What is Revenue Ruling Crypto Separation?

The term revenue ruling crypto separation refers to guidelines established by tax authorities regarding the separation of cryptocurrency assets for tax reporting and compliance purposes. These guidelines are crucial for businesses and individuals engaged in cryptocurrency transactions, ensuring that they meet their tax obligations while optimizing their financial outcomes.

revenue ruling crypto separation

The Importance of Cryptocurrency Taxation

As the cryptocurrency market has expanded dramatically over the last decade, so too have the complexities of tax regulations surrounding it. The IRS in the United States, for example, has issued specific guidance on how cryptocurrencies should be classified for tax purposes. Understanding revenue ruling crypto separation helps individuals and businesses navigate these regulations, aiming to minimize tax liabilities while complying with legal standards.

revenue ruling crypto separation

Historical Context of Crypto Regulations

To fully appreciate the current landscape, we must look back at how cryptocurrency regulations have evolved. Initially, many tax authorities did not recognize cryptocurrencies, leading to confusion and inconsistent reporting. Over time, bodies like the IRS have introduced more comprehensive guidelines, specifying that cryptocurrencies are treated as property. This historical backdrop sets the stage for the emergence of revenue ruling crypto separation.

revenue ruling crypto separation

Case Study: IRS Guidelines

A pivotal moment came in 2014, when the IRS issued Notice 2014-21, clarifying that virtual currencies are treated as property for federal tax purposes. Fast forward to 2023, and we see updates that refine how revenue ruling crypto separation is applied, particularly regarding forks and airdrops. Such examples underscore the need for individuals and businesses to stay informed about tax treatments as the regulatory environment unfolds.

revenue ruling crypto separation

Tax Compliance Challenges

Despite clear guidelines, many individuals encounter significant challenges with tax compliance in the cryptocurrency sphere. For instance, improper separation of funds can lead to inflated tax bills or penalties. The awareness of the revenue ruling crypto separation is crucial to avoid these pitfalls.

revenue ruling crypto separation

Key Concepts of Crypto Separation

Understanding the fundamentals of revenue ruling crypto separation is essential. The key concepts include:

- Asset classification: Identifying what type of cryptocurrency is involved.

- Transaction tracking: Keeping meticulous records of transactions and holdings.

- Capital gains vs. ordinary income: Understanding how different transactions are taxed.

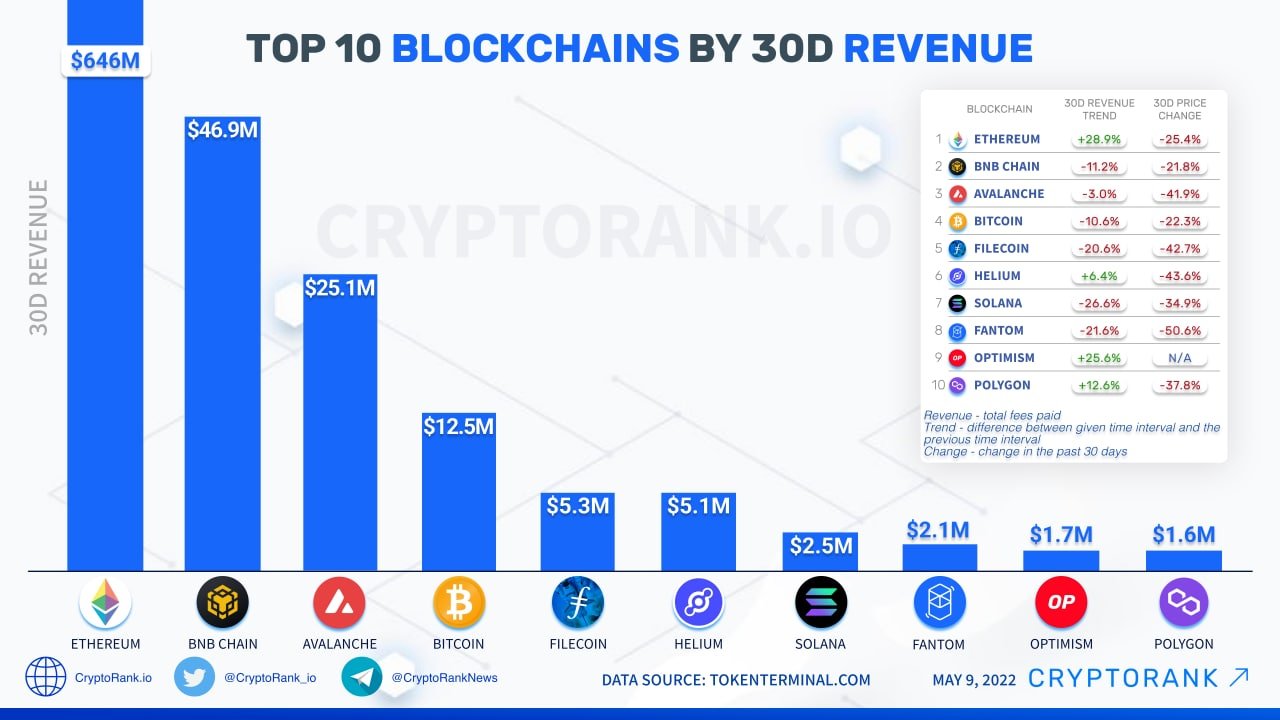

Market Trends in Cryptocurrency

As we progress into 2024, market trends indicate increasing regulatory scrutiny over crypto assets. These trends could affect how revenue ruling crypto separation is applied. Businesses should adopt agile strategies to adapt to these ongoing changes. For instance, implementing rigorous accounting systems can help streamline tax reporting processes, ensuring compliance and potentially minimizing liabilities.

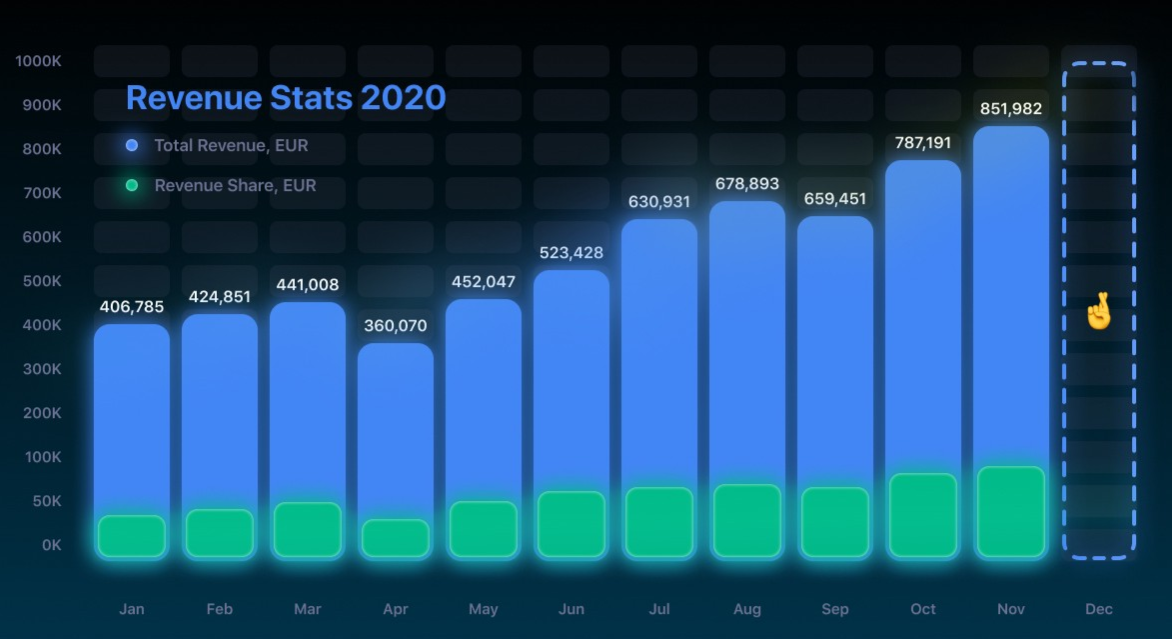

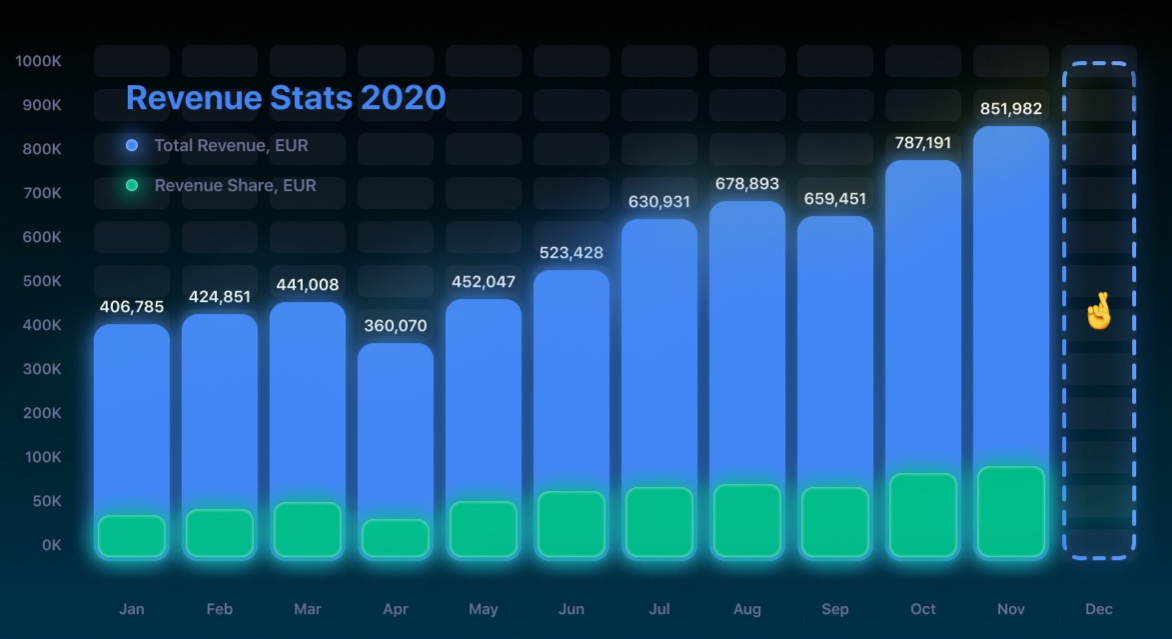

Interactive Chart: Cryptocurrency Market Growth vs. Regulatory Frameworks

User Experiences & Feedback

User feedback on navigating revenue ruling crypto separation highlights both successes and challenges in the current landscape. Users have reported that clarity in regulations has improved, but many still feel overwhelmed. For example, a survey conducted in early 2024 revealed that nearly 60% of respondents found tax regulations challenging to interpret.

Technical Solutions for Compliance

Several technical solutions have emerged to assist users in managing crypto tax compliance. These include software applications that automate transaction tracking and asset classification, ultimately simplifying the process of adhering to revenue ruling crypto separation. Such tools can significantly reduce errors and improve overall reporting efficiency.

The Role of Blockchain in Transparency

Blockchain technology itself offers transparency, which can be harnessed for tax compliance. By maintaining clear records of all transactions, entities can significantly ease the burden of demonstrating compliance with revenue ruling crypto separation requirements. This is not just important for tax purposes, but also enhances trust among investors and regulatory bodies.

Future Predictions: What Lies Ahead

Looking ahead, experts predict that the focus on cryptocurrency taxation will only intensify, with potential updates to regulations as governments seek better control over crypto markets. Staying informed about these developments is imperative for anyone involved in cryptocurrency. The upcoming revenue ruling crypto separation revisions will likely reflect a more nuanced understanding of digital assets.

Conclusion: Navigating Waters of Crypto Compliance

Understanding revenue ruling crypto separation is essential for anyone involved in cryptocurrencies today. As regulations continue to evolve, equipping oneself with knowledge and tools for compliance will pave the way for safer investments and business practices. Those who adapt and prioritize compliance will undoubtedly gain a competitive advantage in the burgeoning crypto market.

Final Thoughts

In closing, the journey through crypto regulations can be daunting, yet it presents opportunities for growth and innovation. By leveraging resources and seeking expert advice, individuals can confidently navigate the complexities of revenue ruling crypto separation, ensuring both compliance and successful financial outcomes in 2024 and beyond.