crypto tax calculator invite accountant

Are you tired of feeling overwhelmed every tax season? If you’ve dipped your toes into the world of cryptocurrency, you know the complexities that come with it. In 2024 and beyond, accurately reporting your crypto transactions can feel like navigating a maze. But don’t worry, using a crypto tax calculator invite accountant approach can simplify the process significantly. In this article, we’ll breakdown the essentials of using a crypto tax calculator, when it’s crucial to invite an accountant, and how this duo could save you money and frustration.

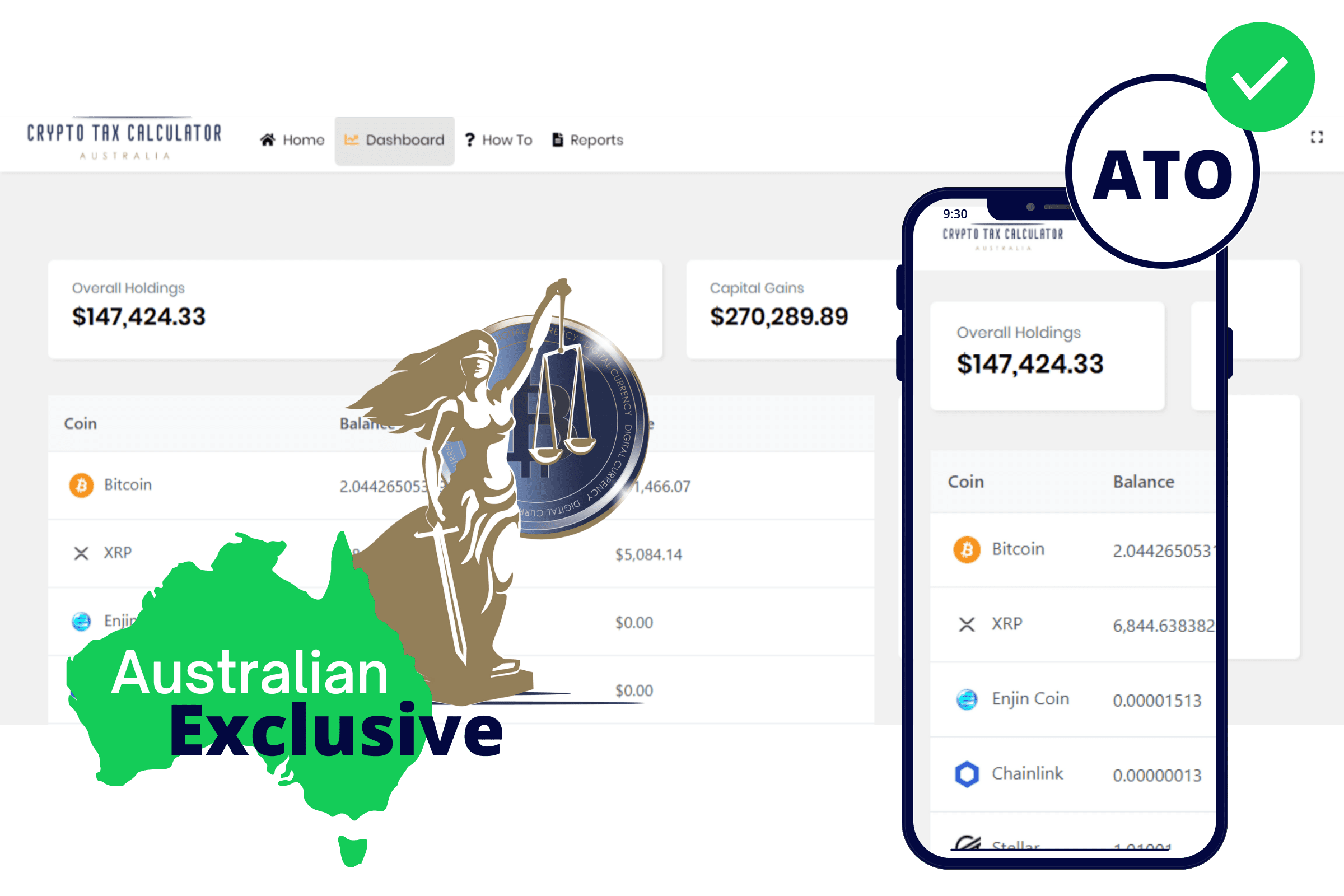

What is a Crypto Tax Calculator?

crypto tax calculator invite accountant

Why Do You Need One?

crypto tax calculator invite accountant

Not using a crypto tax calculator invite accountant can lead to a significant oversight. The IRS treats cryptocurrencies as property, not currency, which means every trade can be a taxable event. If you don’t track these transactions, you could face penalties. Imagine the disappointment of facing an audit because of incomplete records! A crypto tax calculator helps keep track of all your trades, allowing you to report accurately and avoid issues down the line.

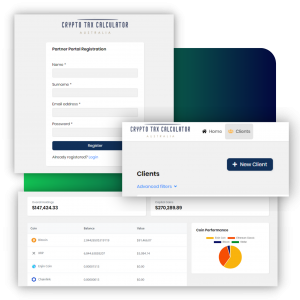

How Do Crypto Tax Calculators Work?

crypto tax calculator invite accountant

Types of Calculators

crypto tax calculator invite accountant

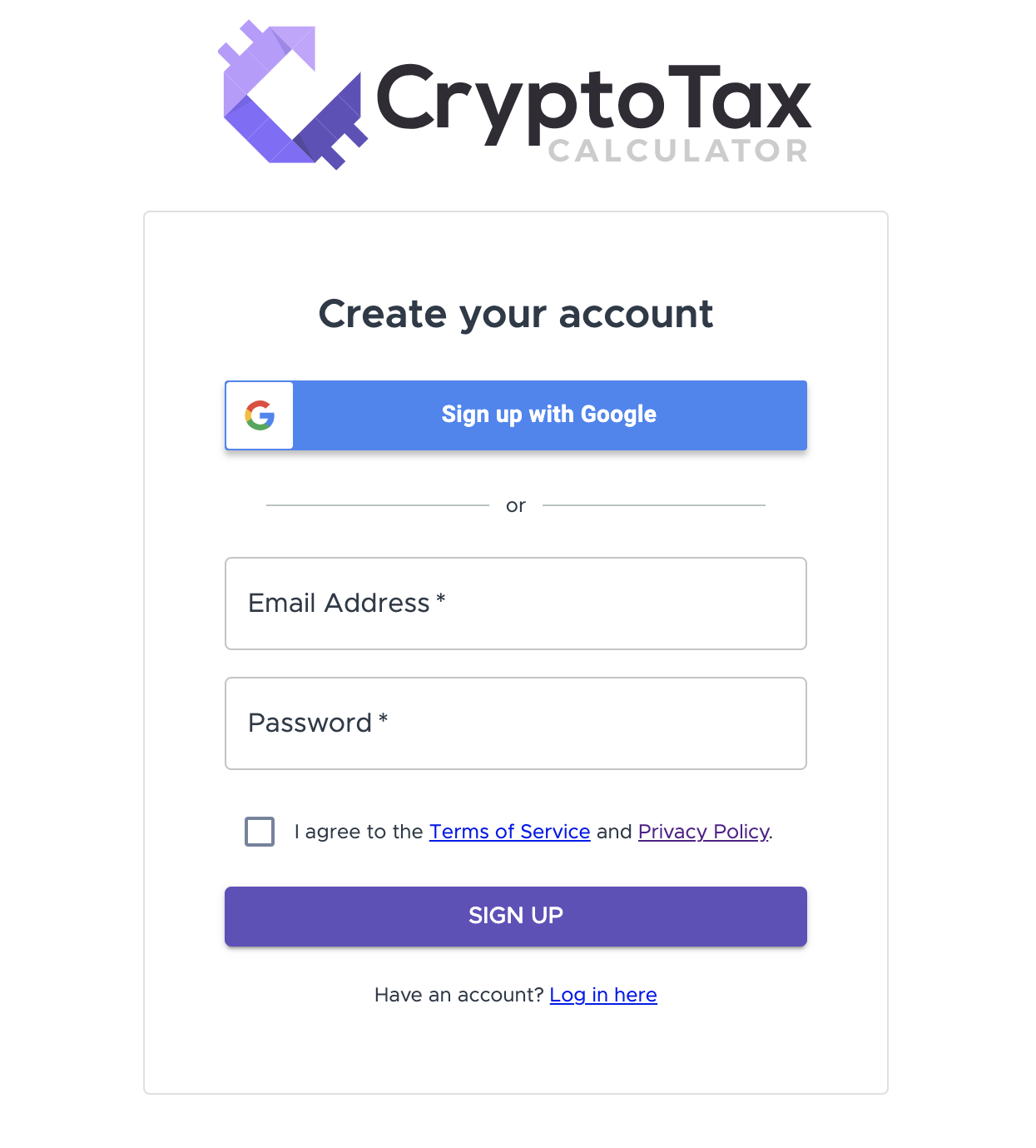

There are several tools on the market, each with its unique features. Some popular options include:

- CoinTracking: Offers detailed analytics of trading activities and a tax report.

- CryptoTrader.Tax: Designed to simplify tax calculations with various export options.

- ZenLedger: Integrates with multiple exchanges and wallets, providing detailed forms and reports.

Each of these calculators caters to different user needs, so choosing the right one can be important based on your trading volume and portfolio complexity.

Real-World Case Study: John’s Crypto Journey

Connecting with an Accountant

- Personalized Advice: They provide tailored strategies to minimize your tax liabilities.

- Compliance Assistance: Navigating IRS guidelines can be tricky. An accountant makes sure you’re on the right side of law.

- Future Planning: They can help strategize your trading plans to optimize for tax purposes in the future.

When Should You Invite an Accountant?

1. Trading Volume is High

2. Have Inherited or Gifted Cryptocurrency

3. Multiple Sources of Income

How to Choose the Right Accountant for Crypto Transactions

Not every accountant is familiar with cryptocurrency tax laws, so it’s essential to choose wisely. Look for professionals who have experience in blockchain or crypto transactions and who understand the nuances involved. A few key questions to ask include:

- What experience do you have with cryptocurrency taxes?

- Can you help me with both federal and state tax reporting?

- What fees do you typically charge for your services?

The Intersection of Technology and Tax: Visualizing Data

Conclusion: Making the Right Moves in Crypto Taxation

Utilizing a crypto tax calculator invite accountant approach can not only minimize your tax liabilities but also ensure you’re compliant with IRS regulations. The collaboration can save you from future headaches and can be particularly advantageous as laws and regulations evolve.

FAQs

1. Do I really need a crypto tax calculator if I only trade occasionally?

2. What happens if I don’t report my crypto gains?

3. Can I do my taxes without an accountant?

Yes, with the right tools, you can file your taxes yourself, but consulting an accountant can provide peace of mind, especially if you deal with significant trading activities.