, it’s a method that amplifies both profits and losses. In the context of crypto, leverage can vary significantly from platform to platform, typically ranging from 2x to 125x!

leverage trading crypto

For instance, if you decide to use 10x leverage, you could control $10,000 worth of a cryptocurrency with just $1,000 of your own money. However, this amplified exposure means if the price goes down, your losses can exceed your initial deposit.

leverage trading crypto

Understanding How Leverage Works

Let’s break it down a little more. When you leverage your investments, you’re essentially using borrowed funds to enhance your trading position. This is essentially a double-edged sword. On the one hand, increased potential profits; on the other, increased risk. It’s essential to understand the mechanics involved.

leverage trading crypto

Example Scenario

Consider a scenario where the price of Bitcoin is $20,000. You have $1,000, and by using a 10x leverage, you can control $10,000 worth of Bitcoin. If the price of Bitcoin increases to $22,000, you’ve made a profit.

leverage trading crypto

Profit Calculation: With 10x leverage, your profit is not just based on your $1,000 but on the full position. Thus, you gain $2,000 from the rise in price. However, this high reward comes with the risk; if Bitcoin’s price drops to $18,000, your position could be liquidated, resulting in a total loss of your initial investment.

The Risks and Rewards of Leverage Trading

Before diving into leverage trading crypto, it’s crucial to be aware of the associated risks and rewards. Let’s take a deeper look.

Reward Potential

Leveraging provides traders with the ability to maximize their returns on investment. This potential for substantial profit can be highly enticing, especially in a volatile market like cryptocurrency.

Risk Factors

Conversely, the risks can also be significant. High leverage can lead to a situation known as a margin call, where you are required to deposit more funds into your account to maintain your position. If you fail to do so, your broker may close your position entirely, resulting in the loss of your invested capital.

Market Volatility

The cryptocurrency market is notorious for its volatility. Prices can swing dramatically in a short amount of time, and when combined with leverage, your risks are magnified. According to a report by the Financial Conduct Authority (FCA), many retail clients suffer significant losses in high-leverage trading environments.

Tips for Successful Leverage Trading

If you’re still intrigued and want to explore leverage trading crypto, consider these tips for maximizing your success:

1. Start Small

If you’re new to leveraging, start with lower amounts of leverage. Testing the waters through smaller trades can help you understand how leverage affects your positions without exposing yourself to massive losses.

2. Utilize Stop-Loss Orders

Implementing stop-loss orders is vital in protecting your investment. These orders trigger selling your position at a pre-set level, minimizing your losses in case the market turns against you.

3. Keep Learning

Stay updated on market trends, trading techniques, and news related to cryptocurrencies. Leverage trading can be unforgiving, and staying informed is crucial for making smart decisions.

Real-World Case Study: The Rise and Fall of XYZ Traders

Let’s explore a real-world scenario of a trader using leverage. XYZ Traders entered the crypto market with enthusiasm, employing 50x leverage to maximize their Bitcoin investments.

The Initial Success

Initially, things went well. Bitcoin surged, and the trader saw significant profits. With their initial investment of $1,000, leveraging up to $50,000 allowed them to reap a profit of $5,000 in a short period!

The Turning Point

However, the situation turned quickly. A sudden market dip led to an unforeseen drop in Bitcoin prices. The trader didn’t have a stop-loss in place and quickly suffered a margin call, resulting in a total loss of their account.

Key Takeaway

This story highlights the unrelenting nature of leverage trading: it’s not just about the potential rewards, but also understanding the critical importance of risk management.

Future Trends in Crypto Leverage Trading for 2024

As we step into 2024, the landscape for leverage trading in crypto continues to evolve. Regulatory bodies are stepping in to establish better oversight, potentially leading to safer trading environments. Moreover, advancements in technology could see new platforms emerge that allow for more robust risk management features.

Increased Regulation

Increased regulation may shape the leverage trading sector, aiming to protect investors from deceptive practices. Regulatory bodies are becoming more active in ensuring that traders are educated about the risks they are undertaking.

Technology Innovations

With emerging technologies such as blockchain and machine learning, traders will have access to more sophisticated trading tools. These advancements could lead to innovative methods for managing risk and improving the overall trading experience.

Conclusion: Ready to Dive into Leverage Trading?

So, are you ready to explore leverage trading crypto? With its potential risks and rewards, the journey of leverage trading can be both exciting and educational. Keep learning, stay cautious, and always remember that with great power comes great responsibility.

As you gear up for your trading journey in 2024, consider integrating what you’ve learned here. The world of cryptocurrency is vast, and leverage trading can amplify your experience—just be sure to tread carefully.

Want to get involved? Leave a comment or question below and explore the world of crypto with fellow enthusiasts. Knowledge is power!